Sep 20

The History & Evolution of Value Investing

Share this article

Many of you are probably familiar with the term value investing and see Warren Buffett as the poster boy for it. But did you know that value investing started out very differently from Buffett’s famous investments like See’s Candies, Coca-Cola and American Express?

Benjamin Graham

To know how it evolved, we have to start from its intellectual patriarch. Meet Benjamin Graham – the father of value investing. When Graham first penned down his thoughts about investing in Security Analysis, the term ‘value investing’ wasn’t even coined yet. But to Graham, he already had his own distinct ideas on how to differentiate a company’s stock price and its intrinsic value.

Security Analysis

Security Analysis’s first edition was published in 1934 and America had just gone through one of the most severe economic recessions in the 20th Century – the Great Depression of 1929. The stock market collapsed as well and there were many publicly listed companies that were worth more dead than alive.

In other words, those companies were selling for less than their liquidation values. Graham’s analysis was very much on the Balance Sheet – what those companies owned and owed. In fact, he ran his own very successful hedge fund, the Graham-Newman Corporation (which had annual returns of around 20% from 1936 to 1956), using a technique which relied extensively on Balance Sheet analysis.

The technique was called Net-Net and it can actually be expressed in a simple formula:

Net-Net = Current Assets – Total Liabilities

Graham wanted to find stocks that were selling at two-thirds its Net-net value because he wanted a Margin of Safety. He knew that stocks selling at such depressed valuations were often in trouble in some way or another and so, wanted to use a very low buying price as a buffer in case things did not work out.

Cigar-butt Investing

To increase his odds of success, Graham also diversified widely, with some accounts saying he had more than 100 stocks in his portfolio at any one time. By diversification, he allowed the natural laws of statistics to play out with the stocks in his portfolio. Surely, such cheap stocks will rebound in price as people realised the folly of leaving a company worth more ‘dead than alive’, especially when they had minimal debt loads and were still making profits, he thought.

Graham’s investing style could not be more aptly named than ‘cigar-butt’ investing. Warren Buffett coined the term when he described Graham’s investing methods as finding a used-cigar lying on the ground that was still good for one final puff – it did not cost a cent and could still provide one enjoyable puff.

Graham’s investing style could not be more aptly named than ‘cigar-butt’ investing. Warren Buffett coined the term when he described Graham’s investing methods as finding a used-cigar lying on the ground that was still good for one final puff – it did not cost a cent and could still provide one enjoyable puff.

Margin of Safety

Perhaps, Graham’s greatest legacy was leaving the world with the concept of a ‘margin of safety’ – making sure your purchase price is low enough to mitigate any potential mistakes in evaluating a business’s intrinsic value – and Mr. Market.

Mr. Market’s an allegory for the stock market as he likened the stock market to an individual suffering from bipolar disorder. The stock market can be extremely euphoric at times, resulting in overpriced stocks, and then swing to despair, resulting in severely under-priced stocks.

As Graham’s student in Columbia Business School, those were the greatest lessons Buffett gleaned from his teacher. But, how did he end up investing in businesses with great economic characteristics – businesses that could grow their profits slowly, but surely, over the years?

Mr. Market’s an allegory for the stock market as he likened the stock market to an individual suffering from bipolar disorder. The stock market can be extremely euphoric at times, resulting in overpriced stocks, and then swing to despair, resulting in severely under-priced stocks.

As Graham’s student in Columbia Business School, those were the greatest lessons Buffett gleaned from his teacher. But, how did he end up investing in businesses with great economic characteristics – businesses that could grow their profits slowly, but surely, over the years?

Warren Buffett

Graham taught an investing course at Columbia Business School, which Warren Buffett attended. After Buffett’s graduation from Columbia, he eventually ended up working for Graham at his investment firm, the Graham-Newman Corporation (GNC).

