AI Revolution Unveiled: NVIDIA vs. AMD in a Battle for Dominance

Share this article

In the wake of NVIDIA’s remarkable stock surge driven by their revolutionary AI chips fueling ChatGPT, a new contender steps onto the scene – AMD. This formidable player has unleashed their own potent AI chips, aiming to challenge NVIDIA’s dominance in this dynamic AI landscape.

The pivotal question emerges: Is now the ideal time to invest in AMD and capitalize on the AI revolution?

In this blog article we’ll delve into:

- Unveiling AMD's essence through a blend of qualitative and quantitative analysis

- AMD;s strategic vision and future roadmap to seiZe the burgeoning AI boom

- A high-stakes showdown: AMD's chips vs Nvidia's in the thrilling AI race.

Get ready to unravel the dynamic interplay of technological giants and explore the potential opportunities in the captivating world of AI revolution!

To gain a deeper understanding, we’ve dedicated a section on AMD in our YouTube channel. Don’t miss out on the opportunity to gather additional insights by watching the video provided below.

QUALITATIVE ANALYSIS OF AMD

AMD, formally recognized as Advanced Micro Devices, Inc., is a prominent American fabless semiconductor enterprise. Its primary concentration encompasses chip design, software bolstering, and comprehensive marketing initiatives.

This company extends a diverse spectrum of offerings, encompassing both hardware and software realms. Among its offerings, semiconductor chips stand as notable hardware products, complemented by a suite of software solutions. These innovations find extensive utility across a multitude of sectors, including:

- Consumer electronics, such as personal computers and desktops.

- Data Centers – Centralized facility designed to house and manage a large amount of computing hardware, data storage, networking equipment, etc.

- Gaming – Dynamic realm of digital games, catering to avid gamers and enthusiasts.

- Robotics & Edge AI devices – Integration of AI and automation into robotic systems for intelligent automation and real-time decision-making.

AMD’s inception traces back to 1969, and a significant milestone was reached when it conducted an IPO in 1972. During this milestone moment, the company debuted on the Nasdaq stock exchange under the ticker symbol “AMD”.

Products & Solutions

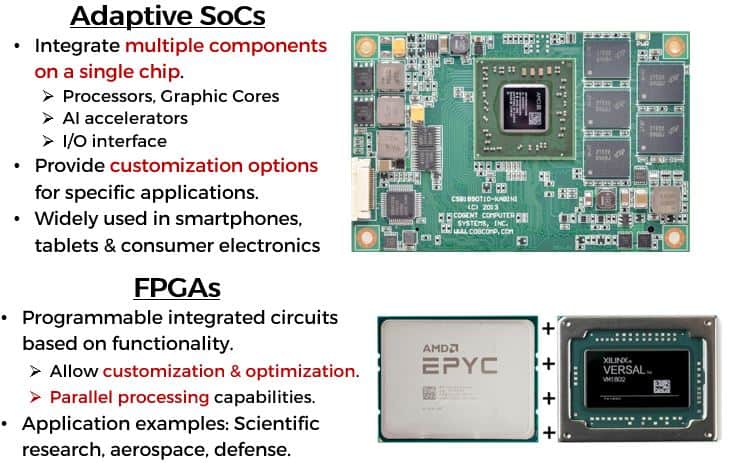

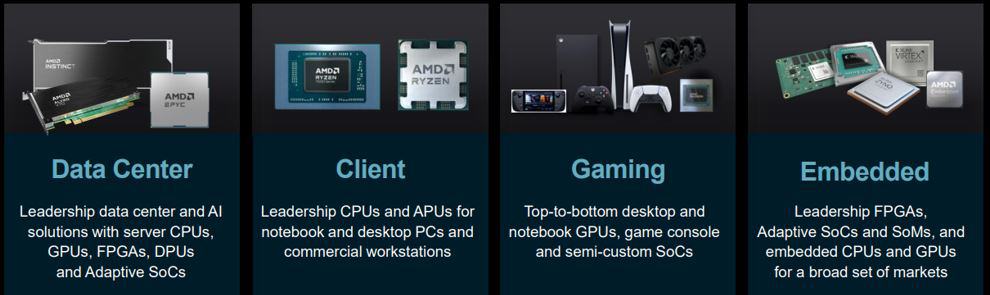

AMD primarily designs semiconductor chips for their hardware products, categorized into four main groups:

