US Case Study: Unlock the Secret Strategy I Use To Produce Over 5 Figures Every Month With Just 15 Minutes A Week

LEARN HOW TO GROW YOUR OWN PASSIVE INCOME - WITH MINIMAL EFFORT

Write your awesome label here.

No Hidden Fees • 24/7 Instant Access • Risk Free 7-Day Policy

Struggling With These Problems?

Just Started Investing And Range Of Options Are Overwhelming?

Too Busy To Find, Research And Explore New Opportunities?

Unsure Of How To Evaluate Or Apply Value Investing Methodology?

Lack Of Portfolio Diversification = Being Exposed To More Risks?

Here's How The Membership Can Help...

In 3 simple steps with just 15 minutes a week,

Start collecting multiple streams of income every month... all in the comfort of your own home!

With annual inflation rate at 4.5%, can you afford to not invest regularly and consistently?

With the rising cost of living and inflation eroding the purchasing power of money over time, people who do not take action to invest are missing out not only on the power of compounding but also the potential monthly cash flow that option strategy can bring.

Write your awesome label here.

US Case Study Membership

Finally, A Proven And Comprehensive Solution To Cut Down Time, Effort, and Guesswork Needed.

Discover Entry & Exit Points With Company Valuations

One Page IV Directory Online

ViA's proprietary intrinsic value calculator provides a 9-step evaluation funnel report based on value investing methodology.

ViA's proprietary intrinsic value calculator provides a 9-step evaluation funnel report based on value investing methodology.

Illustrates the Application of Value Investing Methods

24 New Case Studies

Case Studies evaluate real live companies to demonstrate evaluation classification as Growth, Fair and Undervalued to aid learning.

Case Studies evaluate real live companies to demonstrate evaluation classification as Growth, Fair and Undervalued to aid learning.

Authors Conduct Thorough Research and Deep Dives

Access To 70+ Case Study Vault

Case studies are segmented into COC, fundamentals and valuation, and a downloadable executive summary report.

Case studies are segmented into COC, fundamentals and valuation, and a downloadable executive summary report.

Cash Flow Option Strategies Opportunities Illustrated LIVE

4 Inner Circle Zoom Lives

Join an exclusive community with quarterly live meetups on Zoom for case updates and illustrations of new CFOS opportunities.

Join an exclusive community with quarterly live meetups on Zoom for case updates and illustrations of new CFOS opportunities.

Diversification is A Key Strategy to Managing Risk

In 8 Different S&P Sectors

Diversify your portfolio in different industries and sectors can help mitigate risk and create a more stable foundation for consistent returns.

Diversify your portfolio in different industries and sectors can help mitigate risk and create a more stable foundation for consistent returns.

Stay Updated and Informed with Notifications

Monthly Update Notifications

Get notified with news and updates through email and WhatsApp messages so you can stay informed even on your busiest days.

Get notified with news and updates through email and WhatsApp messages so you can stay informed even on your busiest days.

Take A Glance Of What You Can Do In Just

15 Minutes A Week With Just 3 Simple Steps:

Step 1

Find Qualified Opportunities

In Less Than A Minute

Simply login and view the One Page Directory, search and filter by sectors.

Step 2

Deep Dives Into Each Case

Study In Just 15 Minutes

Bite-size videos segmented into CoC, Fundamentals and Valuation, great for on-the-go.

Step 3

Cash Flow Option Strategies

Opportunities Illustrated LIVE

Quarterly community Zoom meetups highlighting updates and various CFOS opportunities.

