Is This Membership Right for You?

A Personal Message from Cayden

Here's What You'll Get When You Join The Membership

24/7 Access to IV Directory

- Over 70+ U.S. Listed Companies Case Study with In-Depth Value Investing Analysis

- Plus 24 New or Revised U.S. Company Case Studies Every Year

- Company Updates and additional notes when there are changes to the company fundamentals

- Narrow down opportunities in as little as 15 minutes using valuation filters

- BONUS: Mobile app access on the go

- BONUS: Asset Portfolio Allocation - Video Lessons on ViA Risk Management Framework

Online Mentorship: Cash Flow Option Strategy (CFOS)

- 4 Inner Circle Live Mentorship sessions per year - Get alerts on new opportunities

- 4 Company Updates per year on Circle of Competence, Fundamentals, and Intrinsic Value

- Q&A with Cayden and the Case Study authors

- All Replays of Past Sessions

- Build a Monthly Cash-Flow Machine with CFOS.

- Cash Flow Options Strategies (CFOS) Online Tutorial

Huat with ViA: New

Members Onboarding Event

BONUS: Interactive Brokers (IBKR) Hands-On Class

- Get invited to our optional Interactive Brokers (IBKR) hands-on session!

- How to set up and navigate Interactive Brokers

- How to execute buy and sell orders

- How to sell put / call options

- How to track earned premiums

BONUS: Value Investing Bridging Course

- A concise 9-part video series designed to explain key concepts and terminology of value investing

- Designed to 'bridge' the understanding of Value Investing concepts to non-value investors.

BONUS: Members Only Loyalty Renewal Discount

- Save up to 40% on your membership fees when you stay on and renew your membership

- Receive additional discount when you continue to renew your membership

- Get exclusive invitations to Members only events, offers and updates

Join the Case Study Membership and get this additional bonus!

