How to Maximize Profits from a Bear Market

Since Liberation Day (trade war), I’ve received messages from graduates all over the world. Many of them bought stocks, only to watch the prices drop soon after. Naturally, they became anxious and asked, “What should I do now?”

That’s when I realized—this reaction is completely normal. It’s human nature to worry when your investments decline in value. That’s why I created this article series: to assure you that a drop in share price doesn’t always spell disaster. In fact, it might just be an opportunity.

So, over the next few articles, I want to share how to maximize profits during a bear market.

What Is a Bear Market?

In investing, we often use terms like bull market and bear market to describe market trends.

- A bull market means prices are rising. Think of a bull using its horns to thrust upward—that’s the motion we associate with rising share prices.

- A bear market, on the other hand, involves prices falling. Imagine a bear swiping down with its paw. That downward motion represents declining stock prices.

But how do we measure these movements?

We look at something called a market index, which is a benchmark that represents the overall market.

- Singapore: Straits Times Index (STI)

- Hong Kong: Hang Seng Index

- Japan: Nikkei 225

- USA: S&P500, Dow Jones Industrial Average, NASDAQ

When an index moves up, the market is considered bullish. When it moves down significantly, it's bearish.

Sometimes, the market doesn’t go up or down—it simply moves sideways. This means there’s no clear upward or downward trend. So, we typically describe market movement in three ways: bullish, bearish, or sideways (market consolidation).

So, What Exactly Is a Bear Market?

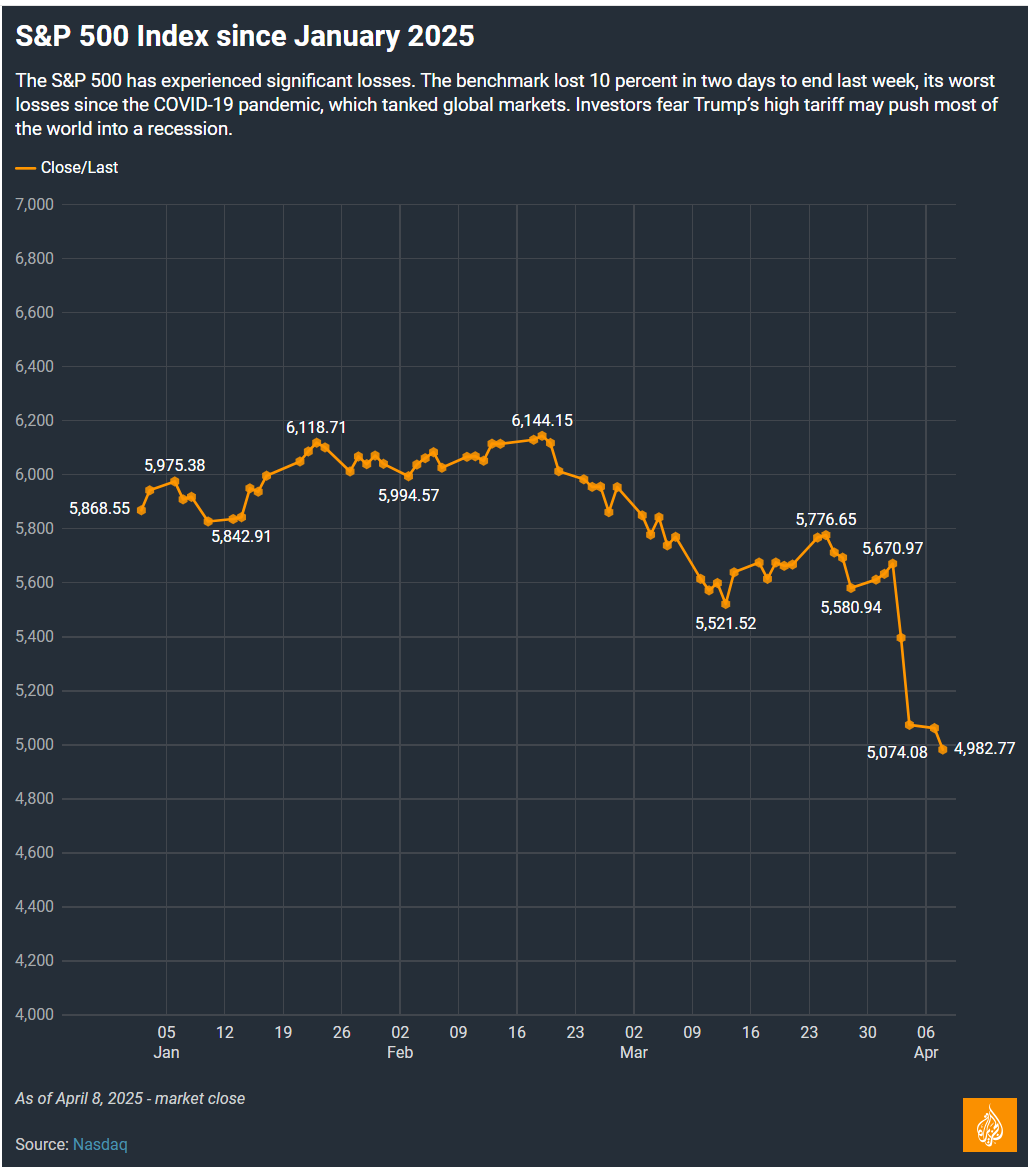

A bear market occurs when an index drops by 20% or more from its recent high. As of the date of this article, the S&P500 is down 17.6% from its high of 6,144.15 in February 2025.

(Source: Al Jazeera)

Characteristics of Bear Markets

- Since World War II, bear markets have lasted 13 months on average.

- On average, markets lose 30% of their value during a bear market.

- Recovery—when prices return to previous highs—typically takes 22 months (nearly two years).

Let me show you some data:

From 1946 to now, there have been multiple bear markets. Some lasted only a month, while others stretched over two years. But if we summarize the numbers:

- Average drop: 30%

- Average duration: 13 months

- Average recovery time: over 13 months

What About Corrections?

You might have heard the term market correction. A correction is a drop of around 10%, which is less severe than a bear market. These happen more frequently and typically last for a shorter period of time. The daily market fluctuation is usually around 3%—these ups and downs are normal and nothing to worry about.

To recap:

- Daily fluctuation: ~3%

- Correction: ~10%

- Bear Market: ~20% of more

Danger or Opportunity?

Why should you care about bear markets or corrections?

Because in every crisis, there are two perspectives:

- Danger (危 – wēi)

- Opportunity (机 – jī)

Most people only see the danger because they don’t understand what’s happening. Without the knowledge or tools, every crisis becomes a source of panic.

But you are different.

You are reading this because you have chosen to learn, and that's what gives you an edge over the speculators.

Final Thoughts

Because when the market drops, the sale begins. And smart value investors know: that’s when you buy.

Stay tuned for Part 2: How to Understand the Difference Between Stock Price and Company Value

Are you ready to invest smart? Want to learn how to spot opportunities? Scroll down below to register for my upcoming webinar!

Webinar: Identifying Opportunities in this Volatile Market

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017

You will learn:

- How to navigate market volatility in spite of changes in global trade and interest rates policies

- How an all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing, support prudent long-term value investing

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying on identifying and evaluating high-quality companies.

Suitable For

Solutions For

Mind Kinesis Investments Pte Ltd. All Rights Reserved.