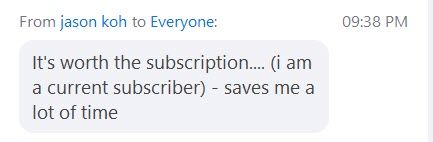

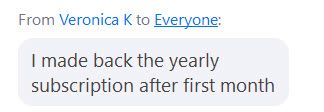

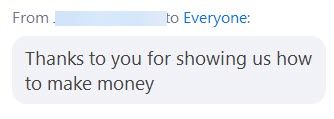

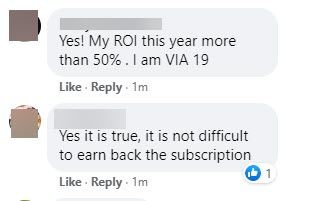

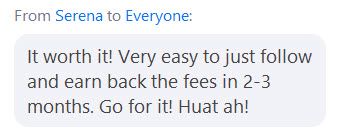

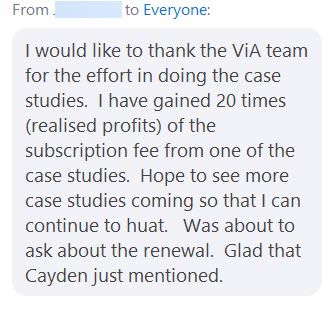

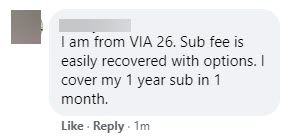

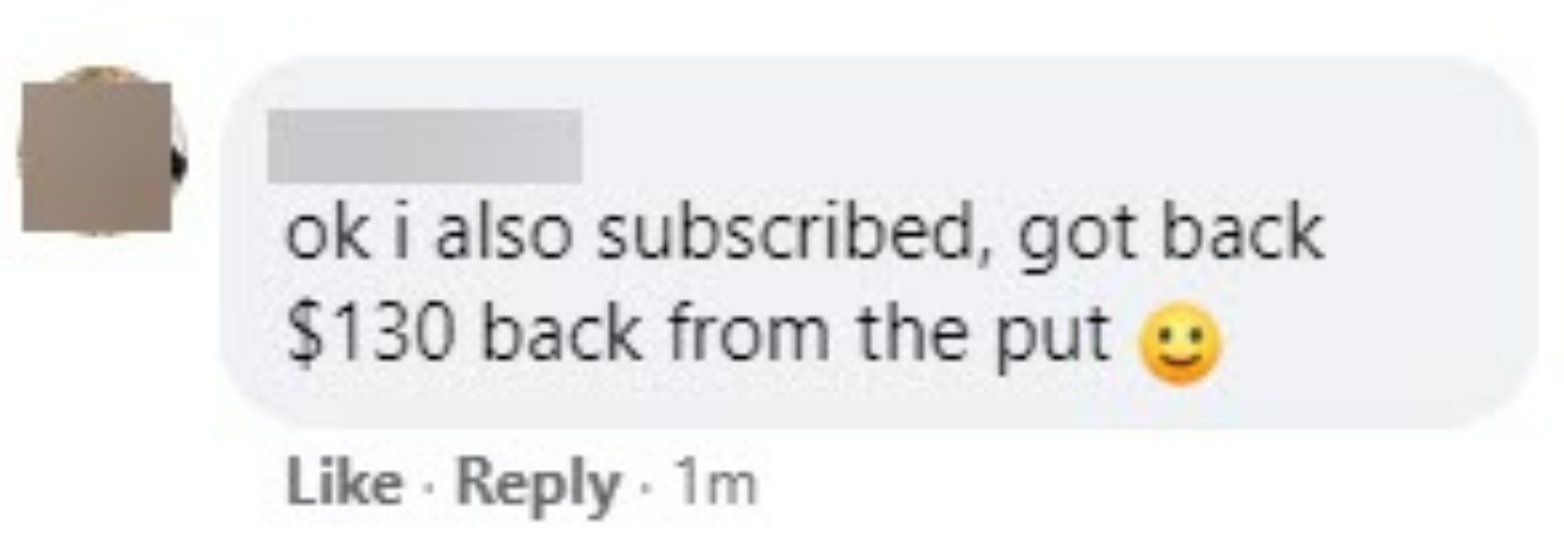

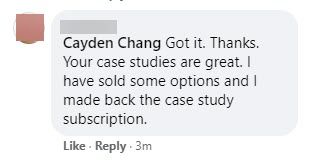

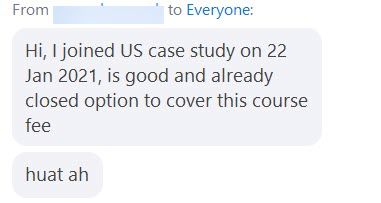

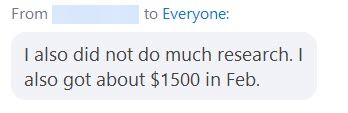

Members Success Stories

*Testimonials shown are real experiences from paying users of Case Study Membership. Their results are not typical and your experience will vary based upon your effort, individual characteristics, profile, risk appetite, and market forces beyond our control. Mind Kinesis Investments Pte Ltd/Value Investing Academy (“VIA”) is an education institute that provides information meant for educational purposes, and is in no instance to be regarded as investment advice. All forms of investments carry risks and such activities may not be suitable for everyone. We are not liable for any losses incurred from your investment activities. Past investment performance is not necessarily indicative of future performance, even if the same strategies are adopted.

Here’s What You’ll Get As An Inner Circle Member

We research using Value Investing framework and provide information in the form of an executive summary report with intrinsic valuations, circle of competence and economic moat so you can learn Value Investing. With our fully online platform, you can view on-demand at your own pace. Here's what members get:

More Of What Members Say

Join the Inner Circle Membership and be part of the exclusive private community.

STARTER

SILVER

US$498/year

-

Unlock full privileges to:

-

12 New US Case Studies

-

1 US Inner Circle CFOS Live

-

1 Authors Update Live

-

Access to 20+ US Case Studies Vault

-

plus all the below bonuses:

-

Bonus: ViA Symposium Online Replays

-

Bonus: Printable Summary Reports

-

Bonus: Option Strategies to Boost ROI

-

Bonus: Mobile App

MOST POPULAR

GOLD

US$888/year

Includes 7-Day Risk Free Policy

-

Unlock full privileges to:

-

24 New US Case Studies

-

4 US Inner Circle CFOS Live

-

4 Authors Update Live

-

Access to 70+ US Case Studies Vault

-