People familiar with the term value investing in modern times might associate it with Warren Buffett and the analysis of a business’s ability to generate above-average and sustainable profit margins and cash flows to determine intrinsic value with a focus on the Income and Cash Flow statement. Buffett wants to find compounders – companies that can grow intrinsic value over time.

But, when Buffett started work with GNC, he analysed stocks differently. In GNC, analysis of a business’s intrinsic value relied heavily on the balance sheet. Graham did not think too hard about what differentiated a ‘good’ business from a ‘bad’ business. To Graham, so long as the stock was statistically cheap enough, it will usually be considered a candidate for investment in a widely diversified portfolio of stocks numbering in the hundreds.

Graham’s methods worked and his investment firm was very successful, but Buffett’s thoughts about investing had started to diverge a little. Buffett left Graham’s firm in 1956 and started his own investment partnerships.He started out using Graham’s methods and was very successful but eventually, Buffett would start investing in the way that people would most closely associate him with in modern times – investing in great businesses that can earn great returns on capital over the long term. But, that would be a development that would take the introduction of a certain Charlie Munger and Philip Fisher, two people who would really reshape the way Buffett thought about investing.

But before we introduce Charlie Munger and Philip Fisher, let’s go back to 1954 when Buffett started work in GNC.

People familiar with the term value investing in modern times might associate it with Warren Buffett and the analysis of a business’s ability to generate above-average and sustainable profit margins and cash flows to determine intrinsic value with a focus on the Income and Cash Flow statement. Buffett wants to find compounders – companies that can grow intrinsic value over time.

But, when Buffett started work with GNC, he analysed stocks differently. In GNC, analysis of a business’s intrinsic value relied heavily on the balance sheet. Graham did not think too hard about what differentiated a ‘good’ business from a ‘bad’ business. To Graham, so long as the stock was statistically cheap enough, it will usually be considered a candidate for investment in a widely diversified portfolio of stocks numbering in the hundreds.

Graham’s methods worked and his investment firm was very successful, but Buffett’s thoughts about investing had started to diverge a little. Buffett left Graham’s firm in 1956 and started his own investment partnerships.He started out using Graham’s methods and was very successful but eventually, Buffett would start investing in the way that people would most closely associate him with in modern times – investing in great businesses that can earn great returns on capital over the long term. But, that would be a development that would take the introduction of a certain Charlie Munger and Philip Fisher, two people who would really reshape the way Buffett thought about investing.

But before we introduce Charlie Munger and Philip Fisher, let’s go back to 1954 when Buffett started work in GNC.

Walter Schloss

Schloss was about 10 years older than Buffett when they first met as colleagues in GNC. Buffett was the golden boy at the firm, favoured by Graham and the other important partners in GNC, while Schloss was treated as a normal employee.

But, Schloss took Graham’s lessons to heart. When he set up his own investing partnership in 1955, he used what he had learnt from Graham in his investing activities and never wavered all the way till his retirement in 2001.

For 46 years, Schloss walked the talk by investing the “Ben Graham way”, focusing on the balance sheet and trying to buy companies that were selling below their working capital. His earliest investors have to thank their lucky stars, for Schloss grew every dollar entrusted to him into $662 by the time he retired, more than thirty times the returns from the overall stock market.

While the whole world was watching Buffett invest in companies like Coke, See’s Candies and American Express, Schloss was happy buying stocks that were selling for less than all their net assets. As communication technology improved over the years, information flowed at a faster rate and Schloss found that Graham’s famous Net-Net investing opportunities were beginning to dry up.

So, Schloss modified it a little by investing in companies that were selling below their total net worth. Even as the internet-era arrived, Schloss still managed to profit handsomely by applying Graham’s investing methods.

Investing in great businesses with unusual and sustainable profitability was what Buffett taught the world. But, Schloss was a testament that Benjamin Graham’s methods of investing with a strong focus on the balance sheet of unloved companies whose intrinsic business values were likely not to grow, could still work in the modern era. That was how Schloss carried Graham’s torch into our times.

