Tech Resurrection of META (2023)

Share this article

Meta, the parent company of Facebook, recently underwent a series of layoffs that affected various business and operating units. This downsizing has left employees with low morale, painting a bleak picture of the company.

Furthermore, there are reports indicating that Meta is scaling back its metaverse ambitions and toning down its advertising pitch for the metaverse.

Are you curious to learn about the latest developments at this tech giant and its future plans to maintain its leadership position in the realm of social media?

In this blog article, we will unravel:

- The recent setbacks faced by Meta.

- The strategies implemented by management to reverse the situation.

- The company’s latest qualitative & quantitative analysis.

LATEST UPDATE ON META

During the tech downturn, Meta’s announcement of job cuts painted a bleak picture. Three rounds of layoffs in November 2022, March 2023, and May 2023 affected 21,000 jobs, primarily non-engineering roles.

This, combined with CEO Mark Zuckerberg’s shift away from metaverse ambitions towards artificial intelligence (AI), has created a negative perception of the company.

Reports indicated that Meta has transitioned from emphasizing metaverse promotion to advertisers and has shifted its focus towards prioritizing AI tools.

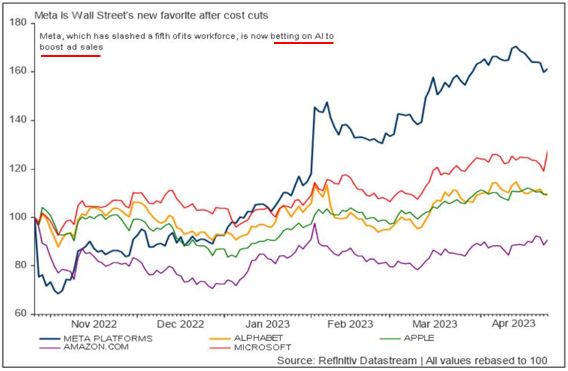

For that reason, Wall Street has responded positively, as Meta’s share price has been rising on the promise of AI.

The chart below illustrates the performance of various tech companies’ share prices since October 2022 (all values rebased to 100).

In the upcoming segment, we will delve into Meta’s future plans and strategies to navigate a new course using AI.

META's FUTURE PLAN WITH AI

Upon Zuckerberg’s initial announcement in 2021, he expressed great enthusiasm for the metaverse‘s future, so much so that he rebranded the company from Facebook to Meta.

Potential future of Metaverse

However, after two years have passed, news surrounding the metaverse has gradually lost momentum and deviated from its original vision. Despite this, Zuckerberg remains steadfast in asserting the company’s dedication to the metaverse.

Meta now emphasizes a dual focus on both AI and the metaverse, with Zuckerberg emphasizing that constructing the metaverse is a long-term undertaking requiring the assistance of AI to become a reality.

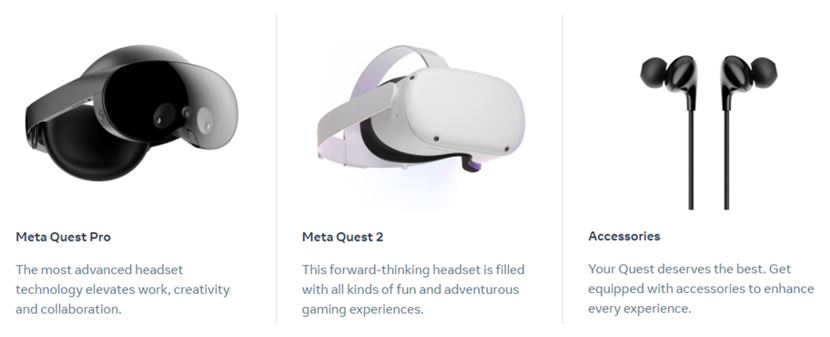

As such, Meta announced their latest virtual reality headset, named Meta Quest 3 in June 2023. Users can now use the headset to play games and connect with friends in the virtual world.

META ADVANTAGE+

Meta has redirected its focus towards launching generative AI advertising tools, notably Meta Advantage+, to harness the power of artificial intelligence.

Meta Advantage+ is an innovative product ad solution that leverages AI to personalize ad templates for each user based on customer data. This streamlined approach accelerates the ad production process, enabling businesses to effectively target specific customer segments and drive sales using Meta’s data.

