Sep 17

Top Value Investors: Strategies and Portfolio

Share this article

Introduction

Have you ever wondered how some of the world's top investors achieve their success and produced market beating results? What if you could follow in the footsteps of renowned value investors? Meet Mohnish Pabrai, Tom Gayner, David Abrams, Michael Lee-Chin, and Allan Mecham—each a master of their craft, employing unique strategies that have generated remarkable returns. This post will guide you through their profiles, investment philosophies, and portfolios, providing valuable insights for aspiring investors.

1. Mohnish Pabrai

Who is Mohnish Pabrai?

Mohnish Pabrai is the founder and managing partner of Pabrai Investment Funds. Known for his ability to identify undervalued companies, Pabrai's approach closely mirrors that of Warren Buffett and Charlie Munger.

Investment Strategies

1. Clone Investing: Adopts successful strategies from renowned investors like Warren Buffett.

2. Concentrated Bets: Makes large bets on a few high-conviction ideas.

3. Value Investing: Seeks undervalued companies with significant upside potential.

4. Checklist Approach: Uses a detailed checklist to avoid investment mistakes.

- Insight: Pabrai's cloning strategy and his rigorous checklist approach help him identify and capitalize on high-potential investments while minimizing errors.

Portfolio

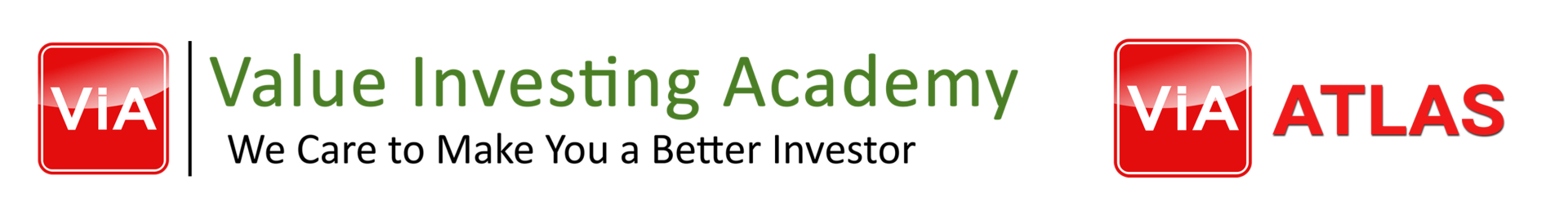

Pabrai's portfolio includes names like CONSOL Engery Inc, Warrior Met Coal Inc, Alpha Meta llurgical Resources, Arch Resources Inc.

Mohnish Pabrai's portfolio. Source: Gurufocus

Tom Gayner

Who is Tom Gayner?

Tom Gayner serves as the co-chief executive officer of Markel Corporation, a prominent financial holding company. Renowned for his conservative and consistent investment strategy, Gayner possesses a talent for identifying high-quality businesses capable of compounding capital over time.

When he joined Markel Corporation, he began as an equity investment manager in a company valued at just $40 million. Today, that valuation has skyrocketed to nearly $18 billion.

An avid admirer of Berkshire Hathaway, Gayner aspires to cultivate a similar success with Markel Corporation.

Investment Strategies

1. Quality Focus: Invests in high-quality companies with strong management.

2. Diversification: Maintains a diversified portfolio to manage risk.

3. Long-Term Horizon: Emphasizes long-term investments to benefit from business growth.

4. Capital Allocation: Skilled at allocating capital efficiently within Markel.

- Insight: Gayner's focus on quality and his ability to allocate capital effectively have been key drivers of his investment success.