Schloss’s story is interesting, but we’re sure you’re still wondering about Buffett’s investing transformation. So, stay tuned next week as we find out how Buffett fused Graham’s lessons with the ideas of two other very important people in investing-lore, Charlie Munger and Philip Fisher, into the value investing philosophy we know so well today.

But, Schloss took Graham’s lessons to heart. When he set up his own investing partnership in 1955, he used what he had learnt from Graham in his investing activities and never wavered all the way till his retirement in 2001.

For 46 years, Schloss walked the talk by investing the “Ben Graham way”, focusing on the balance sheet and trying to buy companies that were selling below their working capital. His earliest investors have to thank their lucky stars, for Schloss grew every dollar entrusted to him into $662 by the time he retired, more than thirty times the returns from the overall stock market.

While the whole world was watching Buffett invest in companies like Coke, See’s Candies and American Express, Schloss was happy buying stocks that were selling for less than all their net assets. As communication technology improved over the years, information flowed at a faster rate and Schloss found that Graham’s famous Net-Net investing opportunities were beginning to dry up.

So, Schloss modified it a little by investing in companies that were selling below their total net worth. Even as the internet-era arrived, Schloss still managed to profit handsomely by applying Graham’s investing methods.

Investing in great businesses with unusual and sustainable profitability was what Buffett taught the world. But, Schloss was a testament that Benjamin Graham’s methods of investing with a strong focus on the balance sheet of unloved companies whose intrinsic business values were likely not to grow, could still work in the modern era. That was how Schloss carried Graham’s torch into our times.

Schloss’s story is interesting, but we’re sure you’re still wondering about Buffett’s investing transformation. So, stay tuned next week as we find out how Buffett fused Graham’s lessons with the ideas of two other very important people in investing-lore, Charlie Munger and Philip Fisher, into the value investing philosophy we know so well today.

Charlie Munger and Warren Buffett

When Warren Buffett stopped working for Graham and set up his own investment partnership, he achieved great success by investing in ‘cigar-butt’ type of stocks – an investment style that was close to what Graham preached. However, all that started to change slowly when Buffett met Charlie Munger for the first time in 1959.

Munger was a lawyer when he met Warren Buffett but was hooked onto investing when Buffett started sharing some of his adventures in the stock market. Eventually, Munger set up his own investment partnership in 1962. It lasted 13 years, during which Munger achieved annualised returns of 19.8%, trouncing the Dow Jones’ (an index used to measure the American stock market) returns of 5% per year. But, even though Munger first got acquainted to investing through Buffett (and by extension, Graham), he ran his partnership with a different sort of view.

Munger was on the look out for great businesses – businesses that could grow their profits at above average rates for many years, making their owners wealthy. And his thinking was influenced by another investing legend whose philosophy could not be more different than Graham’s. Meet Philip Fisher.

Munger was a lawyer when he met Warren Buffett but was hooked onto investing when Buffett started sharing some of his adventures in the stock market. Eventually, Munger set up his own investment partnership in 1962. It lasted 13 years, during which Munger achieved annualised returns of 19.8%, trouncing the Dow Jones’ (an index used to measure the American stock market) returns of 5% per year. But, even though Munger first got acquainted to investing through Buffett (and by extension, Graham), he ran his partnership with a different sort of view.

Munger was on the look out for great businesses – businesses that could grow their profits at above average rates for many years, making their owners wealthy. And his thinking was influenced by another investing legend whose philosophy could not be more different than Graham’s. Meet Philip Fisher.

