What Are the Investment Opportunities in This Tariff War?

In times of uncertainty—especially during something as globally disruptive as a tariff war—the natural question for investors is:

“Where are the opportunities?”

To answer that, we must learn from history. Because while the headlines may feel dramatic, we’ve actually seen trade and tariff tensions many times over the last 50 years. So let's dive into the data.

📉 Do Trade Wars Lead to Bear Markets or Recessions?

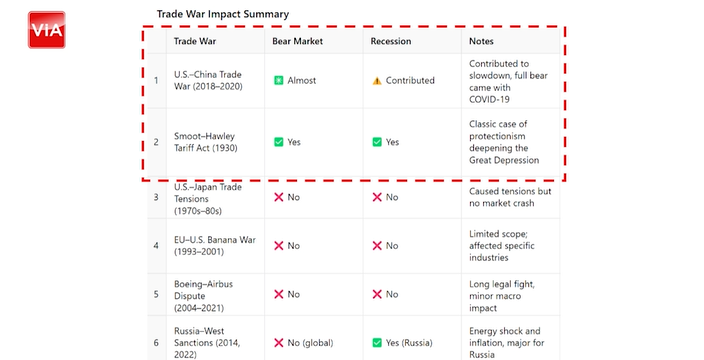

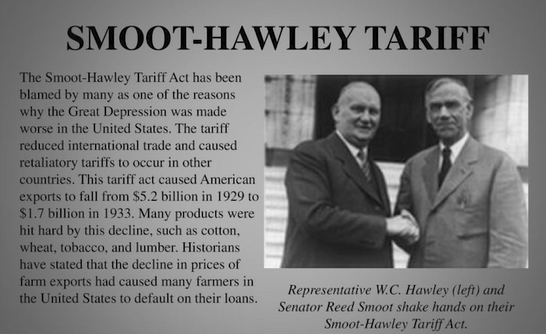

Let’s look at a summary (from 1930–2025) of trade and tariff wars. If you study this historical table, you’ll see that only one trade war triggered both a bear market and a recession—the Smoot-Hawley Tariff Act of 1930.

❗Is the Current Tariff War Triggering a Bear Market?

👉 The market is down 17.6%.

So technically, we’re not in a bear market yet. But could we enter one?

Absolutely. The coming weeks or months will tell.

🌏 How Global Trade Systems Are Changing

Singapore has always benefitted from a rules-based global

system where Most Favoured Nation (MFN) principles gave every

country a level playing field—big or small.

But now, the U.S. wants to dismantle MFN and replace

it with reciprocal tariffs.

This spells trouble for small economies like ours.

Why?

Because we don’t have the bargaining power to retaliate.

As a result, our growth forecast has been cut by the

Ministry of Trade and Industry:

From 1–3% to just 0–2% for this year.

Slower growth now. A possible recession later.

💡 So What Should We Do as Investors?

Let me be clear—this is not investment advice. I’m

not licensed by MAS, and this is purely for learning purposes.

But here’s what I personally would do.

📈 Stick to Dollar-Cost and Value Averaging

Even during uncertainty, I continue to:

- Dollar-cost average (DCA) and

- Value average into ETFs in my portfolio, including the S&P500

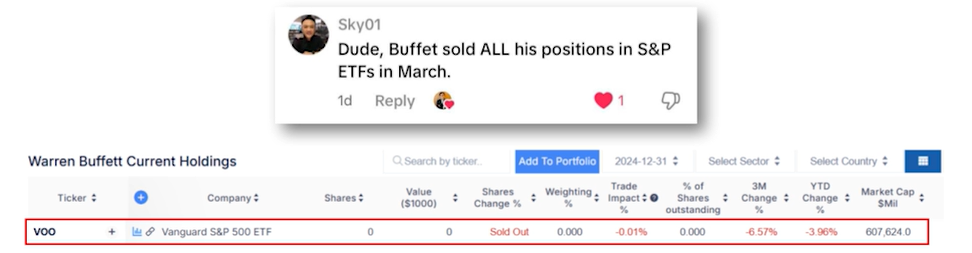

Now someone recently commented on my posts saying:

“Dude, Buffett sold ALL his positions in S&P 500 in March”

Let’s clear this up.

If you look at Warren Buffett’s holdings, the ETF VOO makes up only 0.01% of his portfolio—almost insignificant. It was probably purchased by one of his lieutenants, not Buffett himself.

Remember, Berkshire Hathaway’s job is to beat the S&P 500, not to mimic it. So why would he buy it?

So now the question is why does Warren Buffett kept recommending everyday retail investors to invest into S&P500?