Portfolio

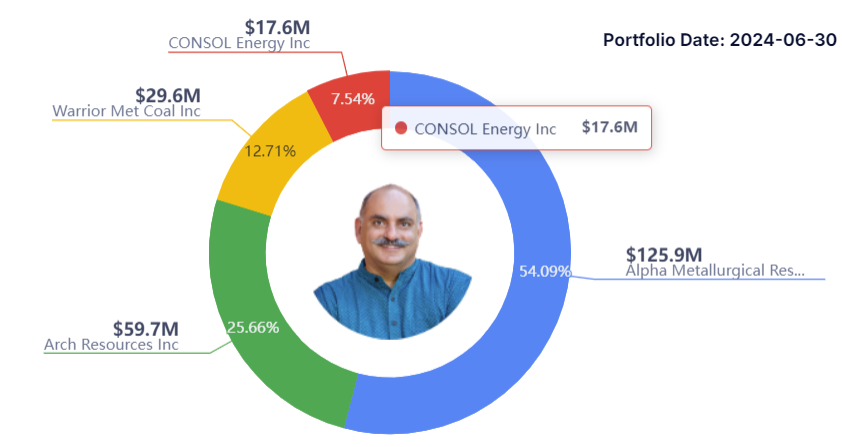

Some of Gayner's top holdings include Berkshire Hathaway, Home Depot, and Alphabet. His portfolio is diverse, spanning various industries such as tech, retail, and largely financial services.

Tom Gayner's Markel Corp fund portfolio. Source: Gurufocus

David Abrams

Who is David Abrams?

David Abrams is the founder of Abrams Capital Management and has earned a reputation for his value-oriented investment style. Abrams prefers to operate under the radar, letting his performance speak for itself.

His portfolio tends to be highly concentrated, and he often takes large positions in companies that the broader market overlooks.

His portfolio tends to be highly concentrated, and he often takes large positions in companies that the broader market overlooks.

Investment Strategies

1. Deep Value Investing: Focuses on undervalued securities with significant upside potential.

2. Concentrated Portfolio: Holds a small number of high-conviction investments.

3. Long-Term Horizon: Prefers holding investments for extended periods to realize value.

4. Contrarian Approach: Often invests in out-of-favor sectors or companies.

- Insight: Abrams' ability to identify deeply undervalued assets and his patience in holding them until the market recognizes their true value is a hallmark of his success.

key quote "We have a bias to liking companies where the management owns a lot of stock and has created value. The idea is fairly simple, people who have created value have a way of figuring out what will do more of it in the future.

If you have a management team whose primary economics are coming through salary and bonus you can be at odds versus being a shareholder."

key quote "We have a bias to liking companies where the management owns a lot of stock and has created value. The idea is fairly simple, people who have created value have a way of figuring out what will do more of it in the future.

If you have a management team whose primary economics are coming through salary and bonus you can be at odds versus being a shareholder."

Portfolio

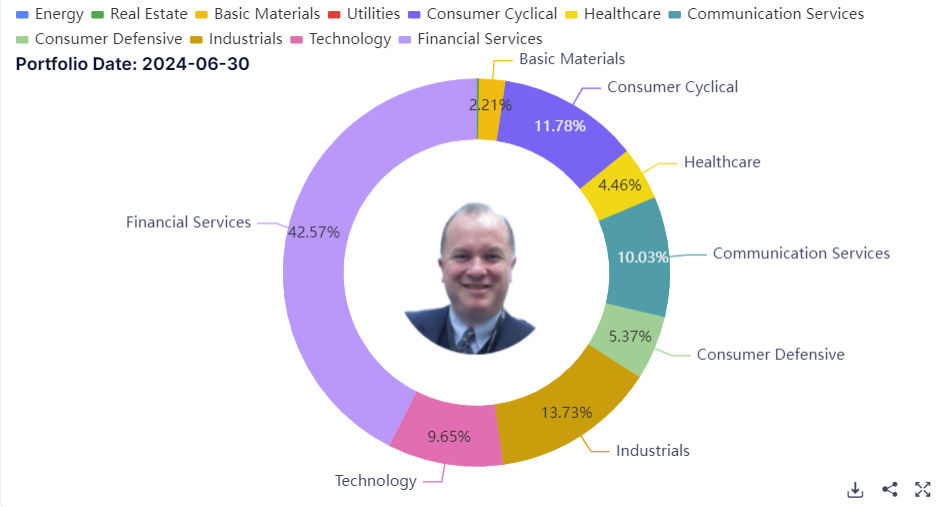

Abrams' portfolio includes major stakes in Lithia Motors, Loar Holdings, and Asbury Automotive Group. He tends to focus on industries like automotive, technology, and retail.

David Abram's portfolio. Source: Valuesider

Michael Lee-Chin

Who is Michael Lee-Chin?

Michael Lee-Chin is a Jamaican-Canadian billionaire and the founder of Portland Holdings. His investment philosophy is centered around building wealth through strategic long-term investments and buying high-quality businesses in industries that he deeply understands, such as financial services and infrastructure.

