Volatility ≠ Risk? How Smart Investors Profit During Market Swings with Value Investing + CFOS

When the market swings wildly—dropping one day, spiking the next—it often triggers panic. Most investors see volatility as danger.

But here’s what smart investors understand:

Price volatility ≠ risk.

In fact, if you follow a proven Value Investing methodology and use Cash-Flow Options Strategies (CFOS), market volatility can become a reliable source of income and profit.

📊 What Is Price Volatility?

Price volatility simply means the tendency of a stock or index to move up or down sharply.

- Volatility is not inherently risky—it’s just movement.

- The real risk lies in not knowing what you're doing.

Think of it like shopping:

A pair of shoes worth $100 might drop to $50 during a sale. Is that risky? Of

course not—it’s an opportunity.

📉 Real Case: The 18.9% Drop in the S&P 500

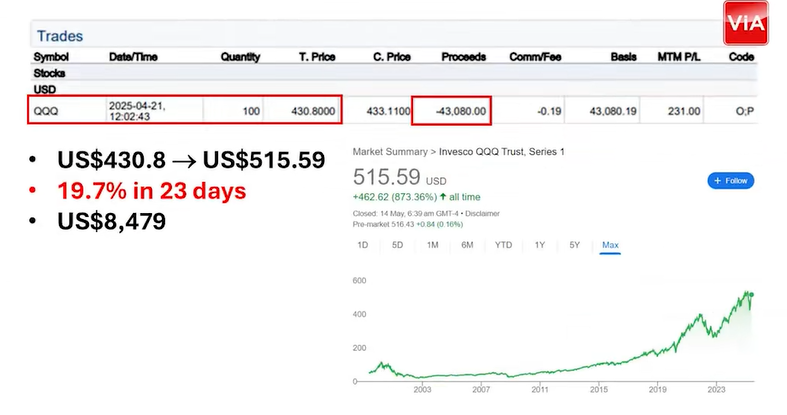

💼 Real-Life Trade Example: Profiting from the Panic

Here’s a real screenshot from my Interactive Brokers account:

- On 21 Apr 2025, I bought 100 shares of QQQ ETF at $430/share, investing $43,080.

- In just 23 days, the position gained 19.7%, generating a paper profit of $8,000+.

How?

Because I acted when others were fearful and the price had dipped far

below the ETF’s intrinsic value.

💸 Where CFOS Come In: Making Cash Flow from Volatility

Here’s the game-changer: When markets are volatile, Cash-Flow Options Strategies (CFOS) can help you earn consistent income, regardless of short-term price swings.

With CFOS, we:

Even during uncertainty, I continue to:

- Sell options contracts based on undervalued companies

- Collect upfront premiums (i.e., cash in your pocket)

- Position ourselves to either buy great companies at a discount or earn returns without owning the stock

Volatility actually increases the option premium we can collect. That means more income for us—as long as we stick to solid fundamentals using Value Investing principles.

🧠 What Buffett Thinks About Risk

“Risk comes from not knowing what you’re doing.”

— Warren Buffett

Buffett’s words apply more than ever in a volatile market.

If you're buying meme stocks blindly? That’s risky.

But if you're sticking to proven methods and applying strategies like CFOS on fundamentally strong businesses? That’s called intelligent investing.

🎓 Ready to Learn How? Register for our upcoming webinar below!

How to Apply a Fundamental-First Approach to Investing

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017, 2025 Spirit of Enterprise Honouree

You will learn:

- How to navigate market uncertainty amidst geopolitical tensions and market uncertainty

- How can all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction.

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing can help you cope with market uncertainty

- How ViA Atlas could help you strengthen your portfolio and streamline your decision-making process

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying high-quality resilent companies

Click the button below to reserve your spot now.

Suitable For

Solutions For

Mind Kinesis Investments Pte Ltd. All Rights Reserved.