Sep 18

Understanding the S&P 500: The Backbone of the Stock Market

Share this article

When it comes to measuring the pulse of the U.S. stock market, one name stands out: the S&P 500. As a benchmark index, the S&P 500 serves as a reliable indicator of the overall health and performance of the U.S. equities market.In this article, we will delve into what exactly the S&P 500 is, its significance in the stock market, and the criteria companies must meet to be included in this prestigious index.

What is the S&P500?

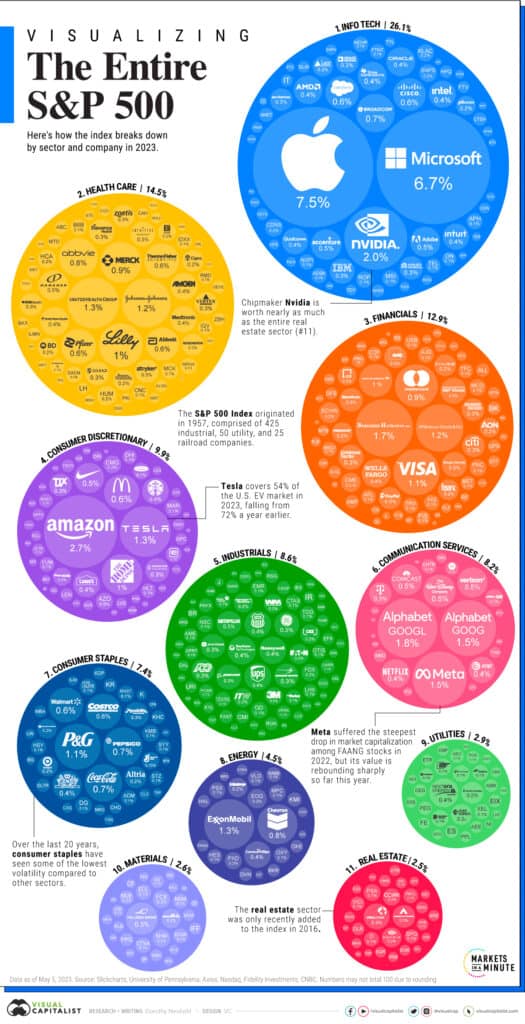

The S&P 500, short for Standard & Poor’s 500 Index, is a market-capitalization-weighted index that tracks the performance of 500 large-cap U.S. companies listed on major stock exchanges. These companies represent a significant portion of the overall market capitalization of the U.S. stock market.

The index was first introduced in 1957 by Standard & Poor’s, a leading global provider of financial market intelligence.

IMPORTANCE OF THE S&P 500 AS A BENCHMARK

1. Market Representation: The S&P 500 is often regarded as a reliable barometer of the broader U.S. stock market’s performance, capturing approximately 80% coverage of available market capitalization. It represents a diverse range of industries, including technology, finance, healthcare, consumer goods, and more, providing a comprehensive snapshot of the U.S. economy.

Graphic source: visualcapitalist.com

2. Investor Confidence: As one of the most widely followed benchmarks, the S&P 500 serves as a gauge of investor sentiment and market confidence. It is frequently used as a reference point by portfolio managers, analysts, and individual investors to assess their investment performance relative to the overall market.

3. Investment Vehicle: Many investment products, such as index funds and exchange-traded funds (ETFs), track the performance of the S&P 500. These investment vehicles allow investors to gain exposure to a broad range of U.S. stocks and benefit from the potential growth of the overall market.

3. Investment Vehicle: Many investment products, such as index funds and exchange-traded funds (ETFs), track the performance of the S&P 500. These investment vehicles allow investors to gain exposure to a broad range of U.S. stocks and benefit from the potential growth of the overall market.

CRITERIA FOR INCLUSION IN THE S&P 500

To be included in the S&P 500, a company must meet the following criteria:

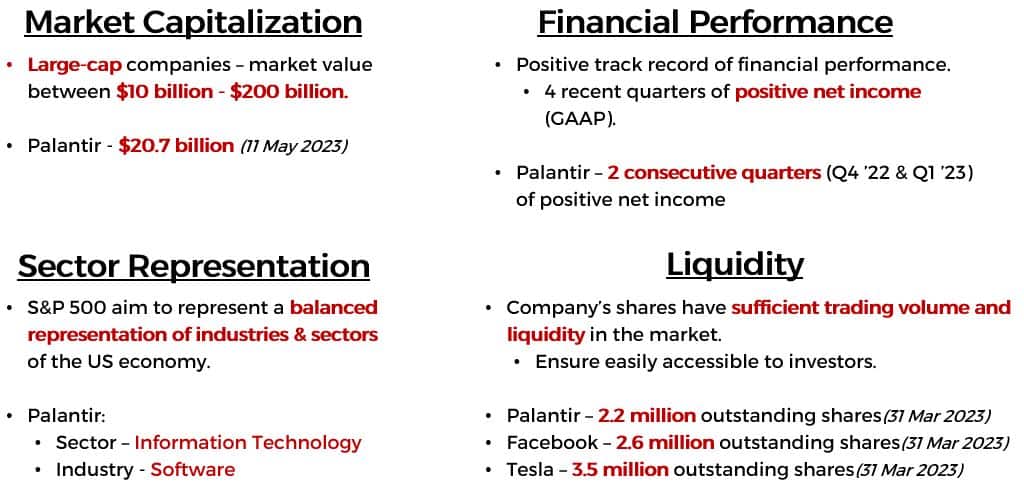

1. Market Capitalization: The company should have a minimum market capitalization of approximately $12 billion or more. However, the threshold may vary based on market conditions.

2. Financial Viability: Companies being considered for inclusion in the S&P 500 must demonstrate a track record of positive earnings over the most recent four quarters, as determined by Generally Accepted Accounting Principles (GAAP).

3. Sector Representation: The index aims to maintain a balance across various sectors of the economy. Therefore, companies from different sectors are included to ensure diversification within the index.

4. Liquidity: Companies should have a certain level of liquidity, ensuring that their shares are actively traded on the exchange and can be easily bought or sold without significant price impact.

In addition to the 4 points mentioned, the company’s stock must be listed on a major U.S. stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ.

2. Financial Viability: Companies being considered for inclusion in the S&P 500 must demonstrate a track record of positive earnings over the most recent four quarters, as determined by Generally Accepted Accounting Principles (GAAP).

3. Sector Representation: The index aims to maintain a balance across various sectors of the economy. Therefore, companies from different sectors are included to ensure diversification within the index.

4. Liquidity: Companies should have a certain level of liquidity, ensuring that their shares are actively traded on the exchange and can be easily bought or sold without significant price impact.

In addition to the 4 points mentioned, the company’s stock must be listed on a major U.S. stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ.

Conclusion

The S&P 500 plays a vital role in the financial markets, serving as a reliable benchmark for assessing the performance of the U.S. stock market. It provides investors with valuable insights into market trends, investor sentiment, and the overall health of the economy.

By understanding the criteria for inclusion in the index, investors can gain a deeper appreciation for the companies that contribute to this important measure of market performance. Whether as a reference point for investment portfolios or a gauge of market confidence, the S&P 500 remains a cornerstone in the world of finance.

To learn more about how you can invest in the S&P500, click here to register to get a FREE ETF Investing eGuide where you can learn more about Index Investing such as Exchange Traded Funds (ETFs).

Related Articles

By understanding the criteria for inclusion in the index, investors can gain a deeper appreciation for the companies that contribute to this important measure of market performance. Whether as a reference point for investment portfolios or a gauge of market confidence, the S&P 500 remains a cornerstone in the world of finance.

To learn more about how you can invest in the S&P500, click here to register to get a FREE ETF Investing eGuide where you can learn more about Index Investing such as Exchange Traded Funds (ETFs).

Related Articles

Ready to take the first step?

Get Your Free ETF eGuide

You will learn how to:

- Learn how to invest in your first ETF

- What is Index (ETF) Investing - the One Thing Needed for a Worry-Free Retirement

- The Power of Compounding - 8th Wonder of the World

- How to Keep Risk Low with Diversification & DCA

- How To Invest on AutoPilot using Exchange-Traded Funds (ETFs), Effortlessly

By submiting the form, you accept ViA's Disclaimer and the collection or use of my data in compliance with the Terms of USe and Privacy Policy, which includes receiving marketing communications, e.g. events and updatex. You may unsubscribe from these communications at any time.

ViA Atlas by Value Investing Academy

Transforming lives by empowering individuals through financial education to take charge of their financial future, and make a positive change in their lives and communities worldwide. We Care To Make You A Better Investor.

Suitable For

Solutions For

Copyright © 2025. VIA Global Online Pte Ltd,

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Disclaimer: The information provided by ViA Atlas by Value Investing Academy, Mind Kinesis Investments Pte Ltd is meant for educational purposes, and is in no instance to be regarded as investment advice. You are advised to practice due diligence before making any financial decisions. All forms of investments carry risks and such activities may not be suitable for everyone. We are not liable for any losses incurred from your investment activities. Past investment performance is not necessarily indicative of future performance, even if the same strategies are adopted.

The Auto-Pilot Investing Handbook For New Investors

Register to get access to the e-Book (worth $15) immediately.