2022 Undervalued Stocks bought by Top Investors (Part 3)

Share this article:

For our past 2 articles, we have been exploring various top value investors’ investing styles that helped them to purchase outstanding companies which generated exceptional market beating results and also their latest stock purchases in 2022.

Click on the links below to read more:

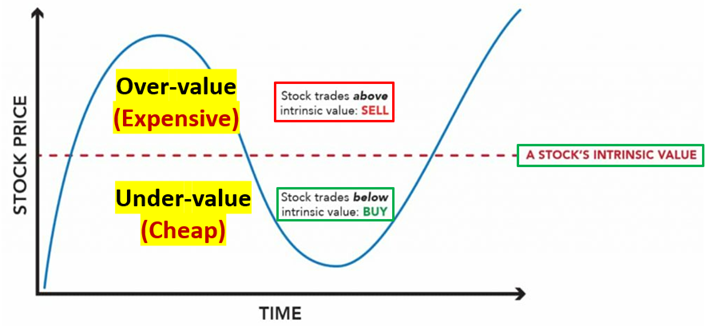

According to Benjamin Graham, the godfather of Value Investing Methodology, Value Investing is an investing strategy that investors have an ownership interest in an actual business and want to buy a good business at a cheap price.

- If the share price is above the intrinsic value (shown in red dotted line), the share price is considered to be expensive or over-value.

- If the share price is below the intrinsic value, the share price is considered to be cheap or under-value.

- How their investing strategies help them to identify undervalue stocks

- Top holding stocks in their portfolio

- Latest stock purchases or stock picks in 2022

Let’s get on with our investigation!

SETH KLARMAN

Seth Klarman is an American billionaire value investor and the author of the famous investment book, “Margin of Safety” which sold only a limited of 5,000 copies since publication.

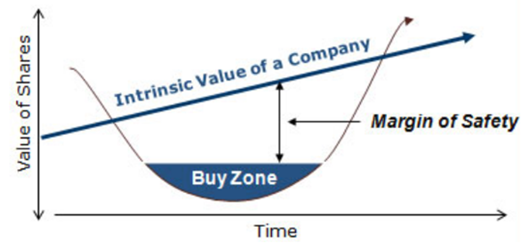

One of his main investing strategies that helped him to generate such consistent high returns is by applying Margin of Safety which helped him to buy undervalued stocks or assets. Margin of Safety is a concept where investors purchase a stock that is below the intrinsic value to provide a buffer of error and also to minimize big losses or permanent capital loss.

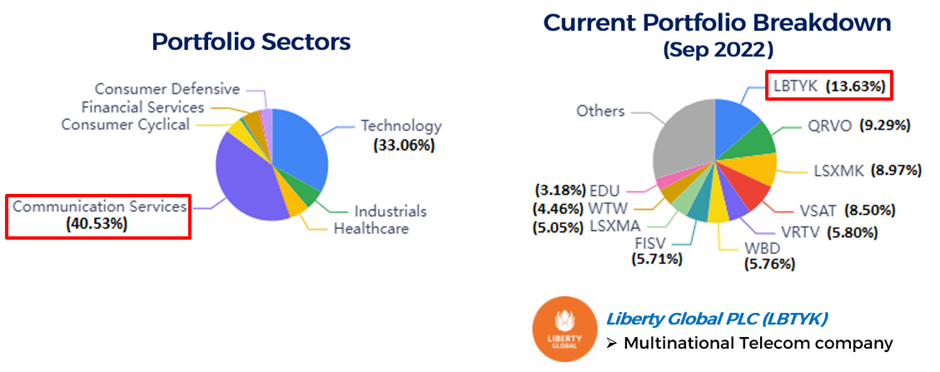

His latest portfolio is made up of seven sectors, with Communication Services (40.53%) takes up the largest portion, followed by Technology sector (33.06%).

Currently, Klarman’s largest stock holding in his portfolio is Liberty Global PLC (NASDAQ: LBTYK), a multinational telecom company with headquarters in London, Amsterdam and Denver.

LATEST STOCK PURCHASE IN 2022

In Q3 2022, Klarman has purchased approximately 250,000 shares of Lithia Motors Inc (NYSE: LAD) at an average price of $261.28.

LAD is the largest US Auto dealership that sells new and used vehicles. It offers 41 brands of cars at 282 locations in 26 US states and 14 locations in Canada as of 2022. The company also provides auto repair & maintenance services, financing & insurance sales. These services are provided under 4 brands.