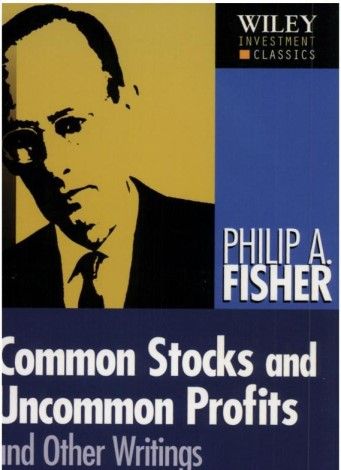

Philip Fisher

Fisher was the author of one of the seminal books on investing titled Common Stocks and Uncommon Profits. Warren Buffett values Fisher’s thinking so much that he had said ‘Common Stocks and Uncommon Profits is a book that ranks behind only The Intelligent Investor and the 1940 edition of Security Analysis (another one of Graham’s works) in the all-time-best list for the serious investor”.

While Graham was famous for appraising a business’s intrinsic value based mostly on its balance sheet and believed in diversification, Fisher instead, looked at a business’s qualitative factors and believed in making concentrated bets.

Fisher was famous for elucidating 15 points he looked out for in a company that he believed would help him unearth businesses that can growth at much higher rates than the average business. Some of the 15 points include:

Warren Buffett actually took these points to heart if we look at some of his writings and speeches he has given over the years. In Buffett’s words, “in looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if you don’t have the first, the other two will kill you.” That’s a throw-back to Fisher’s insistence on having ‘management of unquestionable integrity’ isn’t it? Buffett also once talked about his view about the conflict between long-term and short-term goals in his 2005 shareholder letter. He said: “When short-term and long-term goal conflict, widening the moat must take precedence.” In effect, Buffett was saying that long-term thinking in regard to profit will always be more important than short-term gains – that’s similar to Fisher’s thinking again.

Fisher was an investor who wouldn’t mind paying high prices for a stock if he believed in his growth potential, whereas Graham was looking at how much a stock would be worth if the company was liquidated. While Fisher was known as a growth investor, he actually had a huge part to play in shaping the modern view of value investing that Buffett’s more widely recognised for.

While Graham was famous for appraising a business’s intrinsic value based mostly on its balance sheet and believed in diversification, Fisher instead, looked at a business’s qualitative factors and believed in making concentrated bets.

Fisher was famous for elucidating 15 points he looked out for in a company that he believed would help him unearth businesses that can growth at much higher rates than the average business. Some of the 15 points include:

- Does the company have products or services with sufficient market potential to make possible a sizeable increase in sales for at least several years?

- Does the company have an above-average sales organization ?

- Does the company have depth to its management?

- Does the company have a short-range or long-range outlook in regard to profits? (Fisher prefers the latter, as do Buffett)

- Does the company have a management of unquestionable integrity?

Warren Buffett actually took these points to heart if we look at some of his writings and speeches he has given over the years. In Buffett’s words, “in looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if you don’t have the first, the other two will kill you.” That’s a throw-back to Fisher’s insistence on having ‘management of unquestionable integrity’ isn’t it? Buffett also once talked about his view about the conflict between long-term and short-term goals in his 2005 shareholder letter. He said: “When short-term and long-term goal conflict, widening the moat must take precedence.” In effect, Buffett was saying that long-term thinking in regard to profit will always be more important than short-term gains – that’s similar to Fisher’s thinking again.

Fisher was an investor who wouldn’t mind paying high prices for a stock if he believed in his growth potential, whereas Graham was looking at how much a stock would be worth if the company was liquidated. While Fisher was known as a growth investor, he actually had a huge part to play in shaping the modern view of value investing that Buffett’s more widely recognised for.

Warren Buffett's Interpretation of Value Investing

Many books have been written about how Buffett invests and his annual Berkshire Hathaway (a publicly listed American conglomerate that’s controlled by Buffett) shareholder letters are always eagerly anticipated by investors around the world who are keen on an investing-education from the master. Long-time readers of books on Buffett and his shareholder letters will no doubt pick up on his slant toward investing in great businesses (which can earn and sustain above average profits for long periods of time) at reasonable prices and holding for them for the very, very long term.

