60-Minute Webinar: Deep Dive into a Fast-Growth Company Using Value Investing

October

22

8:00 PM GMT+8

Next session in:

0

days

0

hours

0

minutes

0

seconds

Learn the Proven Framework Used by Successful Investors to Screen High-Value Companies

Master Stock Evaluations Skills So You Can Identify High-Growth Potential Stocks

This webinar is suitable for:

Aspiring Investors: Those looking to apply value investing principles but need guidance on how to screen for growth stocks effectively.

Experienced Investors: People with some experience in investing who want to use a systematic approach to identifying potential stocks.

Busy Professionals: Those seeking a practical, time-efficient way to evaluate stocks without spending hours on complex analysis.

DIY Investors: Individuals who prefer a hands-on approach and want to make informed, confident decisions.

Growth-Oriented Investors: Investors looking for undervalued stocks that have the potential to grow to hedge against long-term inflation.

The webinar will cover:

A deep dive into a fast-growth company case study presented by Mr Cayden Chang, founder of Value Investing Academy.

What are the key financial metrics when evaluating whether a stock has strong growth potential (other than P/E ratio).

Step-by-step guide on how to apply value investing methodology, a proven investing methodology popularized by Warren Buffett.

Learn the exact criteria that successful investors use to evaluate whether a stock is good, fair or over-valued.

How to determine the intrinsic value of a stock so you'll know exactly when to enter or exit the market.

How to get started on building your own portfolio of superhero stocks, even for busy professionals without much time to spare.

ViA Atlas by Value Investing Academy

Transforming lives by empowering individuals through financial education to take charge of their financial future, and make a positive change in their lives and communities worldwide. We Care To Make You A Better Investor.

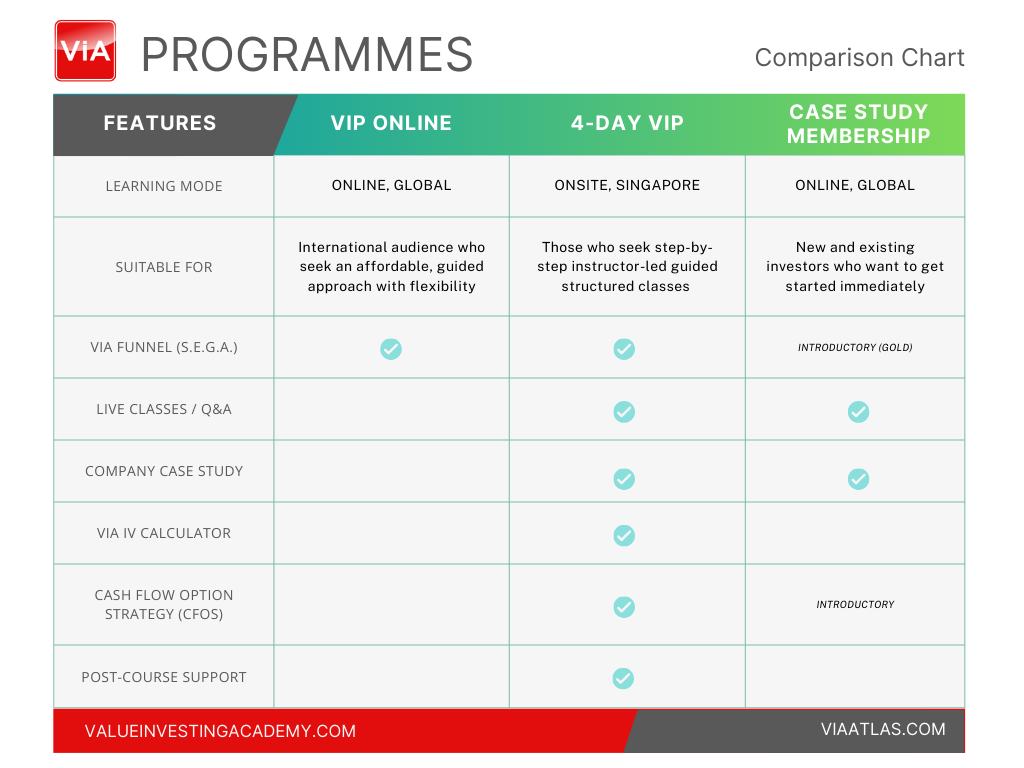

Suitable For

Solutions For

Copyright © 2025. VIA Global Online Pte Ltd,

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Disclaimer: The information provided by ViA Atlas by Value Investing Academy, Mind Kinesis Investments Pte Ltd is meant for educational purposes, and is in no instance to be regarded as investment advice. You are advised to practice due diligence before making any financial decisions. All forms of investments carry risks and such activities may not be suitable for everyone. We are not liable for any losses incurred from your investment activities. Past investment performance is not necessarily indicative of future performance, even if the same strategies are adopted.

Investify Symposium 2024

Standard Ticket Registration Form

Upon registration, you will receive a URL to claim your webinar access pass.

Upon registration, you will receive a URL to claim your webinar access pass.

Get started

Let us introduce our school

Write your awesome label here.

Get your FREE investment video series.

Get our FREE sent to you right now.

Thank you!