- Processors - Brain of the PC (e.g. CPU)

- Graphics - Chip for graphics, visuals and programming parallel processing (e.g. GPU)

- Adaptive System on Chips (SoCs) & Field Programmable Gate Arrays (FPGAs)

- Accelerators, SOMs & Smart NICs

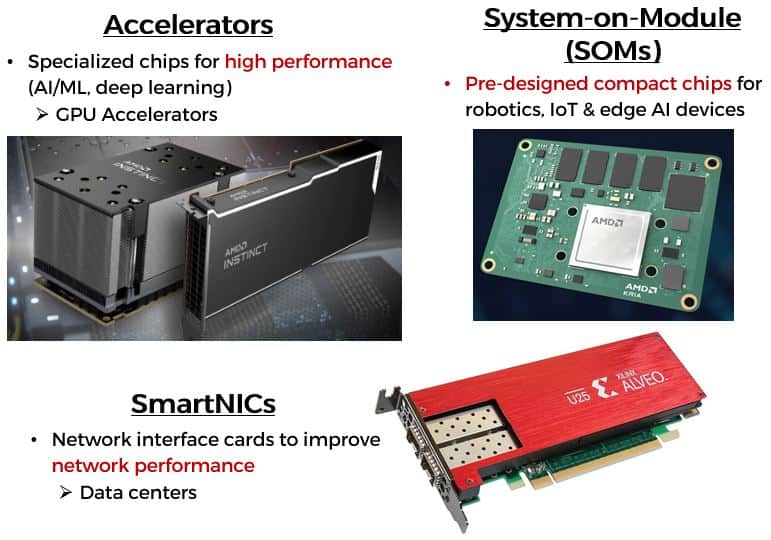

In addition to their hardware chip design endeavors, they provide solutions tailored to six key market platforms within the industry:

FUTURE PLANS OF AMD

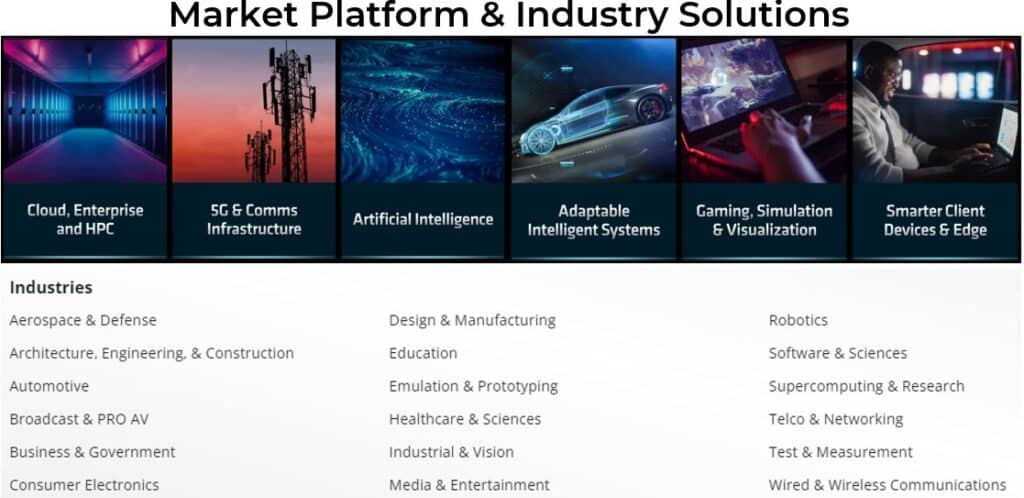

In 2022, AMD unveiled its 5-year growth strategy (2022-2027) centered around expanding five key areas, as depicted in the graphic below:

5 YEARS PLAN – PERVASIVE AI & DATA CENTER

Graphic source: AMD Investor Presentation

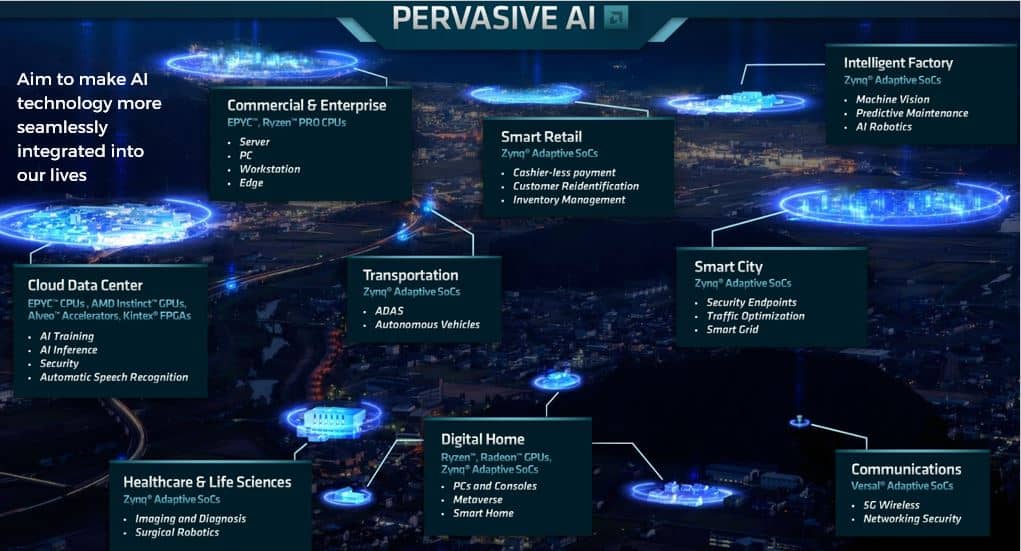

To realize this ambitious vision, AMD has outlined strategies that involves enhancing their training and inference chips across cloud, edge, and endpoint environments, as depicted in the diagram below:

Graphic source: AMD Investor Presentation

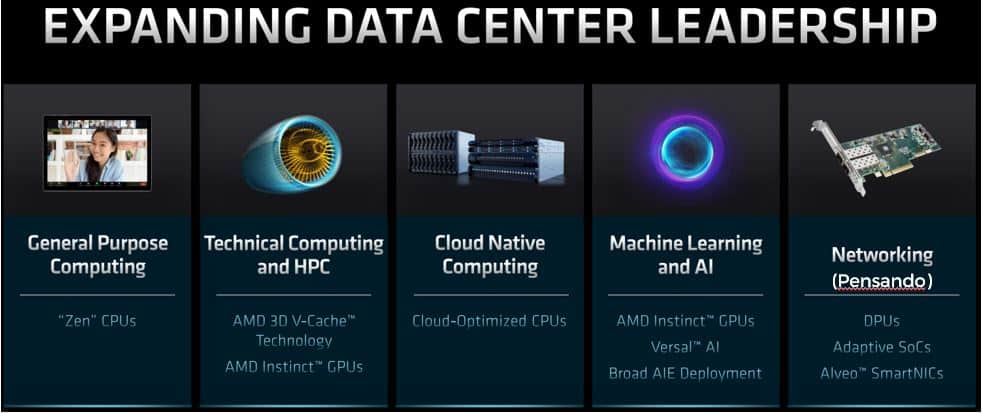

Apart from their drive to enhance their AI capabilities, AMD is also directing their efforts towards advancing their position in data center dominance. This strategic emphasis is attributed to the data center’s pivotal role in fostering the progress of AI, particularly concerning machine learning & deep learning.

In pursuit of an extended footprint in the data center realm, AMD presents an unparalleled array of data center computing solutions, solidifying their stance as an industry leader:

Nvidia is also focusing on their data center leadership expansion. Click on the link to find out more!

MERGER & ACQUISITIONS

During 2022, AMD further broadened its portfolio of chip offerings through the acquisitions of both Xilinx and Pensando.

Xilinx stands at the forefront as the primary supplier of FPGAs and SoCs. These chips boast exceptional customization capabilities, allowing for post-deployment functional modifications.

Xilinx‘s chip solutions find extensive utilization across domains like data centers, telecommunications, automotive, aerospace, and industrial sectors. AMD acquired Xilinx in February 2022, thereby reinforcing AMD’s portfolio in high-performance computing.

Pensando specializes in crafting solutions for software-defined infrastructures in data centers and cloud settings. Their range of products and technological innovations plays a pivotal role in reshaping and contemporizing data center architectures, with a particular focus on enhancing networking and security within cloud environments.

