The Global Investor’s Handbook: 6 Things Smart Investors Do Before Putting Money Into Global Markets

Table Of Content:

-

Introduction

-

#1 Why Invest in the U.S.?

-

#2 Setting Your Financial Goals

-

#3 Key Investment Options

-

#4 Ways To Invest

-

#5 Risk Management & Common Mistakes to Avoid

-

#6 Bonus Resources

The Investor’s Starter Kit – Your Guide to Smart Investing

Introduction

#1: Why Invest in the U.S.?

Why Invest in the U.S.? The Global Powerhouse

Inflation & Wealth Growth

#2: Setting Your Financial Goals

What Are Your Dreams? Short-Term, Medium-Term, and Long-Term

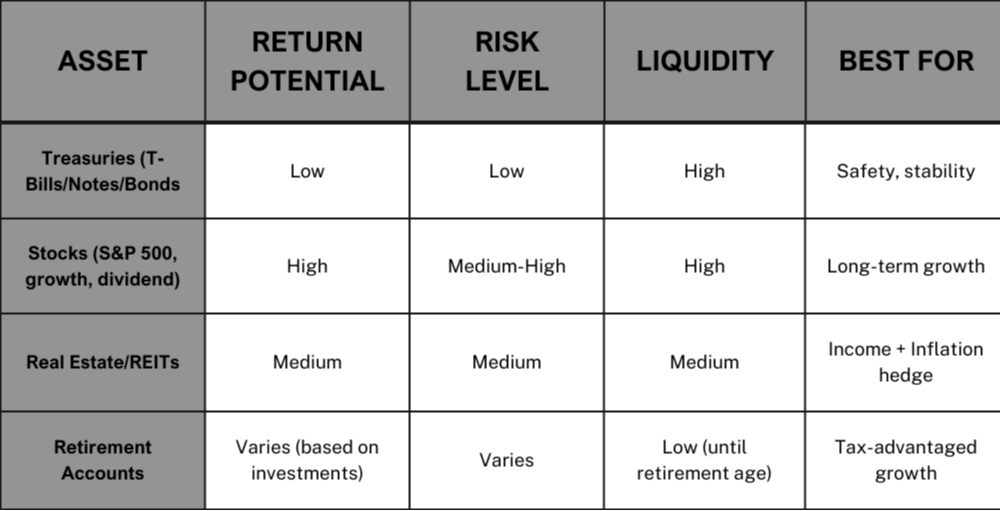

#3: Key Investment Options

1. U.S. Treasury Securities (T-Bills, Notes, Bonds)

Equities (Stocks)

Real Estate Investment Options

Retirement Accounts (Tax-Advantaged Investing)

2. Certificates of Deposit (CDs)

Which is better? CDs or U.S. Treasuries?

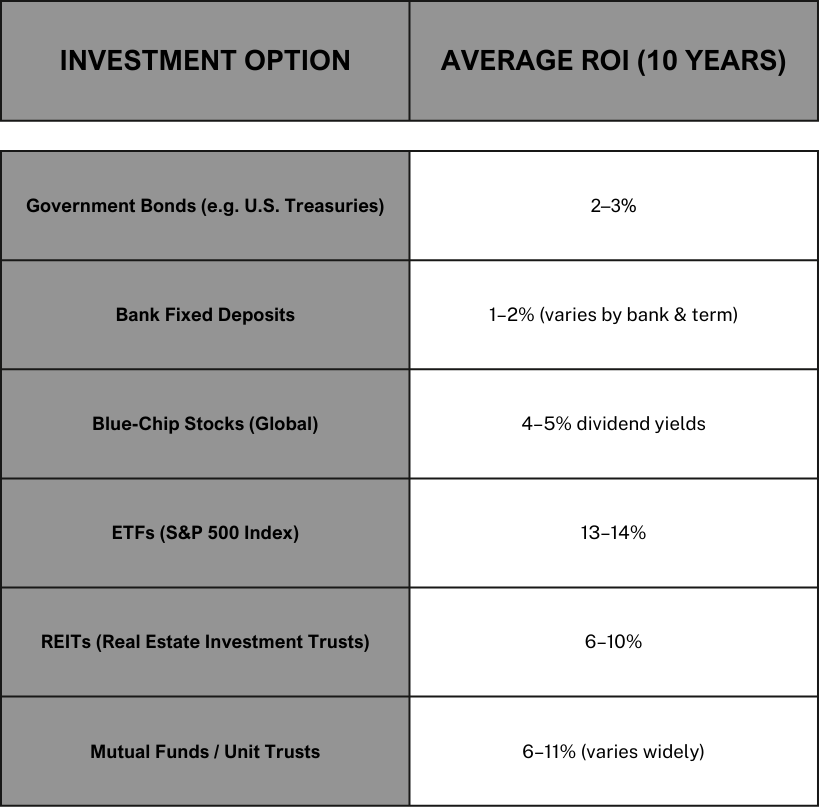

3. Mutual Funds & ETFs: Professional Management + Flexibility

4. Real Estate Investment Trusts (REITs)

5. Exchange-Traded Funds (ETFs)

Why Warren Buffett Recommends Index Funds?

Warren Buffett

Berkshire Hathaway Inc., 2013 Annual Report. Nebraska. Berkshire Hathaway Inc., 2013. pp. 21-22.

6. Stocks: Owning Businesses

Get Started In Investing

Before you buy any investment, it’s important to understand one simple but powerful idea:

There are two types of assets in the world income-generating assets and non-income-generating assets.

- An income-generating asset is something that produces profit or cash flow every year like a rental property or a good business.

- A non-income-generating asset is something that just sits there, hoping to be sold at a higher price in the future like a block of gold, or a business that has been losing money for years.

Now think about it: If you own something that generates profit, the odds of you losing money go down. Even if the price of the business swings up and down in the short term, the business itself is still producing income. That income protects you.

Write your awesome label here.

So how do I get started in value investing?

In fact, it is as simple as A, B and C:

Assess

The first step is to assess the business. Every stock you see in the market is a business behind it and there are really only two kinds of businesses: good or bad.

- A good business generates consistent profits and has strong advantages.

- A bad business struggles and drains your wealth over time.

The key to success is learning how to tell the difference. That’s why this step requires effort, knowledge, and discipline. Remember: if you don’t understand the business, don’t invest in it.

Buy

Once you’ve found a wonderful business, the next step is to buy it but not at any price. Even the best business can be a poor investment if you pay too much.

For example, if a business is worth $10, you don’t want to pay $12 or $15. Instead, you wait patiently until the stock is available at $10 or below. That’s how you build in a margin of safety.

Cashing Out

After buying at a good price, the value of the business will grow over time. Eventually, the stock price rises above what you paid that’s your capital appreciation.

But here’s the beauty of value investing: while you wait, many great businesses pay you dividends along the way. So instead of sitting idle, your investment is already rewarding you with cash flow.

#5: Risk Management & Common Mistakes to Avoid

Portfolio Allocation

The Biggest Risk

If you're ready to take the next step in your life!

Ignoring Fees

Risk Aversion: The Hidden Psychological Trap

Bonus Insights: What Trump's Protectionist Policies Could Mean For Investors

If you're ready to take the next step in your life!

Bonus Resources

Get In Touch

"The biggest risks comes from not knowing what you are doing."

Warren Buffett