Value Investing Bridging Course

-

plus all the below bonuses:

-

Bonus: US Inner Circle Live Replays

-

Bonus: ViA Symposium Online Replays

-

Bonus: Printable Summary Reports

-

Bonus: Option Strategies to Boost ROI

-

Bonus: Renewal Discount Coupon

-

Bonus: E-Mail & WhatsApp Notifications

-

Bonus: Mobile App

-

ViA Graduate Exclusive Bonuses:

-

ViA Bonus: Monthly Gathering Replays

-

ViA Bonus: ViA Online Calculator

BEST VALUE

PLATINUM

US$1,228/year

Includes 7-Day Risk Free Policy

-

Unlock full privileges to:

-

36 New US & SG Case Studies

-

7 US & SG Inner Circle Live

-

7 Authors Update Live

-

Access to 100+ US/SG Case Studies Vault

-

Value Investing Bridging Course

-

plus all the below bonuses:

-

Bonus: Inner Circle Live Replays

-

Bonus: ViA Symposium Online Replays

-

Bonus: Printable Summary Reports

-

Bonus: Option Strategies to Boost ROI

-

Bonus: Renewal Discount Coupon

-

Bonus: E-Mail & WhatsApp Notifications

-

Bonus: Mobile App

-

ViA Graduate Exclusive Bonuses:

-

ViA Bonus: Monthly Gathering Replays

-

ViA Bonus: ViA Online Calculator

Backed By Our 7-Day Risk Free Policy*

#NoQuestionsAsked

We want you to be completely satisfied with your purchase. If you are not entirely happy with your purchase, you can ask for a full refund within 7 days from your date of purchase. There will be a slight discrepancy in the refund amount you will receive due to the currency exchange rate of your bank. Refer to the Refund Policy for details.

ViA Atlas Case Study Membership FAQ

Q. Who is ViA Atlas US Case Study for?

The ViA Atlas US Case Study was made for those who want to cut down on time, effort and guesswork needed to research US companies.

Q. How often are the new case studies released?

The case studies are released whenever each one is completed which may not follow the calendar months (eg. March's Case Study in March), however you will enjoy access to 24 new case studies per membership term.

Q. I'm a new investor, is the membership suitable for me?

The membership provides resources for new investors such as a Guide to Investing Terms and Instruments, Value Investing Bridging Course, Guide to TDA Platform, and Live Inner Circle Members Sessions where CFOS opportunities are illustrated, all to guide new investors.