🧠 Why S&P 500 Still Makes Sense

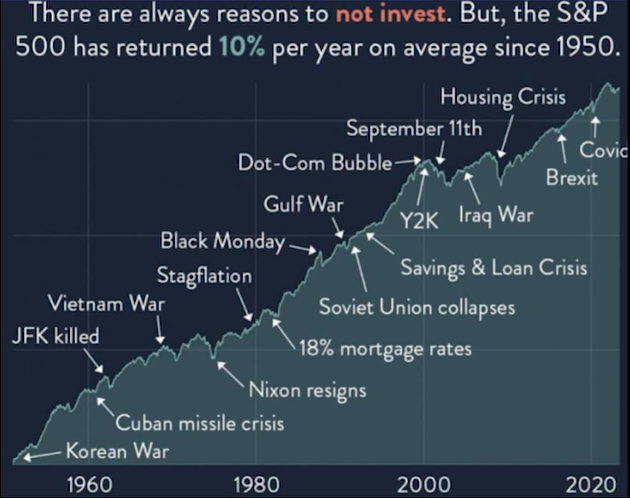

Let’s look at the graph below. Despite:

- The Vietnam War

- Black Monday

- And multiple recessions...

…the S&P 500 has always recovered, and over the

long run, it has delivered an average return of 10% per year, including

dividends.

No bear market or recession lasts forever.

Recovery is inevitable. And often, the economy emerges stronger.

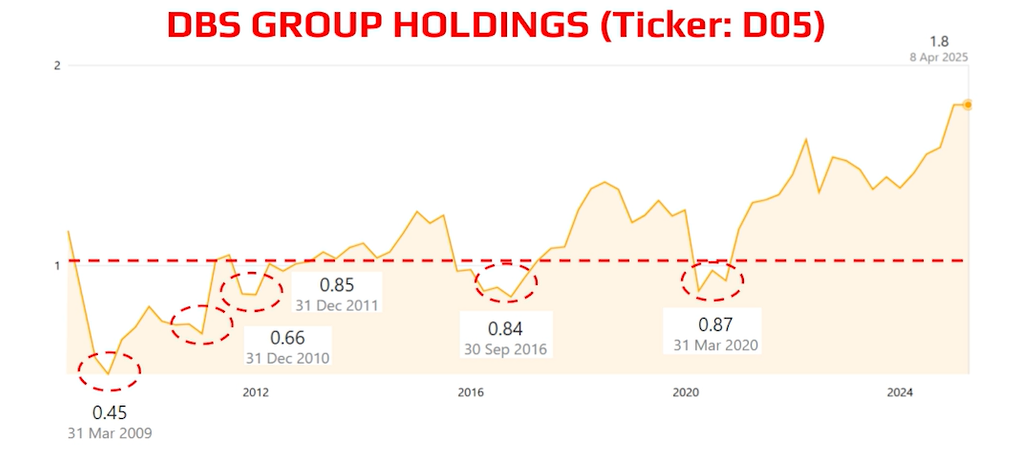

🏦 Local Bank Stocks: A Value Opportunity?

Aside from the S&P 500, here’s where I’m also looking:

DBS, OCBC, and UOB.

But I only consider them when their Price-to-Book (P/B) Ratio is less than 1. Why?

Because that means the stock is undervalued—you’re

paying less than the company’s net worth.

P/B Ratio = Share Price / Book Value Per Share

If you look at the graph below:

For example, during COVID in 2020, DBS’s P/B was 0.87.

During the Global Financial Crisis in 2009, it was 0.45!

Had you invested then and held long-term, you might have

made 4–5X returns in just over a decade.

But remember:

- It must be a good business

- And you must buy it during a bad time

🧭 My Investment Checklist

Before I invest, I always ask myself three key questions:

- What should I invest in?

- When should I invest?

- Do I have the money?

Without these answered, I don't move.

🎯 Want to Learn How I Spot Value Opportunities? Join our upcoming webinar below!

👉 Click the button below to register now.

See you there!

See Value Investing in Action

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017

You will learn:

- A deep dive into a fast-growth company case study.

- The key financial metrics used when evaluating whether a stock has strong growth potential

- Step-by-step guide on how to apply the Value Investing Methodology on real-life companies

- The exact criteria that successful investors use when evaluating any company

- How to determine the intrinsic value of a stock so you will know exactly when to enter or exit the market

- How ViA Atlas Intrinsic Value (IV) Directory can get you started on building your own portfolio of superhero stocks, even for busy professionals without much time to spare.

Click the button below to reserve your spot now.

Suitable For

Solutions For

Mind Kinesis Investments Pte Ltd. All Rights Reserved.