BONUS: Huat with ViA Atlas Onboarding Event

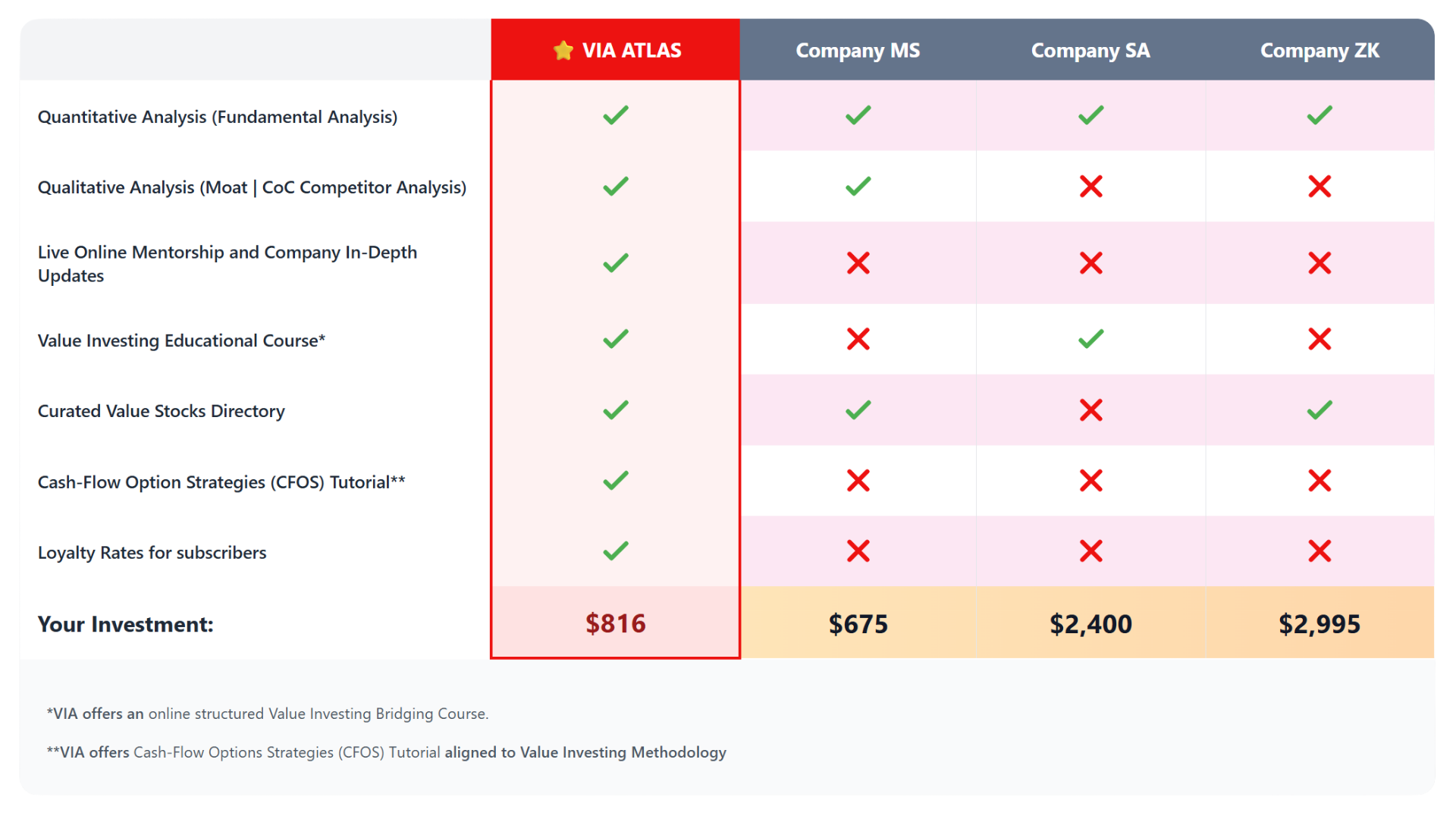

What Makes Us Different

And If You Want To Diversify,

Special Upgrade Offer: Add on Singapore Membership

For Only US$ 340

-

24 U.S. + 12 Singapore Case Study

-

4 US + 3 Singapore Inner Circle Live

-

4 US + 3 Singapore Authors Update Live

-

Access to 100+ US/SG Case Study Vault

-

Value Investing Bridging Course To Gain a Recession-Proof Skillset

-

Portfolio Case Study and ViA's Risk Management Framework

Here's What Our Members Say About Us

Backed By Our 7-Day Risk Free Policy*

#NoQuestionsAsked

Frequently Asked Questions (FAQ)

Q. Who is ViA Atlas US Case Study for?

Note: It is also important to note that our focus is to provide in-depth analyses and insights. A company's inclusion into the Case Studies does not constitute a recommendation to buy, sell, or hold any stocks. Investment decisions should be made based on individual discretion, taking into account personal investment goals and risk tolerance. Please read and refer to our disclaimer below for more information.

Q. I'm not a value investor, is the membership suitable for me?

Q. I'm already a subscriber to the US Case Study Membership.

For Gold Subscribers:

1st year renewal: US$ 598

2nd year renewal: US$ 498

For Platinum Subscribers

1st year renewal: US$ 888

2nd year renewal: US$ 688

Please note that the loyalty rates only apply to those who continue their membership with us in consecutive terms. This means if you pause your membership, and subsequently renew, the loyalty rates do not apply.

Q. What exactly is the US Case Study Subscription?

Our US Case Study Subscription provides in-depth analyses and insights on US companies across various sectors in the S&P500. The companies are sifted through the ViA Funnel, which is based on the value investing criteria, helping investors make informed decisions.

Q. How often are the new case studies released?

Q. What investment time horizon should I be looking at when looking at companies in the US Case Study Membership?

Studies show that value stocks outperform growth stocks in approximately 84% of 5-year periods. This duration allows investors to ride out short-term volatility and benefit from market corrections. And over a decade (10 years), the performance range of value stock narrows significantly, with historical data indicating higher average returns and reduced likelihood of negative outcomes. Longer time horizons also mitigate risks associated with market drawdowns, as value portfolios tend to recover faster than the broader market. Thus, It is important to take a long term view as value investors.

It is also important to note that our focus is to provide in-depth analyses and insights. Investment decisions should be made based on individual discretion, taking into account personal investment goals and risk tolerance. Please read and refer to our disclaimer below for more information.

Q. What does CFOS stand for?

CFOS stands for Cash-Flow Options Strategies, which allows investors to generate weekly or monthly income from 'writing' options, while waiting for the stock prices to hit the desired price levels.

Keep in mind that Options are derivatives that represent 100 shares of the underlying stock. Before dealing with Options, it’s essential to understand the risks associated with derivatives such as Options.

Q. Do the case studies provide explicit buy/sell recommendations?

Our focus is solely to provide in-depth analyses and insights by applying value investing methodologies and various valuation methods in the context of real-life companies, for continued investor education. We do not provide recommendations, or buy and sell signals.

Under no circumstances does any information provided in the Case Study Membership represent a recommendation to buy, sell or hold any stocks. Investment decisions should be made taking into account your personal investment goals, risk tolerance, and time horizon.

Please read and refer to our disclaimer below for more information.