The Singapore Investor's Handbook: Navigating The Investment Landscape

Table Of Content:

-

Introduction

-

#1 Understanding The Basics Of Investing

-

#2 Setting Your Financial Goals

-

#3 Key Investment Options

-

#4 Way To Invest

-

#5 Risk Management & Common Mistakes to Avoid

-

#6 Bonus Resources

The Singapore Investor’s Starter Kit – Your Guide to Smart Investing

Introduction

#1: Understanding the Basics of Investing

Why Invest? The Power of Compounding

Inflation

#2: Setting Your Financial Goals

What Are Your Dreams? Short-Term, Medium-Term, and Long-Term

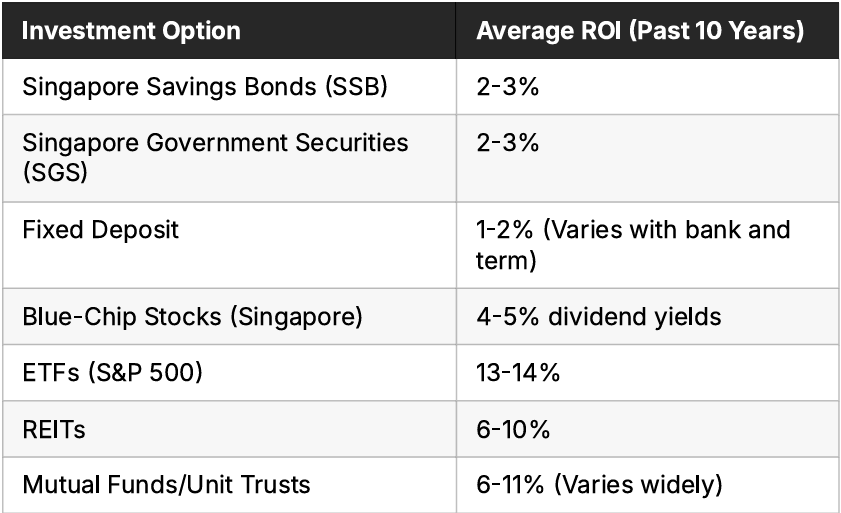

#3: Key Investment Options

1. Singapore Government Securities (SGS)

Singapore Savings Bonds (SSBs)

Treasury Bills (T-bills)

Long-Term SGS Bonds

2. Fixed Deposits: Simple and Secure Savings

Which is better? FD or SSB?

3. Mutual Funds/Unit Trusts: Professional Management

4. Real Estate Investment Trusts (REITs)

5. Exchange-Traded Funds (ETFs)

Why Warren Buffett Recommends Index Funds?

Warren Buffett

Berkshire Hathaway Inc., 2013 Annual Report. Nebraska. Berkshire Hathaway Inc., 2013. pp. 21-22.

6. Stocks: Owning Businesses

Get Started In Investing

Before making the purchase of investment products, it is vital to understand the following in order not to lose money: Income generating assets and Non-income generating assets. An example of an income generating asset would be a property or a good business which generates profit every year.

Hence, if you purchase an investment product that has a history of earning profits, the chances of you losing money is slim. Whereas for a non-income generating asset, it could be a block of gold or a business that is making losses for many years.

Write your awesome label here.

So how do I get started in value investing?

In fact, it is as simple as A, B and C:

Assess

Assessing the business (stock) that we are investing in is important and usually, there are only 2 types of business that we would encounter, good business or bad business. Without a doubt, a good business is more attractive as it allow us to make money from it.

This is the first and also the most crucial point of all, which also requires much effort and knowledge to assess a company.

Buy

After finding out a good business, the next step is to buy.

However, we do not purchase the business (stock) at any price.

For example, if a business (stock) is worth ten dollars, we should not be paying for anything above that. Instead, we only buy them when they are either at or below ten dollars.

For example, if a business (stock) is worth ten dollars, we should not be paying for anything above that. Instead, we only buy them when they are either at or below ten dollars.

Cashing Out

Going back to the example above, this refers to when you purchased the business (stock) at either ten dollars or

below it and then selling it at above ten dollars. The difference between the purchased price and the selling price is called capital appreciation. However, this process do not always occur immediately.

Thus, while waiting for the price to go up, you can collect dividend along the way.

Thus, while waiting for the price to go up, you can collect dividend along the way.

#4: Ways To Invest

Investing Through a Brokerage Account

Using Robo-Advisors for Automated Investing

#5: Risk Management & Common Mistakes to Avoid

Portfolio Allocation

The Biggest Risk

"The biggest risks comes from not knowing what you are doing."

Warren Buffett

Ignoring Fees

Risk Aversion: The Hidden Psychological Trap

If you're ready to take the next step in your life!

Bonus Insights: What Trump's Protectionist Policies Could Mean For Investors