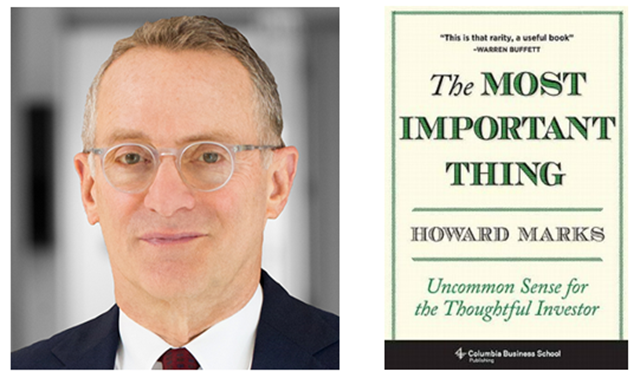

HOWARD MARKS

Howard Marks is another famous American billionaire top value investor, co-founder & co-chairman of Oaktree Capital Management. He is an author of 3 books and frequently writes memos on value investing philosophy where Buffett enjoys reading his memos!

From his memos, we learned that he like to apply Deep Value Investing methodology, where he purchases bad businesses that are completely ignored by the investment community. The reason he invested in these types of companies is because he understands that there is a price mismatch due to greed and pessimism during a market cycle. To avoid losses when investing in such companies, he focuses on risk management via asset diversification and applying margin of safety.

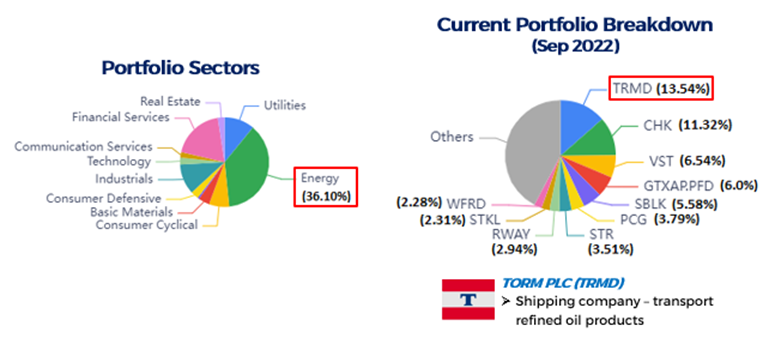

As such, he was able to generate post-fees annual return of 19% compared to S&P 500’s 10.4%. His portfolio is widely diversified in various S&P 500 sectors, with Energy sector making up almost 36% of his portfolio. His current largest holding stock is TORM PLC (NASDAQ: TRMD), which is a UK-based shipping company that transports refined oil products.

LATEST STOCK PURCHASE IN 2022

PAGS offers various financial services and digital payment platforms to customers, solo entrepreneurs, small & medium enterprises under 2 brands – PagSeguro & PagBank.

LI LU

Li Lu is a Chinese-born American value investor, businessman and philanthropist. He is the founder and chairman of Himalaya Capital Management hedge fund company that focusses on Asian public companies. He wrote 2 books, one is in English, and another is in Chinese, as shown in the graphic below.

Due to his exceptional investing acumen, he is one of the super-value investors who had achieved a compounded annual return of 30% since 1998. This had led to Munger described him as “Chinese Warren Buffett”.

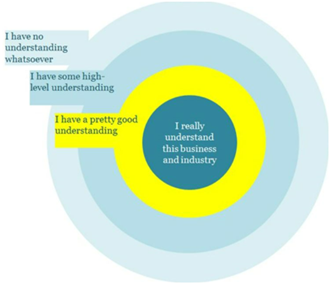

For him to generate such exemplary returns from the stock market, he has an investing mantra – “Accurate & complete information”. This means that he will gather as much information as possible about the company, to fully understand the company’s business model before investing in the company. This strategy is known as Circle of Competence. He will also identify if the company is being led by a great management team that has competitive advantage and great growth potential.