Reflecting this objective, AMD completed the acquisition of Pensando in May 2022, marking a strategic move to augment AMD’s prowess in data center solutions.

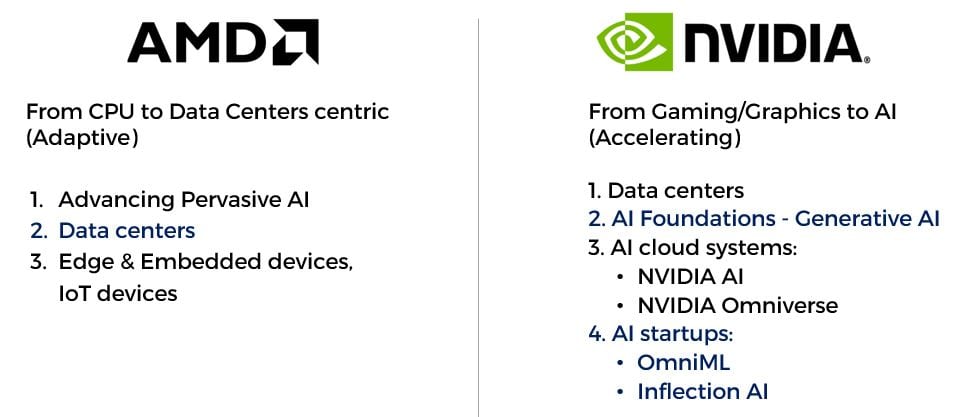

AMD VS NVIDIA

AMD and Nvidia, two industry giants, stand as prominent players in the realm of advanced computing and graphics solutions. As such, it is beneficial for us to compare their potential advancement in the AI field and their market share respectively.

Here’s a brief comparison between the two based on key pointers:

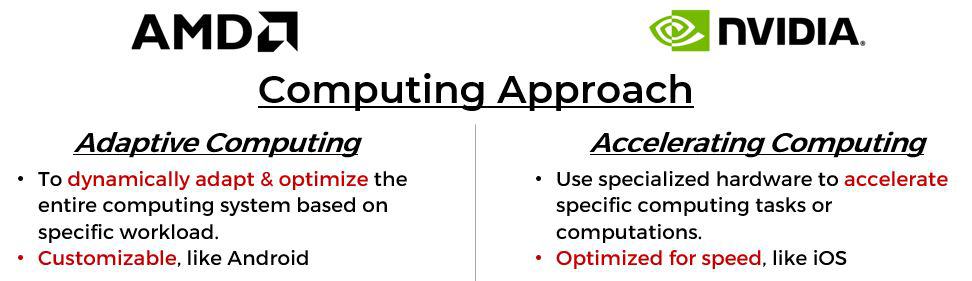

COMPUTING APPROACH & SOFTWARE SUPPORT

The computing approach pertains to the fundamental hardware structure employed for AI computations. This involves distinct hardware elements like CPUs, GPUs, or dedicated AI chips, along with their capacity to enhance AI tasks.

The illustration below presents a comparison of the computing approaches adopted by AMD and Nvidia:

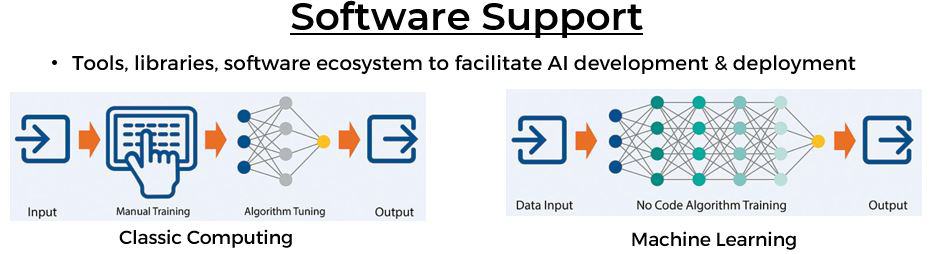

Software support for AI frameworks is like having a toolbox full of helpful tools for people who want to create and use AI technology. These tools make it easier to build, train, and use AI models, so that computers can learn and make smart decisions. It’s like having special tools that help AI technology work better and faster.

The diagram below shows the comparison between classic computing and machine learning when developing the AI frameworks:

In traditional computing, algorithms need hands-on training. Whereas in machine learning, algorithms can be trained with less human involvement, which accelerates the AI framework creation process.Large text.

