Webinar: Market Panic? Turn Fear to Opportunity with Buffett's Proven Method

Step-By-Step Company Analysis of a Value US-Listed Company

Build a Recession-Proof Portfolio with ViA Atlas

As Seen On:

Presented by Cayden Chang, Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017

In this Webinar, Cayden will cover:

-

Case Study Breakdown: Analyze a real-life value company's economic moat and financials

-

Key Financial Metrics to watch when evaluating whether a stock has strong growth potential

-

Buffett's Checklist: Step-By-Step Criteria to identify undervalued entry points / overvalued exit points

-

Case Study Breakdown: Analyze a value company's economic moat and financials

-

Via Atlas IV (Intrinsic Value) Directory Demo: How to screen 'superhero' stocks in 15 minutes, even with a busy schedule

Webinar link will be sent to your registered email address

Do NOT Join This Webinar If You ....

Why Investors Should Stay Calm Amid Extreme Market Fear:

A Value Investor’s Guide to Opportunity

The U.S. tariffs, introduced April 2nd, 2025, triggered widespread market disruptions and heightened fears of a global recession.

The Fear & Greed Index stands at 4 now.

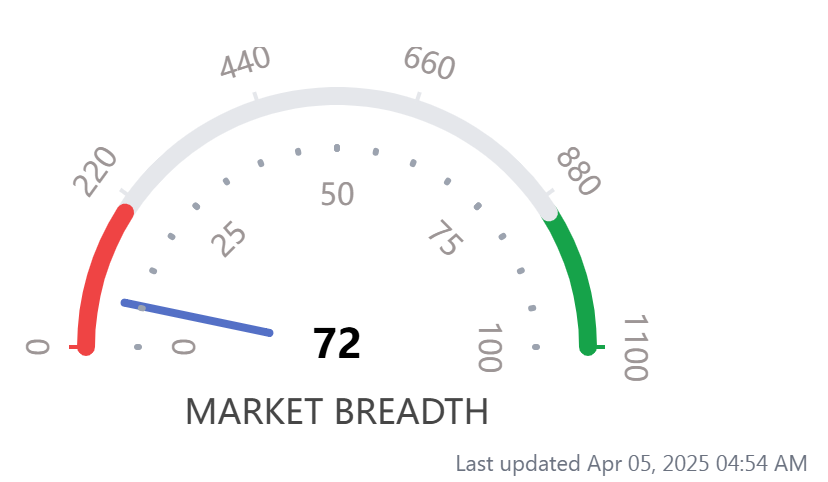

Additionally, the 'market breadth' indicator stands at 72, suggesting that over 92.8% of the S&P 500 stocks are trading below their 20-day moving average. Meanwhile, the 'Fear and Greed Index' indicates 'extreme fear,' reflecting heightened market uncertainty.

And it certainly doesn't help that with the 'orange haired man' in charge, we will continue to face prolonged market volatility and F.U.D (fear, uncertainty, doubt).

More likely than not, your portfolio is in the red too, with the recent bloodbath in the stock markets.

😱Does this mean you should start panicking and selling everything?😱

Absolutely not!

While fear dominates the headlines, it is important to step back and look at the bigger picture.

History and Value Investing Principles reveal a different truth: market downturns are not threats - they are invitations to build generational wealth.

🚨Here's why disciplined investors should resist the urge to panic and seize this rare opportunity:🚨