Buffett learnt about investing from his mentor Benjamin Graham, who is widely considered the intellectual patriarch of value investing. Graham invested very mechanically, and basically wanted to invest in a large basket of stocks that were selling at prices lower than their theoretically recoverable value should it be liquidated – these companies were essentially worth more dead than alive.

And at the start of Buffett’s professional investing career, that was indeed how he operated. That’s a far cry from some of Buffett’s well known investments in companies such as Gillette, American Express, Coca-Cola and See’s Candies and what he preached about investing in his Berkshire Hathaway shareholder letters isn’t it?So, what happened was Buffett came to know Philip Fisher and Charlie Munger and both of them were always on the look-out for the kinds of great businesses mentioned earlier. Buffett slowly adopted their methods into his own framework and became the investor he is today.

So, let’s take a look at what’s arguably the most important aspect of Buffett’s interpretation of value investing, apart from his rightly-placed emphasis on the parable of Mr. Market and a Margin of Safety (both of which were briefly described in the first post) – Buffett’s focus on an Economic Moat and by extension, a company’s Return on Equity.

Buffett learnt about investing from his mentor Benjamin Graham, who is widely considered the intellectual patriarch of value investing. Graham invested very mechanically, and basically wanted to invest in a large basket of stocks that were selling at prices lower than their theoretically recoverable value should it be liquidated – these companies were essentially worth more dead than alive.

And at the start of Buffett’s professional investing career, that was indeed how he operated. That’s a far cry from some of Buffett’s well known investments in companies such as Gillette, American Express, Coca-Cola and See’s Candies and what he preached about investing in his Berkshire Hathaway shareholder letters isn’t it?So, what happened was Buffett came to know Philip Fisher and Charlie Munger and both of them were always on the look-out for the kinds of great businesses mentioned earlier. Buffett slowly adopted their methods into his own framework and became the investor he is today.

So, let’s take a look at what’s arguably the most important aspect of Buffett’s interpretation of value investing, apart from his rightly-placed emphasis on the parable of Mr. Market and a Margin of Safety (both of which were briefly described in the first post) – Buffett’s focus on an Economic Moat and by extension, a company’s Return on Equity.

Buffett describes an economic moat as a protective barrier to a company’s above average profits, much like how a real moat protects a castle a ‘above average profit’ from invaders. In the capitalist world, companies that earn high profits will likely attract competitors. The more competitors there are, the lower the profits the original company can earn, or at least that’s how the theory goes. In reality, there are companies who have successfully prevented competitors from taking away their profits and that is due to the presence of an economic moat.

Moats can come in many forms and Pat Dorsey’s book The Five Rules for Successful Stock Investing contains a great framework to think about economic moats. To Dorsey, economic moats can arise from:

Moats can come in many forms and Pat Dorsey’s book The Five Rules for Successful Stock Investing contains a great framework to think about economic moats. To Dorsey, economic moats can arise from:

- Real Product Differentiation through “superior technology or features”

- Perceived Product Differentiation through “a trusted brand or reputation”

- Being a Low-Cost Producer so that products or services can be offered to consumers at lower prices than competitors

- Making it very expensive for customers to switch to a competitor’s product or service by creating High Switching Costs. A good example can be the IT systems used by companies – they are generally very reluctant to change such systems due to existing familiarity with the systems as well as the costs associated with it.

- Create a High Barrier to Entry such as through the need for very costly equipment or premises.

These forms of Economic Moats might not be the exact way Buffett thinks about them, but they do provide a great starting point to study the reasons why a company can earn above average profits for sustained periods of time.

And this brings us to the return on equity, or ROE. Buffett likes companies to demonstrate consistently high ROEs (there’s no official definition of ‘high’ though) as a sign that there is something that is able to protect the company’s above-average profit. ROE measures the return on the capital that shareholders have pumped into a business and generally the higher the return, the better it is for shareholders. If companies do not employ significant leverage by taking on too much debt, its ROE can be a very good gauge on the true profitability of a company’s operations and it can provide investors with a great clue on the presence or absence of an economic moat.