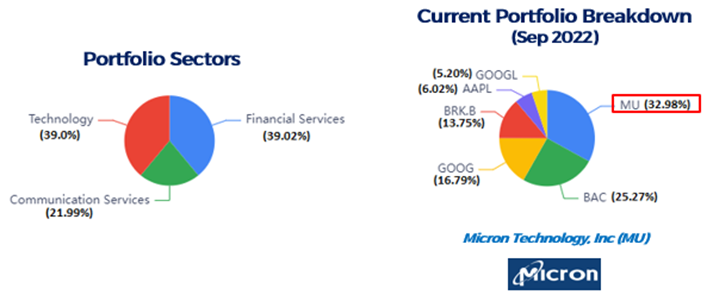

Hi current portfolio in 2022 is made up of 3 sectors – Financial Services, Technology and Communication Services. His largest holding stock is a US semiconductor company, Micron Technology, Inc (NASDAQ: MU), takes up approximately 33% of his portfolio.

LATEST STOCK PURCHASE IN 2022

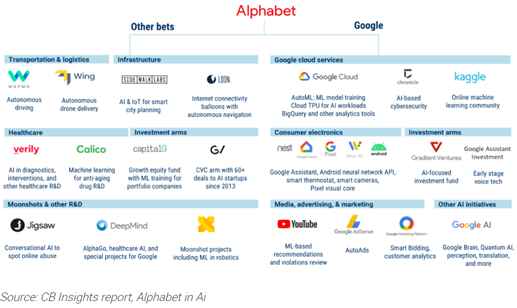

In Q2 2022, Li Lu bought 948,000 shares of Alphabet Inc (NASDAQ: GOOGL) at an average price of $118.50.

- GOOGL (A class shares) - 1 voting right

- GOOG (C class shares) - no voting right

GOOGL is an American multinational technology holding company where it is the parent company of Google. It also invested in various technological ventures and owns a number of other technological subsidiaries besides Google.

MERYL WITMER

She also served on the Berkshire Hathaway’s board since 2013 and general partner at Eagle Capital Partners.

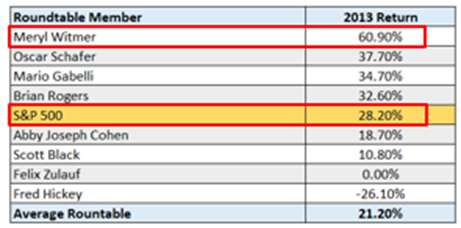

Due to her stellar performance in stock picking, her investment return (60.90%) in 2013 has beat her other Roundtable counterparts and also S&P 500 index (28.20%).

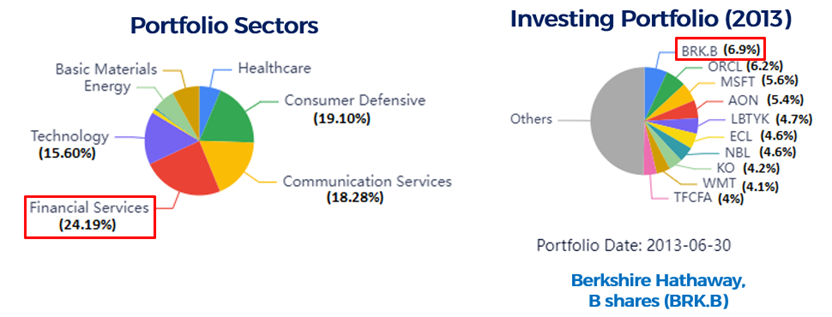

However, her portfolio was last updated and disclosed in 2013 where her largest holding stock is Berkshire Hathaway, B shares (NYSE: BRK.B). Her portfolio in 2013 was made up of 6 sectors, with the largest sector in Financial Services (24.2%).

LATEST STOCK PICK IN 2022

Even though Witmer no longer disclose her portfolio (and we are unable to keep track of what she is buying in her portfolio), as she is still active as a Barron’s Roundtable member, she provides her stock picks annually.

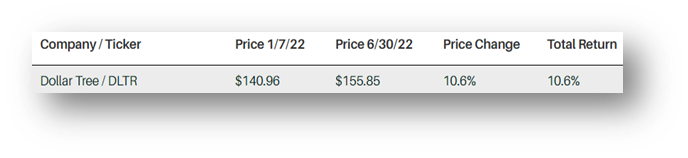

In Jan 2022, she has suggested Dollar Tree (NASDAQ: DLTR) as one of her five stock pick suggestions. The stock has been performing well into half year of 2022 where it had generated a total return of 10.6% in Jun 2022.

JIM ROGERS

Jim Rogers is an American investor and financial commentator based in Singapore. He is also the creator of Rogers International Commodities Index (RICI) where the index tracks 38 commodity futures in Agriculture, Energy and Metals.

Rogers has written 6-8 books on investing, with his latest released in 2013, titled “Street Smarts: Adventures on the Road and in the Market”.

