Sep 13

Growth Investing vs Value Investing. Which is better?

Share this article

Investing in the stock market can feel overwhelming, especially with the myriad of strategies available. Two prominent paths are growth investing and value investing. But how do you decide which is best for you? This guide will unravel the complexities, offering insights to help you make informed decisions aligned with your financial goals.

Introduction

The stock market is often divided into two categories: growth stocks and value stocks. Each has unique traits and appeals to different investor types. Understanding these differences is crucial for strategic investing. By exploring the benefits and risks of each, you’ll be better equipped to choose a path that suits your investment style.

What Are Growth Stocks?

Growth stocks are shares in companies poised for above-average growth compared to the broader market. These firms typically reinvest earnings to fuel expansion rather than distribute them as dividends. They are often found in innovative sectors like technology and healthcare.

Characteristics of Growth Stocks

High Growth Potential: These companies exhibit strong revenue and earnings growth, often surpassing market averages.

Reinvestment Focus: Profits are reinvested to drive further growth, rather than being divided among shareholders.

Higher Valuations: Growth stocks usually have higher price-to-earnings ratios, reflecting optimism for future performance.

Benefits

Significant Capital Appreciation: The potential for high returns is a major draw, with expectations of rapid earnings growth leading to increased stock prices.

Innovation Leadership: Often at the forefront of technological advancements, investing in growth stocks means participating in industry innovation.

Risks

Volatility: Growth stocks can experience significant price swings and are more susceptible to market fluctuations.

Uncertain Outcomes: If growth projections fall short, stock prices can decline sharply, leading to potential losses.

What Are Value Stocks?

Value stocks are shares that appear undervalued relative to their intrinsic worth. These stocks often trade at lower prices compared to their earnings, dividends, or sales, making them attractive to investors seeking bargains.

Characteristics of Value Stocks

Established Companies: Typically belong to firms with a robust performance history but facing temporary setbacks.

Dividend Payments: Frequently offer dividends, providing a consistent income stream for investors.

Benefits

Steady Income: Dividends provide regular income, appealing to conservative investors.

Lower Volatility: Generally less volatile than growth stocks, offering greater stability.

Risks

Prolonged Undervaluation: Stocks may remain undervalued for extended periods, yielding limited returns.

Unresolved Issues: If underlying problems persist, the stock may not recover, posing risks to investors.

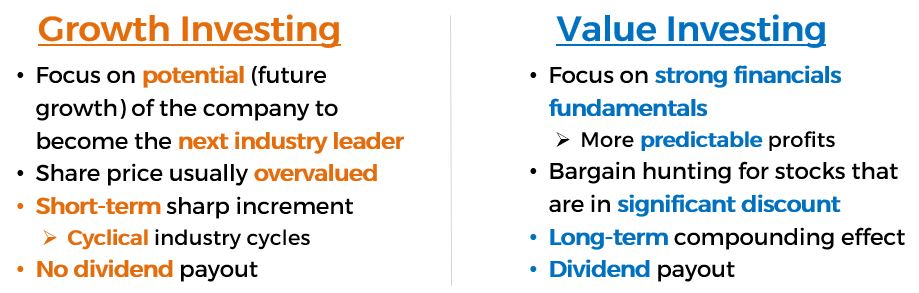

Growth vs. Value Investing: Key Differences

Having explored the characteristics and potential risks associated with these two investing strategies, you may be wondering, "Which method should I choose to achieve my financial goals? Should I invest more in growth stocks or value stocks?" To assist you, we’ve provided a concise comparison of these two approaches:

Growth Investing: Focuses on capital appreciation, willing to accept higher risk for greater returns.

Growth Investing: Focuses on capital appreciation, willing to accept higher risk for greater returns.

Value Investing: Seeks steady returns through dividends and gradual price appreciation.

Time Horizon

Growth Stocks: Suited for long-term investors who can handle volatility.

Value Stocks: May appeal to those seeking immediate returns with less fluctuation.

Risk Tolerance

Growth Investing: Requires higher risk tolerance due to inherent volatility.

Value Investing: Generally more conservative, suitable for risk-averse investors.

Comparison of Past Performance: Growth Stocks vs Value Stocks

Growth Stocks:

Value Stocks:

Historically, growth stocks yield higher returns in bull markets. For instance, the tech sector, featuring companies like Apple (AAPL) and Amazon (AMZN), has experienced significant growth over the last decade.

2020-2021: During the COVID-19 pandemic, growth stocks thrived due to heightened demand for technology and digital services.

