Sep 17

Understanding P/E Ratio and PEG Ratio in Stock Analysis

Share this article

A key principle of value investing involves analyzing a stock’s P/E and PEG ratios. These metrics enable investors to assess whether a stock is undervalued relative to its earnings. However, it's crucial for investors to recognize the limitations of these ratios as well. In this article, we delve into these two commonly known financial metrics.

What is the P/E Ratio?

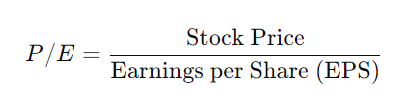

The Price-to-Earnings (P/E) ratio is a fundamental metric used to determine whether a stock is overvalued or undervalued. It is calculated by dividing a company’s current stock price by its earnings per share (EPS). Essentially, it tells you how much investors are willing to pay for each dollar of earnings.

For example, if a company’s stock is trading at $50 per share and its EPS is $5, then the P/E ratio would be 10. This means investors are willing to pay $10 for every $1 of earnings.

A negative P/E ratio indicates that a company is experiencing negative earnings or incurring losses.

For example, if a company’s stock is trading at $50 per share and its EPS is $5, then the P/E ratio would be 10. This means investors are willing to pay $10 for every $1 of earnings.

A negative P/E ratio indicates that a company is experiencing negative earnings or incurring losses.

Significance of P/E Ratio

What is a good P/E ratio? There isn't a strict range that universally defines whether a stock is undervalued, fairly valued, or overvalued based solely on the P/E ratio, as it varies depending on the industry, company growth prospects, and market conditions.

However, general guidelines can be used:

Undervalued: P/E ratio below 10–15 (suggesting the stock may be cheap relative to earnings).

Fairly valued: P/E ratio between 15–20 (considered reasonable for many companies).

Overvalued: P/E ratio above 25 (suggesting the stock may be expensive unless justified by high growth expectations).

However, general guidelines can be used:

Undervalued: P/E ratio below 10–15 (suggesting the stock may be cheap relative to earnings).

Fairly valued: P/E ratio between 15–20 (considered reasonable for many companies).

Overvalued: P/E ratio above 25 (suggesting the stock may be expensive unless justified by high growth expectations).

Limitations of P/E ratio

P/E Ratio Varies by Industry

The P/E ratio can differ significantly across industries, making cross-sector comparisons challenging. For instance, technology companies typically exhibit higher P/E ratios than utility companies due to their greater growth potential. Therefore, it's essential to evaluate a company's P/E ratio in relation to its peers within the same industry.

P/E Ratio Ignores Debt

It also does not account for a company's debt levels. A firm with a high debt-to-equity ratio might display a low P/E ratio, which could indicate financial distress. Conversely, a company with minimal debt may report a high P/E ratio, potentially reflecting strong financial health.

Earnings Can Be Manipulated

P/E Ratio Ignores Debt

It also does not account for a company's debt levels. A firm with a high debt-to-equity ratio might display a low P/E ratio, which could indicate financial distress. Conversely, a company with minimal debt may report a high P/E ratio, potentially reflecting strong financial health.

Earnings Can Be Manipulated

Earnings can be influenced by unexpected gains or losses that may obscure the true nature of the earnings metric. Moreover, company management can manipulate reported earnings to align with earnings expectations.

While the P/E ratio is a valuable metric, it fails to consider several important factors, including a company's growth potential. To address this, we turn to the PEG ratio, which takes a company's growth potential into account.

While the P/E ratio is a valuable metric, it fails to consider several important factors, including a company's growth potential. To address this, we turn to the PEG ratio, which takes a company's growth potential into account.

What is the PEG Ratio?

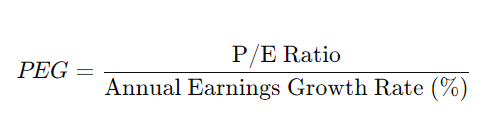

The Price/Earnings to Growth (PEG) ratio adds another layer of sophistication to the P/E ratio by factoring in the company’s expected growth rate. This makes it a more comprehensive tool for evaluating a stock’s value.

Here’s how you calculate the PEG ratio:

It is calculated by taking the P/E ratio divided by its earnings growth rate over a period of time.

For instance, if a company has a P/E ratio of 15 and an expected annual growth rate of 10%, the PEG ratio would be 1.5.

What is a Good PEG ratio?

Growth Potential: A lower PEG ratio (below 1) typically suggests that a stock is undervalued relative to its growth potential. A higher PEG ratio (above 1) may indicate that the stock is overvalued.

Balanced Valuation: Unlike the P/E ratio, which can be high due to future growth expectations, the PEG ratio adjusts for growth, providing a more balanced valuation.

For instance, a company with a high P/E ratio but a very low growth rate could have a high PEG ratio, signaling that it may not be worth its price.

Limitations of the PEG Ratio

The PEG ratio may not be applicable in certain sectors, including financial services, materials, energy, and real estate, due to the volatile nature of earnings caused by cyclical market conditions and asset revaluations. These fluctuations make growth estimates more challenging to predict. Additionally, a company's growth projections can shift dramatically based on a single strong or weak quarterly performance.

Summary

Both the P/E ratio and PEG ratio are valuable tools for assessing the valuation of stocks, helping investors gauge whether a stock is overvalued, fairly valued, or undervalued. While the P/E ratio provides insight into a stock's price relative to its earnings, the PEG ratio offers a more comprehensive view by incorporating growth potential. However, these metrics have their limitations, especially across different industries and when earnings are volatile or manipulated. Investors should use these ratios alongside other factors to make informed investment decisions for a well-rounded analysis.

To learn more on how to get started with Value Investing, sign up a FREE account at https://viaatlas.com/signup for more training resources.

To learn more on how to get started with Value Investing, sign up a FREE account at https://viaatlas.com/signup for more training resources.

Related Posts

How to Apply a Fundamental-First Approach to Investing

In the midst of global trade tensions and market uncertainties, discover how smart investors are adapting and thriving using ViA Atlas.

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017, 2025 Spirit of Enterprise Honouree

You will learn:

- How to navigate market uncertainty amidst geopolitical tensions and market uncertainty

- How can all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction.

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing can help you cope with market uncertainty

- How ViA Atlas could help you strengthen your portfolio and streamline your decision-making process

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying high-quality resilent companies

Click the button below to reserve your spot now.

ViA Atlas by Value Investing Academy

Transforming lives by empowering individuals through financial education to take charge of their financial future, and make a positive change in their lives and communities worldwide. We Care To Make You A Better Investor.

Suitable For

Solutions For

Copyright © 2025. VIA Global Online Pte Ltd,

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Disclaimer: The information provided by ViA Atlas by Value Investing Academy, Mind Kinesis Investments Pte Ltd is meant for educational purposes, and is in no instance to be regarded as investment advice. You are advised to practice due diligence before making any financial decisions. All forms of investments carry risks and such activities may not be suitable for everyone. We are not liable for any losses incurred from your investment activities. Past investment performance is not necessarily indicative of future performance, even if the same strategies are adopted.