What’s the Difference Between Investing and Speculating? (Part 2)

Earlier, I mentioned that when a company makes money, the share price usually goes up. But there are exceptions. Sometimes, even when a company releases good news and makes more profit, the share price still drops. Let me walk you through these exceptions, because I want to make sure we cover all angles.

So here’s the strange part — a company reports positive earnings, and yet people still sell the stock. And when most people sell, what happens to the share price? It goes down. Always remember this: the only reason a share price drops is because most people are selling. It’s not always logical or scientific — human behavior can be irrational.

Let me illustrate this for you: the company’s intrinsic value keeps increasing as it earns more money, but the share price keeps falling. So here’s a quick recap: even if the share price goes down, the intrinsic value does not. And when the share price is lower, the risk is lower and the potential return is higher.

I’ll show you a real example — a stock I’ve bought and shared about previously. At the time, it was trading at $1.40. Then it dropped to $1.20… then to $1.00… then $0.90… and at its lowest, it was $0.95. But throughout that time, the company was actually growing in value.

Let’s go back to our ViA (Value Investing Academy) calculator. You remember how we use EPS (Earnings Per Share) to calculate intrinsic value, right? Let’s take a look at this company’s financial report — you tell me if it’s becoming more valuable or less.

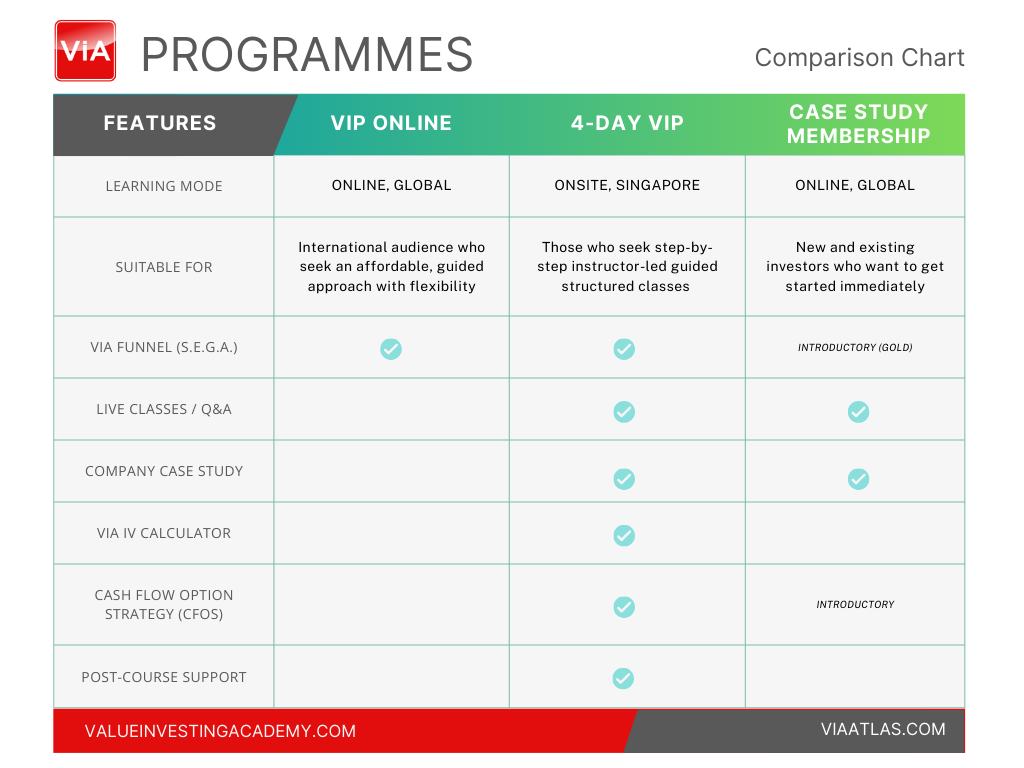

(ViA calculator is available for graduates and students of the Value Investing Programme. To find out more, join our Value Investing Masterclass)

This is a comparison between Q3 2017 and Q3 2018 — quarter to quarter. The net profit increased by 85%. It’s like your salary getting an 85% raise — how would that feel? The profit margin increased from 26.8% to 32.7%, and EPS increased significantly as well — meaning intrinsic value went up.