In essence, ROE and the presence of an Economic Moat helps to differentiate a great business from a run-of-the-mill business. That’s the main difference between Buffett’s thinking and Graham’s form of value investing. Graham never sought to find out if a business was better than its competitors or not whereas Buffett eventually placed a lot of emphasis in investing in companies that are a notch above their competitors. Buffett believed that investing in such companies would prove to be a lot more profitable than investing in statistically-cheap companies over long stretches of time.

And this brings us to the return on equity, or ROE. Buffett likes companies to demonstrate consistently high ROEs (there’s no official definition of ‘high’ though) as a sign that there is something that is able to protect the company’s above-average profit. ROE measures the return on the capital that shareholders have pumped into a business and generally the higher the return, the better it is for shareholders. If companies do not employ significant leverage by taking on too much debt, its ROE can be a very good gauge on the true profitability of a company’s operations and it can provide investors with a great clue on the presence or absence of an economic moat.

In essence, ROE and the presence of an Economic Moat helps to differentiate a great business from a run-of-the-mill business. That’s the main difference between Buffett’s thinking and Graham’s form of value investing. Graham never sought to find out if a business was better than its competitors or not whereas Buffett eventually placed a lot of emphasis in investing in companies that are a notch above their competitors. Buffett believed that investing in such companies would prove to be a lot more profitable than investing in statistically-cheap companies over long stretches of time.

Summary

Perhaps, the best summary on how Buffett had evolved as an investor could be this quote of his: “It’s far better to purchase a wonderful company at a fair price than a fair company at a wonderful price”. Graham would have preferred a fair company at a wonderful price and that was how Buffett started. But over time, Buffett would become the well-known investor and businessman he is today by following his maxim of buying a wonderful company at a fair price.

Value investing has indeed evolved a lot from Graham’s thinking to Buffett’s current philosophy. But the greatest takeaway among their very different approaches, is their insistence on studying stocks as a piece of a business. Value is a subjective measure, as can be seen from Graham and Buffett’s different views on it. But, never forget that investing by thinking of stocks as a business will always ring true.

Access our free training series “Formula to Financial Freedom” by registering a free account on https://viaatlas.com/signup

Related Articles

Value investing has indeed evolved a lot from Graham’s thinking to Buffett’s current philosophy. But the greatest takeaway among their very different approaches, is their insistence on studying stocks as a piece of a business. Value is a subjective measure, as can be seen from Graham and Buffett’s different views on it. But, never forget that investing by thinking of stocks as a business will always ring true.

Access our free training series “Formula to Financial Freedom” by registering a free account on https://viaatlas.com/signup

Related Articles

How to Apply a Fundamental-First Approach to Investing

In the midst of global trade tensions and market uncertainties, discover how smart investors are adapting and thriving using ViA Atlas.

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017, 2025 Spirit of Enterprise Honouree

You will learn:

- How to navigate market uncertainty amidst geopolitical tensions and market uncertainty

- How can all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction.

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing can help you cope with market uncertainty

- How ViA Atlas could help you strengthen your portfolio and streamline your decision-making process

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying high-quality resilent companies

Click the button below to reserve your spot now.

ViA Atlas by Value Investing Academy

Transforming lives by empowering individuals through financial education to take charge of their financial future, and make a positive change in their lives and communities worldwide. We Care To Make You A Better Investor.

Suitable For

Solutions For

Copyright © 2025. VIA Global Online Pte Ltd,

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Disclaimer: The information provided by ViA Atlas by Value Investing Academy, Mind Kinesis Investments Pte Ltd is meant for educational purposes, and is in no instance to be regarded as investment advice. You are advised to practice due diligence before making any financial decisions. All forms of investments carry risks and such activities may not be suitable for everyone. We are not liable for any losses incurred from your investment activities. Past investment performance is not necessarily indicative of future performance, even if the same strategies are adopted.