Discover The Proven Investing Framework

To Generate

3 Streams Of Income

Looking to build an investment portfolio but unsure how to get started?

- Have you always wanted to build a portfolio of great businesses to generate passive income?

- Are you overwhelmed by the vast amount of information about investing?

- Do you wonder why share prices often drop right after you invest?

- Do you feel like the stock market is always against you?

- Curious about the secrets of the world’s top investors?

- Are you concerned that every investment feels like a gamble, leaving you afraid of losing your hard-earned money?

Whether you're a total newbie to the stock market or a seasoned investor/trader, the programme will train you to become an Intelligent Investor.

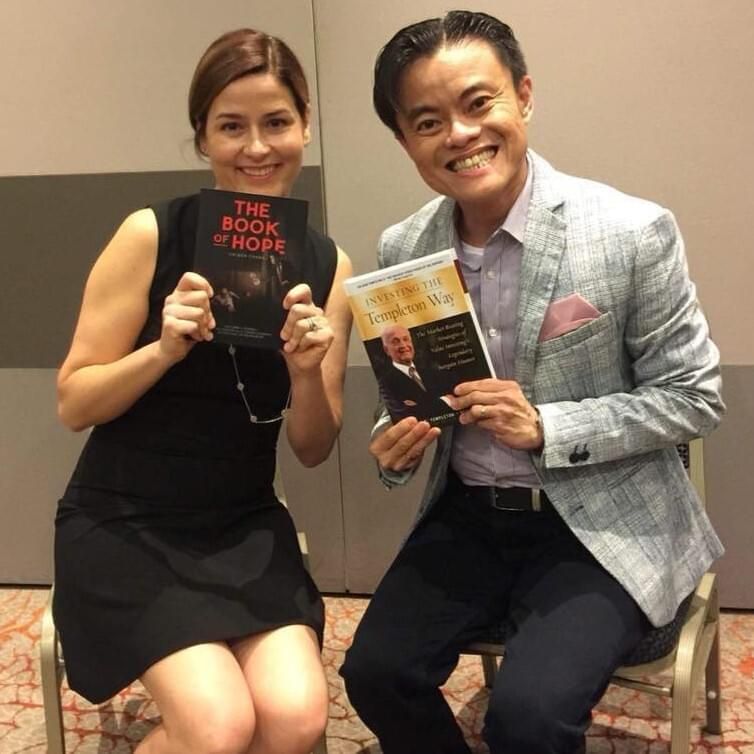

"I highly recommend Cayden Chang's investment courses to anyone who are interested in getting started on investing.

Lauren C. Templeton

Founder and President of Templeton & Philips Capital Management, LLC

Co-Author Investing the Templeton Way; The Market Beating Strategies of Value Investing's Legendary Bargain Hunter- Sir John Templeton

Co-Author Investing the Templeton Way; The Market Beating Strategies of Value Investing's Legendary Bargain Hunter- Sir John Templeton

Uncover The S.E.G.A. SYSTEM That Has Helped Thousands Achieve Over 20% ROI!

Find & Build Fast Growth Companies To Own

Write your awesome label here.

What You Will Learn

[Module 1] Key Pillars Of Successful Investing

Why Should We Invest?

Investing vs Speculation

How Much Is Needed To Start Investing?

Why Learn Value Investing?

Formula To Financial Freedom

Cash Flow Options Strategy (CFOS)

Investing vs Speculation

How Much Is Needed To Start Investing?

Why Learn Value Investing?

Formula To Financial Freedom

Cash Flow Options Strategy (CFOS)

[Module 2] Secrets To Passive Investing

Warren Buffett's Recommendation

The Most Important Rule Of Investing

Different Types of Funds

How To Invest In The S&P500

Passive Investing (3 Part Video)

Performance Comparison

How To Make Your First Million Quick

The Most Important Rule Of Investing

Different Types of Funds

How To Invest In The S&P500

Passive Investing (3 Part Video)

Performance Comparison

How To Make Your First Million Quick

[Module 3] The Insider Blueprint To Financial Freedom

The Secret to Warren Buffett's Wealth (5 Part Video)

VIA Funnel (5 Part Video)

Financial Statements (6 Part Video)

Intrinsic Value (8 Part Video)

Forming A Portfolio (4 Part Video)