Then they compared the first three quarters of 2017 with the first three quarters of 2018. Profit rose by 154%, gross margin improved from 26% to 34%, and EPS jumped by 148%. So based on all this data, is the company’s value going up or down?

Clearly, the company’s value is increasing, even though the share price was dropping.

Now, here’s the million-dollar question: What’s the opportunity?

Most people only look at the price, not the value. They see the price dropping and panic. But as a value investor, you see both — the falling share price and the rising value. That’s your edge.

This is the ideal scenario in the stock market — the company’s value keeps rising, while the price keeps falling. Why? Because speculators and gamblers don’t understand value. They only react to headlines or follow the crowd.

Eventually, when the company keeps releasing strong results, the speculators start to take notice. They hear good news again and again, and they think, “Eh? Something’s going on.” Then their friends start buying, their barber buys, their uncle buys… and finally, they jump in.

And when enough of them jump in, what happens to the share price? It goes up. So those who know something are always ahead. Those who know nothing will always follow. That’s why it’s so important to be the first group — to know something.

Now, some people think education is expensive. But remember this: my average purchase price for that stock was around $1.19. Today, it’s $1.30. You are not right or wrong because others agree with you — you are right because your data and reasoning are right.

So when the share price falls, I ask myself, “Is my reasoning still valid?” If it is, I continue to buy more. Without data analysis, you won’t have the courage to act when the market goes against you.

Before investing, you must realistically assess your probability of being right — and how you’ll react if you’re wrong. And that’s why we always include a margin of safety.

Now, let’s flip the situation: what kind of company consistently loses money yet sees the share price go up?

Yes — Tesla.

Tesla was losing money quarter after quarter, and yet the share price kept soaring. In fact, its EPS was negative. Their financials looked like a swimming pool — drowning!

Their operating cash flow? Mostly negative, only one year positive. ROA? Negative. ROE? Negative. Debt? Increasing. So how could this be considered a good company?

So, what exactly are people betting on?

They're betting on the founder — Elon Musk. Maybe they believe one day he’ll send humans to Mars. That’s their bet.

Now, this is just my personal view: Elon Musk is brilliant at selling dreams. He’s incredibly gifted at painting visions and making people believe they’ll come true. And that’s what he’s truly good at — selling dreams. And whenever people buy into dreams, the share price goes up.

But remember, we are value investors. We don’t buy dreams.

We buy the value of the business.

Want to know how to spot value stocks? Scroll down below to join our upcoming webinar!

Spot Value Stocks Now

In this live session, you'll see a step-by-step company analysis demonstrated by Cayden Chang, founder of Value Investing Academy.

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017

You will learn:

- A deep dive into a fast-growth company case study.

- The key financial metrics used when evaluating whether a stock has strong growth potential

- Step-by-step guide on how to apply the Value Investing Methodology on real-life companies

- The exact criteria that successful investors use when evaluating any company

- How to determine the intrinsic value of a stock so you will know exactly when to enter or exit the market

- How ViA Atlas Intrinsic Value (IV) Directory can get you started on building your own portfolio of superhero stocks, even for busy professionals without much time to spare.

Click the button below to reserve your spot now.

Suitable For

Solutions For

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Investify Symposium 2024

Upon registration, you will receive a URL to claim your webinar access pass.

Robert G Allen

Through the past 40 years, MILLIONS of people have attended his live seminars and his graduates have earned BILLIONS in profits by following his financial advice. Today there are literally thousands of millionaires and multi-millionaires worldwide who attribute their success to Mr. Allen’s systems and strategies. Empowered by his philosophy of the Enlightened Entrepreneur, his students have generously contributed over 50 million dollars to their favorite churches, causes and charities.

As a public speaker, he has spoken to audiences worldwide as large as 20,000 people, sharing stages with the likes of Sir Richard Branson, Tony Robbins, Robert Kiyosaki, Oprah Winfrey, Prime Minister Tony Blair and Donald Trump. In America, the National Speaker Association gave him an award as America's Top Millionaire Maker.

As a trainer and educator, he has spoken to groups all over the world from United States, Singapore, Mexico, Canada, South Africa, Russia, Kazakhstan, Latvia, Slovenia, Australia, Italy, England, Japan, Taiwan, Hong Kong and China. He teaches on the subjects of personal finance, wealth creation, multiple streams of income, entrepreneurship, authorship, sales, marketing and personal growth.

