Understanding Investment Styles: Why Value Investing and ETFs Are Ideal for New Investors

Share this article

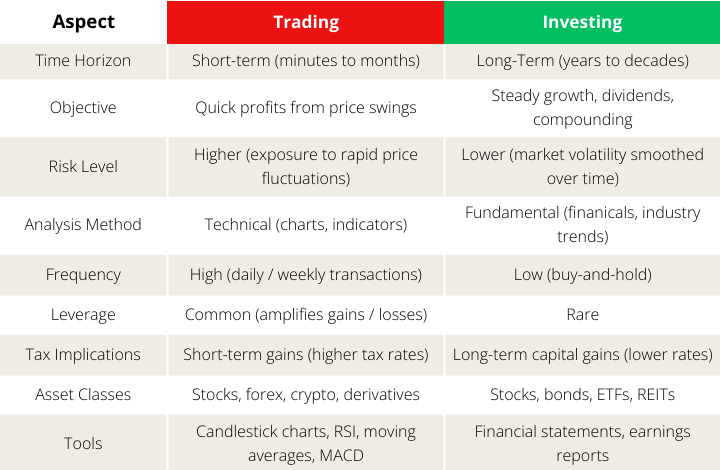

Investing v.s. Trading: The Core Difference

What is Investing?

Investing is often compared to planting a tree—requiring patience, care, and steady nurturing to see the fruits of your labor. This metaphor holds true across all investment styles, including Growth Investing and Value Investing, two of the most prominent approaches. While Growth Investing focuses on companies poised for rapid expansion, Value Investing seeks out undervalued opportunities with strong fundamentals. In this article, we’ll explore examples of both strategies, including insights from Warren Buffett’s legendary career, to help you understand their differences and why Value Investing may be the superior choice for beginners.

What is Trading?

Trading involves buying and selling assets frequently—sometimes within minutes—to profit from price changes. Traders thrive on volatility, using charts and market trends to make quick decisions. While trading can generate fast returns, it’s riskier and requires constant attention. Imagine trying to catch falling knives; one wrong move can lead to significant losses

Key Differences:

- Time Horizon: Investors think in decades; traders think in days or hours.

- Risk: Trading has higher risk due to market timing and leverage.

- Effort: Investing is passive; trading demands active monitoring

Popular Investment Styles Explained

Passive Investing

Passive investors buy and hold diversified assets like index funds or ETFs to mirror market returns. This "set-and-forget" strategy minimizes fees and avoids the stress of picking individual stocks. For example, an S&P 500 ETF lets you own small pieces of 500 top U.S. companies with one purchase.

Growth Investing

Growth Investing is centered around identifying companies with high potential for future expansion. These businesses often operate in emerging industries or are developing innovative products that could disrupt the market. However, investing in growth stocks comes with significant risks due to their reliance on future performance rather than current profitability. Below are some notable examples of Growth Investing:

Amazon (AMZN) in the Early 2000s

In the early 2000s, Amazon was a rapidly growing e-commerce company that had yet to turn consistent profits. Investors who believed in its vision for transforming retail poured money into its stock despite high valuations. At the time, Amazon was trading at price-to-earnings (P/E) ratios far above traditional benchmarks, reflecting expectations of future growth. Those who held onto their shares saw massive returns as Amazon became one of the largest companies in the world.

Zoom Video Communications (ZM) During the Pandemic

The COVID-19 pandemic created a surge in demand for remote communication tools, making Zoom a standout growth stock. Investors flocked to Zoom during its meteoric rise in 2020, driven by expectations that remote work would become a permanent fixture in professional life. While Zoom’s stock price soared initially, it later faced challenges as competition increased and pandemic-driven demand waned—highlighting the risks inherent in growth investing.

Dividend Investing

Dividend stocks pay regular cash rewards to shareholders, often from stable companies like utilities or consumer brands. This strategy provides steady income, but dividends can be cut during economic downturns.

