USD Hits 3-Year Low as Trump Eyes New Fed Chief — What This Means for Inflation, Interest Rates, and Your Investments

The U.S. dollar just plunged to a new low, not due to war or crisis, but a political move: Trump may announce the next Federal Reserve Chair as early as September (Source: The Straits Times).

The market is interpreting this as a sign that lower interest rates are coming, and investors are recalibrating their positions fast.

But this isn't just about currency — it's about the domino effect that interest rates have on inflation, the stock market, and ultimately your financial future.

In this article, we unpack:

- Why the USD is weakening

- How interest rates, inflation, and stocks are all connected

- What you can do to protect and grow your capital in 2025

1.🏛️Why The USD is Falling?

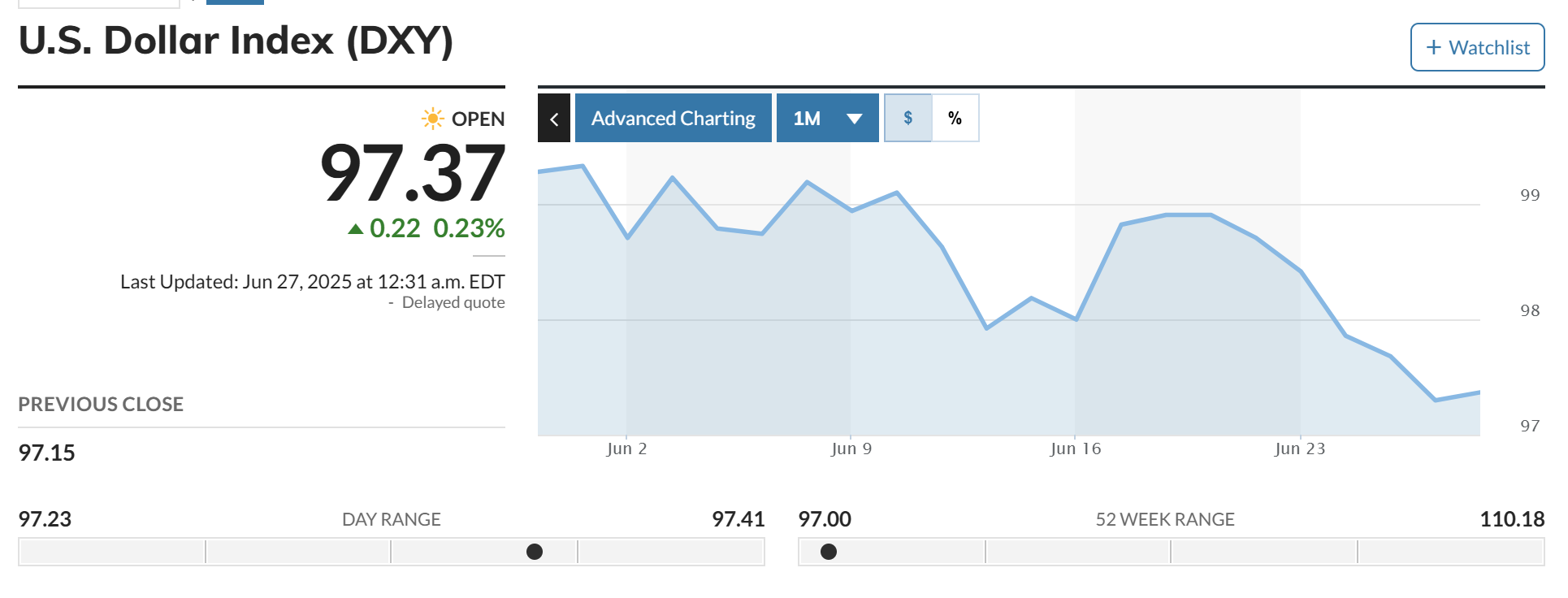

The U.S. Dollar Index (DXY) fell sharply after reports surfaced that Trump is considering replacing Fed Chair Jerome Powell, likely with someone who will cut interest rates aggressively. Trump has long criticized Powell for being "too slow" with rate cuts, and this new move is seen as his attempt to regain influence over the Fed.

What's the Market Reaction?

- Dollar down ~10% YTD

- Euro and Swiss franc surge

- Gold and Bitcoin tick up as hedges against currency debasement

- Rate-sensitive tech and growth stocks rally

2. 📉 Interest Rates, Inflation & Stock Markets: The Domino Effect

🧠 Let’s break down the chain reaction:

📈 So How Does This Affect the Stock Market?

| When Rates Fall | When Rates Rise |

| ✅ Growth stocks benefit (especially tech) | ❌ Growth stocks fall as future cash flows are discounted more harshly |

| ✅ Real estate & REITs gain from cheaper debt | ❌ REITs become less attractive vs. bonds |

| ✅ Commodities and gold often rise | ❌ Safe assets like bonds outperform |

| ✅ Consumers spend more, boosting retail sectors | ❌ Consumer discretionary spending may fall |

📈 How Interest Rates Affect the Stock Market And Why It Matters Right Now

So we can see here that when interest rates fall, the cost of money (borrowing) also drops. This means businesses can access cheaper capital, and consumers are more willing to spend. The result? Increased corporate profits and greater liquidity flowing through the economy.

With higher earnings, share prices tend to rise. That’s why interest rate cuts often lead to a rally in the stock market.

But here’s the catch: when too much money chases too few goods, we get inflation. That means the purchasing power of your money decreases, and prices go up.

Now, do you see the opportunity here?

If you’re prepared, falling rates can present a rare window to build wealth faster.

But if you’re not prepared, your money may lose value quietly — eroded by inflation while others capitalize on the upside.

☂️ Jack Ma said: “Always repair the roof when the sun is shining.”

📺 In My Recent Webinar, I Said This Clearly:

Volatility ≠ Risk

As Warren Buffett wisely said:

“Risk comes from not knowing what you’re doing.”

In a volatile market, knowledge becomes your greatest asset.

In fact, volatility can create opportunity, if you know where to look.

I covered this in depth in my recent webinar:

🧭 What Are the Opportunities in This Volatile Market?

If you’re already a ViA Atlas subscriber, you can watch the replay here if you have an account with ViA Atlas. If not, you can sign up for a ViA Atlas accoun here.

Final Thoughts

Are you prepared? The question is 'prepared for what?'. Remember, we need to not only be prepared before the storms comes but also when the sun comes out.

I will hosting an exclusive webinar "Identifying Opportunities in this Volatile Market". Scroll down to register!

Webinar: Identifying Opportunities in this Volatile Market

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017

You will learn:

- How to navigate market volatility in spite of changes in global trade and interest rates policies

- How an all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing, support prudent long-term value investing

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying on identifying and evaluating high-quality companies.

Suitable For

Solutions For

Mind Kinesis Investments Pte Ltd. All Rights Reserved.