At just 26, he embarked on his career as a financial advisor and quickly progressed to branch manager due to his growing success. By the age of 32, he had become both a financial advisor and portfolio manager. During this time, Lee-Chin took a bold step by borrowing funds to invest $500,000 in Mackenzie Financial Corporation stock.

Remarkably, within four years, the stock value surged sevenfold, allowing him to acquire AIC Limited, a small investment firm based in Ontario. Under his leadership, AIC grew from under $1 million to more than $15 billion in assets under management at its peak.

Remarkably, within four years, the stock value surged sevenfold, allowing him to acquire AIC Limited, a small investment firm based in Ontario. Under his leadership, AIC grew from under $1 million to more than $15 billion in assets under management at its peak.

Investment Strategies

1. Buy and Hold: Focuses on acquiring high-quality businesses and holding them long-term.

2. Concentration: Invests in a few well-understood businesses.

3. Economic Moats: Looks for companies with strong competitive advantages.

4. Leverage: Uses leverage prudently to enhance returns.

- Insight: Lee-Chin's emphasis on understanding and holding a few high-quality businesses allows him to capitalize on their long-term growth potential.

Portfolio

Lee-Chin's portfolio is diverse, including investments in financial services, telecommunications, and media. Among his notable investments is AIC Limited, which was sold to Manulife in 2009. He also holds a significant stake in NCB Financial Group, which constitutes a substantial portion of his wealth.

Allan Mecham

Who is Allan Mecham?

Mecham, co-founder of Arlington Value Capital, has built a strong reputation for delivering remarkable returns with a lean team. He employs a deep-value investing strategy, acquiring stocks when they are substantially undervalued and holding them for the long term, regardless of market fluctuations.

Despite his unconventional approach, he consistently surpasses market performance.

Despite his unconventional approach, he consistently surpasses market performance.

Investment Strategies

He emphasizes straightforward, reliable businesses

He primarily concentrates on risk mitigation.

He dedicates significant time to assessing the durability and longevity of a business, employing Porter’s Five Forces framework.

He seeks management teams with established long-term track records focused on value creation.

Additionally, he rigorously stress tests ideas against various macroeconomic conditions.

Portfolio

Mecham's portfolio includes companies like Berkshire Hathaway, Cimpress plc, Autonation. His investments span various sectors, including consumer goods and financial services.

Summary

The insights drawn from these five highly successful value investors reveal their distinct investing strategies for achieving substantial returns. Yet, several shared characteristics emerge from their expertise:

All five investors place a strong emphasis on long-term investments rather than short-term gains, reflecting a commitment to sustainable growth. They adhere to value investing principles, seeking undervalued companies with potential for significant appreciation.

Moreover, these investors typically maintain concentrated portfolios, holding a select few high-conviction stocks.

This focused approach enables them to capitalize on their insights and convictions regarding specific companies.

If you would like to learn more about value investing and how it can help you can kickstart your journey, simply sign up for a free account at https://viaatlas.com/signup to access our available free training videos.

Related Articles

If you would like to learn more about value investing and how it can help you can kickstart your journey, simply sign up for a free account at https://viaatlas.com/signup to access our available free training videos.

Related Articles

How to Apply a Fundamental-First Approach to Investing

In the midst of global trade tensions and market uncertainties, discover how smart investors are adapting and thriving using ViA Atlas.

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017, 2025 Spirit of Enterprise Honouree

You will learn:

- How to navigate market uncertainty amidst geopolitical tensions and market uncertainty

- How can all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction.

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing can help you cope with market uncertainty

- How ViA Atlas could help you strengthen your portfolio and streamline your decision-making process

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying high-quality resilent companies

Click the button below to reserve your spot now.

ViA Atlas by Value Investing Academy

Transforming lives by empowering individuals through financial education to take charge of their financial future, and make a positive change in their lives and communities worldwide. We Care To Make You A Better Investor.

Suitable For

Solutions For

Copyright © 2025. VIA Global Online Pte Ltd,

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Disclaimer: The information provided by ViA Atlas by Value Investing Academy, Mind Kinesis Investments Pte Ltd is meant for educational purposes, and is in no instance to be regarded as investment advice. You are advised to practice due diligence before making any financial decisions. All forms of investments carry risks and such activities may not be suitable for everyone. We are not liable for any losses incurred from your investment activities. Past investment performance is not necessarily indicative of future performance, even if the same strategies are adopted.