CHIPS COMPARISON

AMD, with its Radeon Instinct GPUs, is carving a space in data centers for AI and HPC workloads. The acquisition of Xilinx further enhances AMD’s data center capabilities.

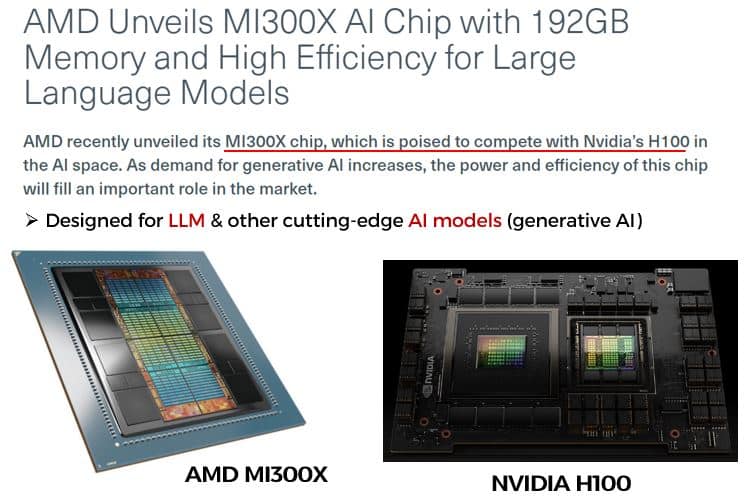

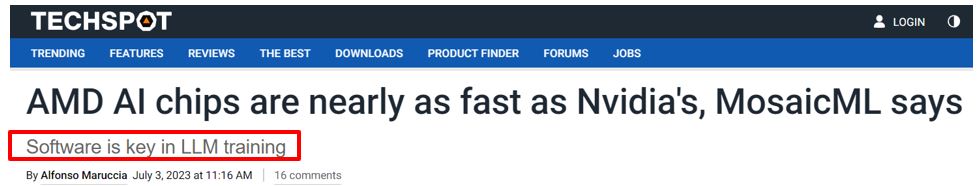

While Nvidia has traditionally led in AI and GPU-accelerated computing, recent developments reveal that AMD has introduced the MI300X AI chip, positioning it as a contender against Nvidia’s H100 chip.

Although Nvidia’s GPUs have held the spotlight for AI training, software company MosaicML revealed that AMD’s AI chips are approaching similar speed, potentially becoming competitive due to the crucial role of software in large language model (LLM) training.

MARKET PRESENCE

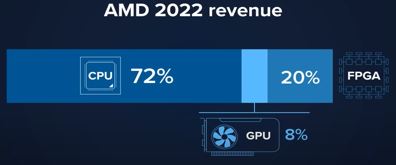

Nvidia has historically enjoyed a significant presence and market share in both gaming and professional graphics markets. Its GPUs have become synonymous with high-performance computing, AI, and deep learning. In 2022, 87% of Nvidia’s revenue came from GPU sales.

In terms of market reach, AMD has a wider presence than Nvidia. Even though many AMD chips power gaming consoles, the company has also expanded through Ryzen processors and Radeon GPUs, competing well in gaming and professional markets. In 2022, GPU revenue contributed only 8%, significantly less than CPU (72%) and FPGA (20%).

This leads us smoothly to the next section, where we’ll delve deeper into AMD’s financial performance in the fiscal year 2022.