2022-2023: Rising interest rates and inflation concerns posed challenges, resulting in more volatile performance.

Value stocks have historically provided consistent returns, particularly during market downturns. The financial sector, including firms like Bank of America (BAC) and Johnson & Johnson (JNJ), stands out as a strong performer in this category.

2020-2021: Value stocks lagged behind growth stocks during the early period of the pandemic.

2022-2023: As investors sought stability amid rising interest rates and economic uncertainty, value stocks regained favor.

Long-Term Trends:

1990s: Growth stocks, particularly in tech, outperformed during the dot-com boom.

2000s: Following the dot-com bust and during the financial crisis recovery, value stocks took the lead.

2010s: Growth stocks, led by tech giants, significantly outperformed their value counterparts.

Recent Decade (2013-2023):

Growth Stocks: Achieved higher annualized returns, largely driven by dominance in the tech sector.

Value Stocks: Demonstrated steadier performance with less volatility, serving as a hedge during market corrections.

Choosing Between Growth and Value Stocks

Deciding between growth and value stocks depends on your financial goals, risk tolerance, and investment timeline.

Assess Your Financial Goals

Consider what you hope to achieve: high returns with growth stocks or steady income with value stocks.

Understand Your Risk Tolerance

Gauge how much risk you’re comfortable with, as growth stocks are volatile while value stocks offer more stability.

Diversify Your Portfolio

A balanced portfolio with both growth and value stocks can mitigate risks and enhance potential returns.

Warren Buffett's take. "Growth and value are joined at the hip"

Warren Buffett has consistently articulated that growth and value investing are not mutually exclusive; rather, he views them as interconnected. He famously stated, “Growth and value are joined at the hip.”

Buffett believes that growth is a crucial component of value, indicating that a company's future growth potential plays a significant role in determining its intrinsic value.

Buffett believes that growth is a crucial component of value, indicating that a company's future growth potential plays a significant role in determining its intrinsic value.

He has often criticized the rigid classification of investments into "growth" and "value," asserting that intelligent investing revolves around purchasing assets for less than their true worth.

If a company is projected to increase its earnings over time, this growth can enhance its intrinsic value, making it a worthwhile investment—even if it has a seemingly high price-to-earnings ratio.

For Buffett, the essential factor lies in the balance between the price paid and the value received, taking into account both current performance and future potential.

If a company is projected to increase its earnings over time, this growth can enhance its intrinsic value, making it a worthwhile investment—even if it has a seemingly high price-to-earnings ratio.

For Buffett, the essential factor lies in the balance between the price paid and the value received, taking into account both current performance and future potential.

Conclusion

In conclusion, the similar aspects between growth and value investing involves identifying businesses with strong fundamentals and promising potential. Companies that exhibit robust financial health and clear growth prospects present opportunities for investors to realize significant gains over time. By focusing on these attributes, investors can uncover hidden value that sets the stage for long-term financial success.

This requires thorough research and a disciplined approach. Understanding a company's intrinsic value, assessing its market position, and evaluating its management strategies are critical steps in determining its potential. This due diligence, including investing within their circle of competence, allows investors to make informed decisions, reducing risk and maximizing potential returns.

Related Posts

How to Apply a Fundamental-First Approach to Investing

In the midst of global trade tensions and market uncertainties, discover how smart investors are adapting and thriving using ViA Atlas.

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017, 2025 Spirit of Enterprise Honouree

You will learn:

- How to navigate market uncertainty amidst geopolitical tensions and market uncertainty

- How can all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction.

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing can help you cope with market uncertainty

- How ViA Atlas could help you strengthen your portfolio and streamline your decision-making process

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying high-quality resilent companies

Click the button below to reserve your spot now.

ViA Atlas by Value Investing Academy

Transforming lives by empowering individuals through financial education to take charge of their financial future, and make a positive change in their lives and communities worldwide. We Care To Make You A Better Investor.

Suitable For

Solutions For

Copyright © 2025. VIA Global Online Pte Ltd,

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Disclaimer: The information provided by ViA Atlas by Value Investing Academy, Mind Kinesis Investments Pte Ltd is meant for educational purposes, and is in no instance to be regarded as investment advice. You are advised to practice due diligence before making any financial decisions. All forms of investments carry risks and such activities may not be suitable for everyone. We are not liable for any losses incurred from your investment activities. Past investment performance is not necessarily indicative of future performance, even if the same strategies are adopted.