Value Investing

Value Investors seek stocks trading below their 'true worth', otherwise known as the 'Intrinsic Value' or IV for short, due to temporary issue. As the saying goes, 'Trouble is Opportunity'. For instance, a strong company might drop in price after a marital scandal by the CEO, creating a buying opportunity. Over time, the market usually corrects these mispricings, rewarding the patient investors.

“The stock market is a device for transferring money from the impatient to the patient”

~ Warren Buffett

Why Value Investing Works?

- Margin of Safety: Buying undervalued stocks reduces downside risk.

- Focus on Fundamentals: Value Investing prioritize strong financials (e.g. profits, debt levels) over hype.

- Historical Success: Legends like Warren Buffett built fortunes using this approach

Warren Buffett is widely regarded as the greatest value investor of all time. His career offers numerous examples of how patience, discipline, and a focus on fundamentals can lead to extraordinary success. Below are some key instances where Buffett applied his value investing principles:

American Express (1960s)

Why Value Investing Beats Other Strategies

1. Less Stress, More Consistency

Growth stocks and trading require predicting the future or timing the market—tasks even experts struggle with. Value investing relies on objective data (e.g., a company’s balance sheet) rather than guesswork.

Remember that we aren't fortune tellers, and even stock market analysts often get things wrong—sometimes quite significantly. While they use data, financial models, and expert insights to make predictions, the stock market is inherently unpredictable due to factors like economic shifts, investor sentiment, and unexpected news.

How wrong can the analysts be, you ask? It is well-documented that the financial analyst failed to predict the 2008 financial crisis. In fact, it's not that they missed it, but they positively denied that a crisis would happen, according to Franklin Allen, finance professor from the Wharton School of the University of Pennsylvania.

A notable example is the overreliance on complex financial models and derivatives, which led to a false sense of security among market participants. This complacency contributed to excessive leverage and risk-taking, culminating in the crisis.

2. Focus on Fundamentals

Value Investing prioritizes objective metrics like earnings, cashflow, and debt levels rather than speculative predictions about future performance.

3. Proven Track Record

Warren Buffett's success demonstrates how Value Investing can generate consistent returns over decades.

3. Built-In Protection

Undervalued stocks have already absorbed bad news, making them less prone to crashes. If you buy a $1 stock worth $2, you’re halfway to profit before the market notices

4. Compounding Over Time

Reinvesting dividends or gains from value stocks accelerates wealth growth. For example, a $10,000 investment growing at 8% annually becomes $46,610 in 20 years—without additional effort.

It has been said before that compounding is the '8th wonder' of the world.

5. Emotional Resilence

Market swings causes panic to traders and growth investors. Value investors are less affected by market volatility because they focus on long-term business performance rather than short-term price movements.

For beginners looking for an accessible entry point into value investing, ETFs (Exchange-Traded Funds) offer diversification and simplicity while adhering to value principles.

ETFs: The Perfect First Step for New Investors

What Are ETFs?

Why ETFs Align with Value Investing

- Diversification: Spread risk across sectors, avoiding the "all eggs in one basket" problem

- Low Costs: ETFs charge minimal fees compared to mutual funds

- Transparency: Holdings are disclosed daily, so you know exactly what you own.

An ETF tracking undervalued companies (e.g. a "value ETF") lets you practice value investing without analysing individual stocks - which is ideal for beginners

Final Thoughts

Ready to take the first step?

Get Your Free ETF eGuide

- Learn how to invest in your first ETF

- What is Index (ETF) Investing - the One Thing Needed for a Worry-Free Retirement

- The Power of Compounding - 8th Wonder of the World

- How to Keep Risk Low with Diversification & DCA

- How To Invest on AutoPilot using Exchange-Traded Funds (ETFs), Effortlessly

By submiting the form, you accept ViA's Disclaimer and the collection or use of my data in compliance with the Terms of USe and Privacy Policy, which includes receiving marketing communications, e.g. events and updatex. You may unsubscribe from these communications at any time.

Suitable For

Solutions For

Mind Kinesis Investments Pte Ltd. All Rights Reserved.