QUANTITATIVE ANALYSIS OF AMD

REVENUE GENERATION

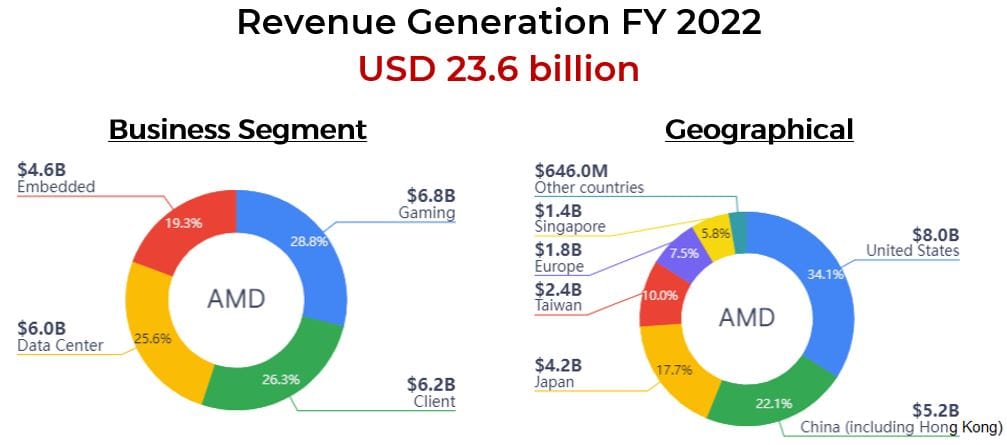

In FY 2022, AMD has generated a total of USD 23.6 billion from these 4 business segments:

In terms of geographical distribution, the United States emerged as the leading contributor, accounting for 34.1% of the total revenue. China (including Hong Kong) secured the second position, contributing 22.1%, followed by Japan at 17.7%. The remaining 26.1% originated from various other global regions.

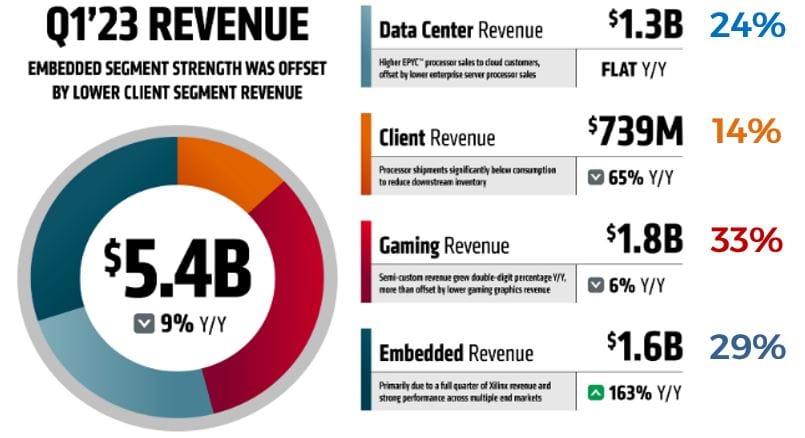

Graphic Source: AMD Q1 FY23 Quarterly Report

Interestingly, in comparison to the preceding fiscal year (FY 2022), the Embedded segment emerged as the second-highest contributor, accounting for around 29% of the overall revenue. This surpassed the Data Center segment, which constituted 24%, and the Client segment, which contributed 14%.

A significant factor behind the substantial revenue decline in the Client segment can be attributed to the broader downturn in the semiconductor industry, causing a decline in PC sales. This industry-wide slump impacted the Client segment’s performance notably.

For a more comprehensive insight into AMD’s financial performance across various metrics and their potential risks, watch them on our YouTube channel!

CONCLUSION

In conclusion, AMD stands as a dynamic player in the semiconductor realm, showcasing their expertise in chip design, software solutions, and potential AI growth. Despite challenges in the Client segment due to industry trends, AMD’s strategic innovation sets a promising path.

Their commitment to research and development, exemplified by the ROCm platform for software support and acquisition of Xilinx and Pensando, places them well in the competitive GPU-accelerated computing and AI field.

As AMD progresses by broadening its offerings and building partnerships, it holds the potential to shape the future of computing. With a steadfast dedication to innovation and growth, AMD is positioned to influence the trajectory of technology.

Are you in search of growth and undervalued companies? Dive into our US Case Study Subscription to:

- Discover companies meticulously researched from thousands in the US market.

- Bypass the tedious research process, we evaluate and pinpoint the intrinsic value using various tools.

- Harness advanced options strategies for a new stream of passive income.

Click on the banner below to find out more!

How to Apply a Fundamental-First Approach to Investing

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017, 2025 Spirit of Enterprise Honouree

You will learn:

- How to navigate market uncertainty amidst geopolitical tensions and market uncertainty

- How can all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction.

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing can help you cope with market uncertainty

- How ViA Atlas could help you strengthen your portfolio and streamline your decision-making process

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying high-quality resilent companies

Click the button below to reserve your spot now.

Suitable For

Solutions For

Mind Kinesis Investments Pte Ltd. All Rights Reserved.