He is a popular media guest appearing on hundreds of radio and television programs including Good Morning America, Regis Philbin, Neil Cavuto and Larry King. He has been the subject in numerous international publications including the Wall Street Journal, The Los Angeles Times, The Washington Post, Newsweek, Barons, Redbook, Money Magazine and The Reader Digest to name just a few.

Ernee Ong

Ernee Ong is the co-founder of Proptiply, a property consulting and investment education company that builds on the concept of co-living to generate rental income. He aims to educate and empower aspiring property investors to attain their life goals through prudent and sound property investing principles.

Ernee is a loving husband to Jelene and a father to two wonderful daughters. Alongside Jelene, he is a co-founder and the driving force behind Proptiply™.

Proptiply™is a Property Education Company that empowers students with a focus on teaching them how to build cashflow by leveraging other people's resources and scaling up. Ernee has achieved remarkable success, moving from living in a 3-room HDB flat to owning a landed property and acquiring an additional one.

Ernee will be sharing insights into how individual Singaporeans or Permanent Residents (PRs) can scale up their property portfolio even with limited resources. His journey has been featured in prestigious media outlets like CNA, the South China Morning Post, and other news channels, showcasing how he managed to build an 8-figure business while overseeing 300+ properties in Singapore.

Vincent Chua

Vincent is a financial planner who specializes in investment and retirement planning. He helps people achieve their financial goals and dreams through comprehensive and customized solutions.

He has nearly a decade of experience in the financial services industry and is a Certified Financial Planner, CFP®. He is passionate about educating people on the importance and relevance of financial planning in today's world.

He grew up in Toa Payoh, a mature estate in Singapore, witnessing many senior citizens struggle with health and financial issues. They often told him that "it's better to be dead than to be sick in Singapore". This made him realize the value of money and motivated him to learn about investments at a young age. Later, he discovered the financial planning industry and decided to pursue it as a career.

He loves what he does because he makes a positive difference in people's lives. Whether it's helping them grow their wealth, protect their income, or plan for retirement, he enjoys seeing them achieve their desired outcomes and live their best lives.

Self-made Millionaire Investor

Liu Feng

Liu Feng graduated from Beijing University and came to Singapore in 1994, and went from having a mere S$100 in his wallet to becoming a millionaire. Armed with a strong determination, he made the majority of his fortune through Value Investing using principles created by Warren Buffett, one of the richest man in the world. Across the years, he has accumulated extensive experience and in-depth knowledge in stock investing.

Liu Feng specialized in stock investment. Since he first read a book about Warren Buffet in 1996, he has since done extensive studies on Value Investing Gurus – Benjamin Graham, Philip Fisher, Peter Lynch and John Neff. Through continuously fine-tuning his investment model, combined with his investment experience, he has founded a set of Investment Philosophies, Value Investing Principles and Methodologies to create passive income. Those who have been taught by him have found his teaching easy to understand as well as benefited from his many years of experience and insight on stock investments.

As an experienced value investor, Liu Feng incorporates real case studies of numerous Singapore-listed companies in his training, coupled with a systematic and proven methodology to provide a distinct advantage in the stock market.

Lauren C Templeton

Lauren C. Templeton is the founder and Chief Executive Officer of Templeton & Phillips Capital Management, LLC. Prior to founding the firm in 2001, Lauren was employed with Morgan Stanley, Homrich Berg, and New Providence Advisors, a hedge fund management company, based in Atlanta, GA.

“Author of “Investing the Templeton Way: the Market Beating Strategies of Value Investing's Legendary Bargain Hunter”, Lauren is also the great niece of Sir John M. Templeton and is a current member of the John M. Templeton Foundation, established in 1987 by renowned international investor, Sir John Templeton. She began investing as a child under the heavy influence of her father as well as her late great-uncle, Sir John Templeton.

About Sir John Templeton

Sir John Marks Templeton was born in 1912, in the small town of Winchester, Tennessee. He attended Yale University and graduated near the top of his class and as President of Phi Beta Kappa. He was named a Rhodes Scholar to Balliol College at Oxford, from which he graduated with a degree in law.