[Bonus] Buffett's Top Stock #1

[Bonus] Buffett's Top Stock #2

[Bonus] Buffett's Top Stock #3

[Bonus] How To Invest Like Warren Buffett

[Bonus] Lauren Templeton

VIA Funnel (5 Part Video)

Financial Statements (6 Part Video)

Intrinsic Value (8 Part Video)

Forming A Portfolio (4 Part Video)

[Bonus] Buffett's Top Stock #1

[Bonus] Buffett's Top Stock #2

[Bonus] Buffett's Top Stock #3

[Bonus] How To Invest Like Warren Buffett

[Bonus] Lauren Templeton

Instant Access to

20+ Years Of Investing Knowledge

Start Generating Income With Proven Expert Strategies

A Sneak Peek Of What You'll Get

Worth $6000

Limited Time Offer

Only $249 USD

(Save 70%)

Valid for 24 Months. Includes 7 day money back guarantee

Why Value Investing?

Based on a Time-Tested Investment Methodology

Consistent Returns of Up To 20% Per year

And that's a modest figure. Many of our students are generating returns of up to 30% per year, even without prior investment knowledge. That’s 60 times higher returns than average if you were to put the same amount of money in a savings account giving you only 0.5%!

We Care To Make You A Better Investor

Founder Mr Cayden Chang, with over 20 years of investing experience, understands exactly how hard it is to lose one's hard-earned money in the stock market. Which is why he has made extensive efforts to help anyone avoid the same pitfalls that many make.

No Prior investment Knowledge or Experience Required

You do not need years of investing knowledge or experience to start right. Many who came and started without any knowledge about the stock market, are able to apply the knowledge immediately and see results.

Over 50,000

Across 11 cities in Asia

have learned the value

investing methodology

Our Results

Who is Cayden Chang?

How Did I Reach My Financial Goal?

Too Broke To Give My Bride A Decent Wedding

Now Available to You

Anywhere at Anytime!

Get the full Value Investing Programme right to you at anywhere and anytime in the world today!

Write your awesome label here.

A TOTAL OF 7 BONUS VIDEOS FOR YOU BY 2 VERY SUCCESSFUL INVESTORS IF YOU JOIN THE COURSE

Write your awesome label here.

1. EXCLUSIVE LAUREN C. TEMPLETON TRAINING FOOTAGE:

People have spent thousands of dollars trying to meet Lauren C Templeton and learn from her how Sir Joh Templeton invest. The good news is that I am going to give you an exclusive training, taught by Lauren Templeton during our Investify Symposium, to you at no costs!

Write your awesome label here.

2. WARREN BUFFETT'S TOP STOCK PICKS:

Imagine learning from Mary Buffett directly sharing with your some of the money-making stocks that Warren Buffett still own today. Wouldn’t that be a stock tip from the Buffett family themselves?

Value and growth are joined at the hip!

— Warren Buffett

Transform Your Strategy Today

Learn How To Invest Safely & Profitably Now!

Frequently asked questions

How do I start investing? Which brokerage should I use?

You are free to choose any brokerage account for your investments. VIA has a comprehensive guide on using Interactive Brokers at https://bit.ly/4esKVRb. However, we are not affiliated nor incentivized to promote their products. You are free to use any brokerage accounts that suit you.

I do not have much capital, is this for me?

If you don’t have much capital to invest, it’s important to understand that you don’t need a large sum to start. On the New York Stock Exchange (NYSE), you can begin with as little as purchasing a single share. For example, if a stock costs US$40, that’s often less than what you’d spend on a nice meal. The key is to ask yourself why you want to invest. Is it to grow your savings and protect them from inflation or to chase a quick profit? At VIA, we don’t endorse any get-rich-quick schemes; instead, we focus on long-term, sustainable growth strategies.

The stock market just crashed! Why should I invest now?

Contrary to what many people believe, a stock market crash can present an excellent opportunity to invest in solid companies at significantly lower prices. The key, however, is knowing how to identify these valuable companies amidst the downturn. This is exactly where the Value Investing Program Online can help. The course teaches you how to assess companies based on their fundamentals, so you can confidently invest in businesses that are undervalued and poised for future growth, even during market downturns.

Why should I learn value investing? My stock broker/insurance agent/financial consultant will do it for me.

Most financial advisors are rewarded based on sales performance instead of how much their clients are making from the investments. This can result in a conflict of interest, which means you may not get the best advice.When you are a knowledgeable investor, you can pick winning stocks on your own terms and set yourself up for greater success