By utilizing AI-generated ads, manual tasks are eliminated, freeing business owners from the need to create individual ads for every item. Here’s an overview of the process flow:

To initiate the process, business owners will begin by setting up their catalog and subsequently categorizing their target audience as either Broad Audiences or Retargeting.

- Broad Audiences – Target customers not yet purchased from the business but have shown similar interest in brands similar to the products & services offered.

- Retargeting – Customer who have expressed interest in specific products on your website to encourage purchase.

In the final step, the software will generate and deliver AI-generated ads from the business’s catalog to the designated target customers.

OTHER INITIATIVES

The company presents augmented reality as an enticing option to advertisers, showcasing new AR Reels Ads and Facebook Stories. Users can effortlessly experience the products through augmented reality on their phones, enhancing their shopping experience.

Using AR to try out sunglasses prior to purchasing

Additionally, the company has announced its upcoming launch of BlenderBot3, an AI-powered chat system designed to serve as both feedback agents and customer service representatives for Facebook users.

Furthermore, they have introduced their own natural language generation technology, known as Large Language Model Meta AI (LLaMA), which can be described as Meta’s equivalent of ChatGPT in simpler terms.

META'S QUALITATIVE ANALYSIS

After the company was rebranded as Meta in 2021, they also categorized their business operations into 2 segments: Family of Apps & Reality Lab.

FAMILY OF APPS

The Family of Apps encompasses four prominent social media platforms, namely Facebook, Instagram, FB Messenger, and WhatsApp. This collective network serves as a thriving ecosystem that connects billions of users worldwide.

The data-driven advertising capabilities offered by the Family of Apps empower marketers to craft tailored ad campaigns and achieve remarkable results. This ensures a mutually beneficial relationship between advertisers and the platform.

REALITY LABS

Reality Labs is a dedicated division within Meta that specializes in the creation of cutting-edge Augmented Reality (AR) and Virtual Reality (VR) products. One of its notable achievements is the development of the Meta Quest VR headset, a state-of-the-art device that immerses users in captivating virtual worlds.

This comprehensive software lineup encompasses a spectrum of applications, making it an appealing prospect for users from various walks of life.

META'S QUANTITATIVE ANALYSIS

Revenue Generation

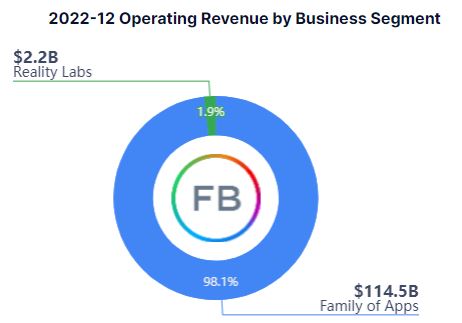

In the financial year (FY) 2022, Meta has generated a total of USD 116.6 billion, where majority of the revenue came from Family of Apps (98.1%). Reality Labs only generated a mere 1.9% of the revenue.

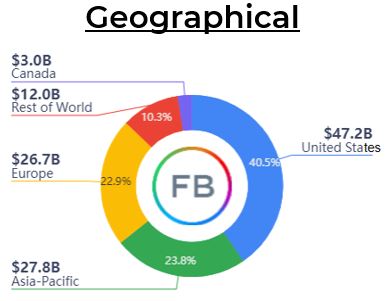

Whereas for their geographical revenue in FY 2022, most of the revenue was derived from the U.S. (40.5%), followed by Asia Pacific (23.8%) and Europe (22.9%). The remaining region – Rest of the World and Canada has contributed 10.3% and 2.5% respectively.

We have also examined other financial metrics of Meta to evaluate the company’s potential as a compelling tech stock investment on our Youtube channel.

Simply click on the video above to gain valuable insights and make informed investment decisions!

CONCLUSION

In conclusion, Meta, formerly Facebook, has undergone significant changes and expansions across various business sectors.

How to Apply a Fundamental-First Approach to Investing

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017, 2025 Spirit of Enterprise Honouree

You will learn:

- How to navigate market uncertainty amidst geopolitical tensions and market uncertainty

- How can all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction.

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing can help you cope with market uncertainty

- How ViA Atlas could help you strengthen your portfolio and streamline your decision-making process

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying high-quality resilent companies

Click the button below to reserve your spot now.

Suitable For

Solutions For

Mind Kinesis Investments Pte Ltd. All Rights Reserved.