He is famous for buying assets when he saw there was serious panic or depression in the market, which is the time to buy low. This is because when there is depression, majority people will be afraid of losing money. Thus, there will be panic selling in the market and push the prices of the assets lower.

This is when he will come into the market to look for bargain sale and invest in something that is struggling or ignored by the market. However, when the panic selling has subsided and the market is recovering, the asset prices may rise again due to optimism. That will be the time he sells away the assets at a higher price.

To accurately determine if the assets is a good investment, an in-depth understanding and knowledge of the assets (Circle of Competence) is a must, for one to have the steel of nerve to execute such trade in a contrarian manner.

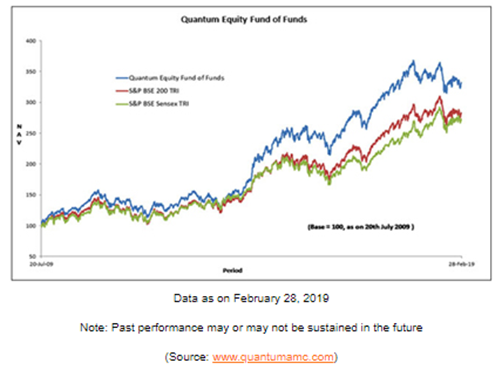

Rogers has managed to generate a return of 4,200% over 10 years, from 2009 to 2019 at Quantum Fund where he co-founded with George Soros.

LATEST INVESTMENT SUGGESTIONS IN 2022

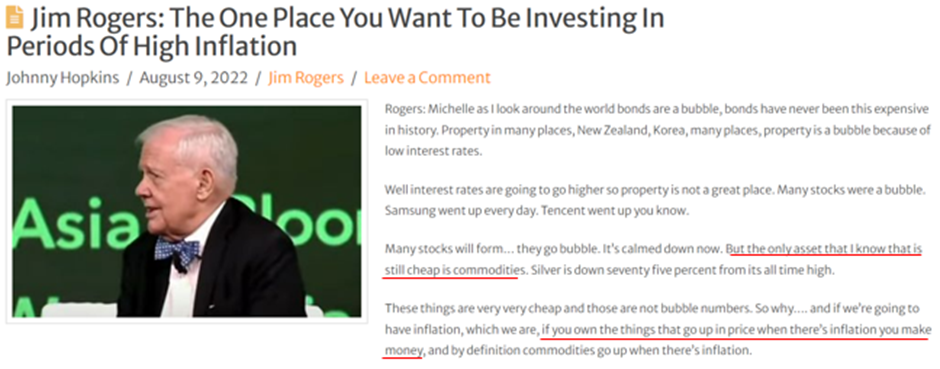

Currently, he is retired from the hedge fund company and thus there was no latest update on his portfolio. Nonetheless, he often appears in news channels to give his thoughts on the latest market trends. One of the assets that he suggested to invest during periods of high inflation is in commodities.

We have searched online for some of the commodity stocks that is available for investing and presented on our YouTube Channel. Click on the link to find out more!

CONCLUSION

As a round up for our 3 series of deep diving into famous value investors’ portfolio and investing strategies, we can conclude that these value investors will only invest in a good quality company or assets that they fully understand (Circle of Competence). This is because they want to invest long-term in the company for the compounding effect to grow their portfolio.

In addition, they will also perform stringent due diligence on the company’s financials and other aspects, such as the management team and economic moats before they invest. To further lower the risk of their investment, they will only buy when the share price is under-value by applying a Margin of Safety strategy.

Mohnish Pabrai was famous for copying Warren Buffett’s investing strategy and produced an impressive portfolio by applying what he learned. If he can copy and grow his portfolio, we can also follow what he did to invest and grow our own money!

You can learn the value investing strategies that these top investors use today to generate streams of passive income for a lifetime.

It’s time to transform your investing strategy into one like a real fund manager today here.

How to Apply a Fundamental-First Approach to Investing

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017, 2025 Spirit of Enterprise Honouree

You will learn:

- How to navigate market uncertainty amidst geopolitical tensions and market uncertainty

- How can all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction.

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing can help you cope with market uncertainty

- How ViA Atlas could help you strengthen your portfolio and streamline your decision-making process

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying high-quality resilent companies

Click the button below to reserve your spot now.

Suitable For

Solutions For

Mind Kinesis Investments Pte Ltd. All Rights Reserved.