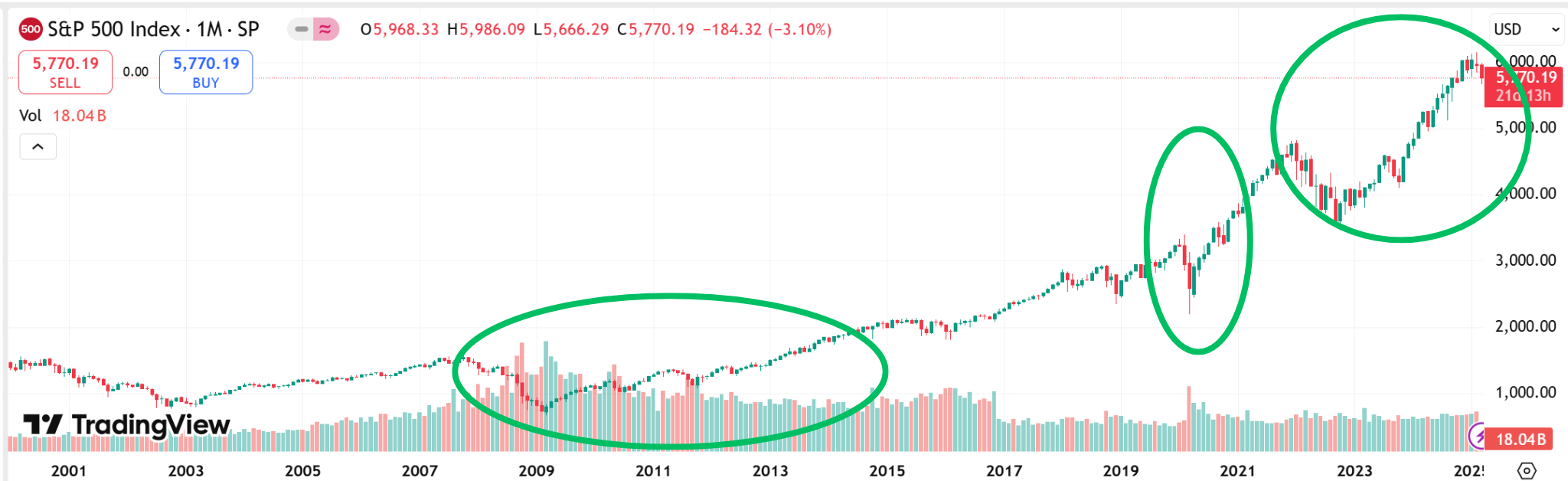

1. Historical Significance of the S&P500

Since 1957, the S&P500 has delivered an average annual return of 10.13%, compounding wealth for patient investors despite wars, recessions, and inflationary spikes.

Even in its worst years - like 2008's - 38.49% crash or 2022's -19.44% slump - the index rebounded with gains of 23.31% in 2024 and 24.23% in 2023.

These recoveries aren't outliers; the reflect the market's structural tendency to reward long-term holders.

Consider this:

🔥 A $10,000 investment in the S&P500 at the 2009 bottom ($676.53) would have grown to $54,200 to $54,200 by 2024.

🔥 The COVID-19 crash of March 2020 saw the index drop 34% in weeks - yet it surged 68% over the next 12 months.

Volatility is the price of admission for compounding gains. Panic-selling during fear-driven dips, however locks-in losses and sidelines you from the subsequent market recoveries.

Have you ever panicked and sold, only to watch the price soar to new highs—then, driven by F.O.M.O. (fear of missing out), jumped back in, only to see it crash again? That’s exactly why staying calm is crucial.

As Benjamin Graham, the father of Value Investing recently wrote:

2. Value Investing Criteria: Your Shield Against Fear

Value Investing's core principles transform market fear into a strategic advantage. By focusing on intrinsic value and financial soundness, investors can identify companies poised to thrive post-downturn:

A. Margin of Safety

Graham's doctrine demands buying stocks at a significant discount to their intrinsic value - a "margin of safety" that buffers against uncertainty.

During sell-offs, quality firms often trade below this threshold due to irrational pricing. For example:

- In 2022, the S&P500 price-to-earnings ratio dropped to 18.4 - its' lowest since 2018 - creating opportunities for investors disciplined enough to apply Graham's margin of safety.

- Tools like the ViA Atlas IV Directory streamline this process, filtering for companies with strong fundamentals (ROE >15%, debt/equity ratio <0.5) that are often overlooked in panic-driven markets.

To see a demonstration of the ViA Atlas IV Directory, sign up for the webinar by Cayden Chang now.