Templeton started his Wall Street career in 1938 and went on to create some of the world’s largest and most successful international investment funds. He was famous for picking companies that hit “points of maximum pessimism” (ie. Rock bottom prices). When war began in Europe in 1939, he borrowed money to buy 100 shares each in 104 companies selling at one dollar per share or less, including 34 companies that were in bankruptcy. Only four turned out to be worthless, and he turned large profits on the others.

Templeton established the Templeton Growth Fund in 1954. With dividends reinvested, each $10,000 invested in the Templeton Growth Fund Class A at its inception would have grown to $2 million by 1992. He eventually sold the family of Templeton Funds to the Franklin Group — scores of them with $13 billion in assets — in 1992, and turned to philanthropies that had engaged him for decades.

Investing the Templeton Way Podcast

Investing the Templeton Way with Lauren Templeton is a podcast that explores the world’s most intriguing investment topics from the overseas markets to mastering our own minds. Gather investment wisdom and educate yourself as you listen to interviews with exclusive managers, executives, and entrepreneurs on a wide range of engaging topics. Visit the Podcast Page.

Dr Todd A Finkle

Todd A. Finkle, Ph.D. is the Pigott Professor of Entrepreneurship at Gonzaga University. He has taught for 34 years at 4 different universities, publishing more than 270 articles, books, presentations, and grants.

Dr. Finkle is an expert on Warren Buffett and Entrepreneurship. His recent book titled," Warren Buffett: Investor and Entrepreneur," is published by Columbia University Press. The book traces the entrepreneurial paths that shaped Buffett’s career, from selling gum door-to-door during childhood to forming Berkshire Hathaway and developing it into a global conglomerate through the imaginative deployment of financial instruments and creative deal making.

Dr. Finkle's initial motivation for writing the book was to show the layperson how Buffett evaluates potential investments. Finkle also zeros in on Buffett’s longtime business partner Charlie Munger and his contributions to Berkshire Hathaway's success. Finkle draws key lessons from Buffett’s mistakes as well as his successes, using these failures to explore the ways behavioral biases can affect investors and how to overcome them.

Dr. Finkle is a pioneer and innovator in the field of entrepreneurship education. He has been an entrepreneur of six ventures and consulted with a wide variety of entities including countries and universities from all over the world. Dr. Finkle has been interviewed or appeared in a variety of media outlets including the Cleveland Plain Dealer, Entrepreneur Magazine, Forbes Magazine, Omaha World Herald, Wall Street Journal, The Washington Post, and several radio and television stations.

Cayden Chang

Cayden Chang is the Founder of Mind Kinesis Investments Pte Ltd and Value Investing Academy Pte Ltd, which runs the first and only Value Investing training that is recommended and endorsed by Mary Buffett, the internationally acclaimed author and speaker of how billionaire Warren Buffett invests. His company also runs Value Investing workshops across Asia. With over 50,000 graduates across 11 cities in Asia, his methodology is tested, proven and easily duplicable even for someone who has no prior experience in investing.

Cayden holds two Bachelors’ Degrees and a Masters Degree from National University of Singapore. He has also been trained in value investing by Professor Bruce Greenwald in Columbia University, the institution where Billionaire investor Warren Buffett met Professor Benjamin Graham, as well as by Professor George Athanassakos, the finance professor who holds the Ben Graham Chair in Value Investing at the Richard lvey School of Business, University of Western Ontario.

Cayden has also received the Lifelong Learners Award 2008 from the Minister of Manpower on 18 November 2008, Mr Gan Kim Yong and he was featured in “TODAY” newspaper, “938Live Online News”, “938Live Radio Station”, “Mediacorp Xin.Sg” and “The Straits Times”. He was subsequently featured in “938Live Breakfast Club” Radio, “Channel News Asia AM Live”, “Shareinvestment”, “The Edge”, and “The Exquisite” Magazine for sharing his secrets of financial success.

In July 2010, he was diagnosed with Renal Cancer. Despite being ill, he launched his first charity project in August 2010, where he donated all of the sales proceeds of his book to The Straits Times School Pocket Money Fund, and was featured on 938 Live Radio Station and The Straits Times. His fight with Renal Cancer was subsequently published in The Straits Times and interviewed on 938Live Radio Station. His life story was featured in The Sunday Times on 10 June 2012. He survived terminal stage Renal Cancer (Stage 4) in September 2014 and launched his second book titled “The Book of Hope” to raise funds for cancer research.