B. Financial Fortitude

Graham's screeners prioritize companies with:

- Debt-current assets <1.10: Ensures liquidity to weather downturns

- Current ratio > 1.50: Signals strong short-term solvency

- 5+ years of earnings growth: Filters for durable business models

These metrics matter. During the 2020 COVID crash, firms meeting these criteria (e.g. Johnson & Johnson, Coca-Cola fell less than the broader market and recovered faster.

C. Contrarian Opportunity

Extreme fear creates mispricing by amplifying biases and distorting liquidity, yet history shows that these periods are optimal entry points.

As Warren Buffett observed, "Be fearful when others are greedy, and greedy when others are fearful"

Mispricing during fear cycles is not a threat - it's a roadmap to long-term alpha (outperforming the market).

3. The Cost of Panic v.s. The Reward of Discipline

- Investors who sold during the 2008 crisis missed the 2009 - 2024 bull market's 258% return.

- Conversely, dollar-cost averaging (DCA) through the 2022 slump woulkd have lowered average entry prices by 22%, amplifying long-term gains.

TL:DR: Value Investing's disciplined approach removes emotion from the equation.

4. How to Act Now?

- Think Long-Term: The S&P500 has never lost value over any 20-year period.

- Diversify: Spread out your risk with low-cost Exchange-Traded Funds (ETF), and balance 'quality' with 'safety' by having at least 25% of your portfolio in cash.

- Screen for Quality: Use ViA's IV Directory to filter stocks meeting Value Investing Criteria (e.g. ROE >15%, debt/equity ratio < 0.5%)

Sign up for our free webinar for a step-by-step company analysis and demonstration of our IV Directory.

About Cayden Chang

BSc (Hons), Msc, Lifelong Learner Award 2008, Personal Brand Award 2017

Cayden Chang is the Founder of Mind Kinesis Investments Pte Ltd and Value Investing Academy Pte Ltd, which runs the first and only Value Investing training that is recommended and endorsed by Mary Buffett, the internationally acclaimed author and speaker of how billionaire Warren Buffett invests. His company also runs Value Investing workshops across Asia. With over 50,000 graduates across 11 cities in Asia, his methodology is tested, proven and easily duplicable even for someone who has no prior experience in investing.

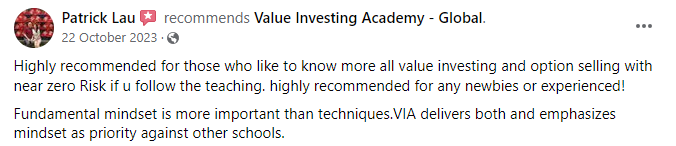

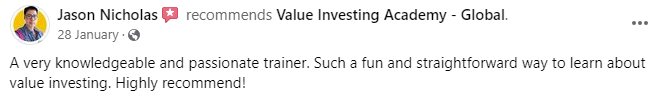

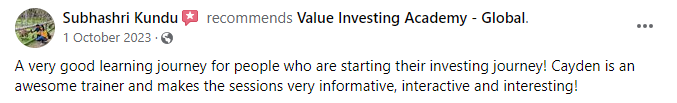

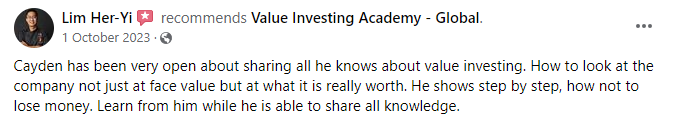

See What Others Say About Value Investing Academy...

This Webinar is Suitable for ...

Disclaimer: The information provided by Mind Kinesis Investments Pte Ltd is meant for educational purposes, and is in no instance to be regarded as investment advice. You are advised to practice due diligence before making any financial decisions. All forms of investments carry risks and such activities may not be suitable for everyone. We are not liable for any losses incurred from your investment activities. Past investment performance is not necessarily indicative of future performance, even if the same strategies are adopted. All materials contained here may not be copied, reproduced, displayed, published or distributed in whole or in part in any manner and is expressly prohibited without prior written permission of the copyright owner.

Tuesday/Wednesday Evening

8:00PM - 9:00PM SGT