Sep 17

The Templeton Investing Approach: A Legacy of Contrarian and Value Investing

Share this article

The world of investing has seen countless investors; however, few have achieved such distinct and noteworthy returns and performance as Sir John Templeton. This man has stood his ground over several decades, market cycles, depressions, wars, frenzies and countries as a true contrarian, deep value investor and risk taker.

Introduction

Sir John Marks Templeton (29 November 1912 – 8 July 2008) was an American-born British investor, banker, fund manager, and philanthropist. In 1954, he entered the mutual fund market and created the Templeton Growth Fund which averaged growth over 15% per year for 38 years.

He was originally from Tennessee but renounced his U.S. citizenship at 55 years old and moved to the Bahamas, where his international funds were based.He was a master money manager and a pioneer innovator in global value investing, and his family of funds held more than $13 billion in assets in 1992 when he sold the firm. Following this sale, he spent the rest of his life focusing on philanthropic pursuits.

He was originally from Tennessee but renounced his U.S. citizenship at 55 years old and moved to the Bahamas, where his international funds were based.He was a master money manager and a pioneer innovator in global value investing, and his family of funds held more than $13 billion in assets in 1992 when he sold the firm. Following this sale, he spent the rest of his life focusing on philanthropic pursuits.

Unique Approach To Investing

Templeton is widely considered to be one of the greatest investors of the 20th century. His principles and thoughts are as relevant today as they were at the beginning of the second world war.

The following are some of the key strategies and philosophies he employed in his investing career:

Value Investing – He was a believer in value investing, more than growth investing. His strategy was simple – find the best bargains and buy them when the stocks are selling at a fraction of their value. He considered himself a bargain hunter.

Global Approach – When he was travelling the world after his studies, he realised that overseas markets and stocks offered just as much opportunity as U.S. markets. He believed in investing in global markets rather than just a single market. He forayed into markets like Japan at a time when the notion of investing in foreign markets was alien to most people. His global view served him well. Between 1966 and 1974 when the Dow Jones Average fell 43 percent, the Templeton Growth Fund rose 129 percent because he had switched into Japanese, Canadian, and German stocks.

Contrarian – Templeton emphasized on overlooked or unpopular stocks and was a true contrarian. He became known for his “avoiding the herd” and “buy when there’s blood in the streets” philosophy to take advantage of market turbulence. He was also known for taking profits when values and expectations were high.

Point of Maximum Pessimism– According to Templeton, the best time to buy stocks is when public sentiment is the most pessimistic, when 99% of all people have given up. Likewise, at any given time, there are usually certain markets, industries and stocks that are especially unpopular.

Fundamental Analysis – Templeton did not buy stocks merely because they were undervalued but also made sure that he was investing in companies which he deemed to be profitable, well-managed and with good long-term potential. He preferred to use fundamental analysis rather than technical analysis.

Disciplined Approach – Templeton attributed much of his success to his ability to maintain an elevated mood, avoid anxiety and stay disciplined. Intelligence, energy, discipline and courage are some of the traits necessary for one to succeed in investing on a consistent basis. Sir John simplifies the formula even further by stating, “The secret of our success has to be hard work, plus using common sense to change from those methods which have become too popular to other methods that are not yet quite so well-known.”

Another example of the success of his formula is the Templeton Growth Fund, one of several mutual funds bearing Sir John’s name. An investment of $10,000 in 1954 would have given the investor more than $700,000 in profits by 1986, assuming the distributions were reinvested.

The following are some of the key strategies and philosophies he employed in his investing career:

Value Investing – He was a believer in value investing, more than growth investing. His strategy was simple – find the best bargains and buy them when the stocks are selling at a fraction of their value. He considered himself a bargain hunter.

Global Approach – When he was travelling the world after his studies, he realised that overseas markets and stocks offered just as much opportunity as U.S. markets. He believed in investing in global markets rather than just a single market. He forayed into markets like Japan at a time when the notion of investing in foreign markets was alien to most people. His global view served him well. Between 1966 and 1974 when the Dow Jones Average fell 43 percent, the Templeton Growth Fund rose 129 percent because he had switched into Japanese, Canadian, and German stocks.

Contrarian – Templeton emphasized on overlooked or unpopular stocks and was a true contrarian. He became known for his “avoiding the herd” and “buy when there’s blood in the streets” philosophy to take advantage of market turbulence. He was also known for taking profits when values and expectations were high.

Point of Maximum Pessimism– According to Templeton, the best time to buy stocks is when public sentiment is the most pessimistic, when 99% of all people have given up. Likewise, at any given time, there are usually certain markets, industries and stocks that are especially unpopular.

Fundamental Analysis – Templeton did not buy stocks merely because they were undervalued but also made sure that he was investing in companies which he deemed to be profitable, well-managed and with good long-term potential. He preferred to use fundamental analysis rather than technical analysis.

Disciplined Approach – Templeton attributed much of his success to his ability to maintain an elevated mood, avoid anxiety and stay disciplined. Intelligence, energy, discipline and courage are some of the traits necessary for one to succeed in investing on a consistent basis. Sir John simplifies the formula even further by stating, “The secret of our success has to be hard work, plus using common sense to change from those methods which have become too popular to other methods that are not yet quite so well-known.”

Another example of the success of his formula is the Templeton Growth Fund, one of several mutual funds bearing Sir John’s name. An investment of $10,000 in 1954 would have given the investor more than $700,000 in profits by 1986, assuming the distributions were reinvested.

Approach To Life

Hard work was nothing new to Sir John. He was not the son of a wealthy family. Templeton attended the local public schools and excelled as a student. After completing high school, he was admitted to Yale University (which almost exclusively took private school students). The Great Depression forced his father to cut financial support, but undeterred, he worked jobs to pay for his school. He then received a Rhodes Scholarship, enabling him to study at Oxford for two years, receiving his M.A. from Balliol College. He travelled the world and learned that overseas markets and stocks offered just as much opportunity as U.S. markets.

Uninterested in consumerism, he lived relatively frugally, drove his own car, never flew first-class and lived year-round in the Bahamas. In fact, he is reported to have followed around family members at home to turn off lights to save electricity.

Religion And Philosophy

The Philanthropic Roots of Templeton

Templeton was just as remarkable at philanthropy as he was in investing. His family had strong Presbyterian roots and raised Templeton to be religious in his everyday life. The values of curiosity and spirituality which were instilled in him early on, stuck with him his entire life, and he habitually promoted them in others.

Spiritual Values that Shaped Templeton’s Life

Templeton was just as remarkable at philanthropy as he was in investing. His family had strong Presbyterian roots and raised Templeton to be religious in his everyday life. The values of curiosity and spirituality which were instilled in him early on, stuck with him his entire life, and he habitually promoted them in others.

Spiritual Values that Shaped Templeton’s Life

A deeply religious man, he became increasingly more concerned that the urgent things were squeezing out those that were truly essential. He pledged to devote 50 percent of his time working with churches and charities, and the other half managing the investments of his customers.

The Templeton Prize: An Award for Progress in Religion

The Templeton Prize: An Award for Progress in Religion

He had a limitless love of helping others and he wanted to foster moral and religious tolerance for the future. Templeton believed that spirituality, in all forms, could aid people and enhance their lives. He endowed an annual award for progress in religion which is known as the Templeton Prize.

The John Templeton Foundation

In 1987, Templeton created the John Templeton Foundation. The foundation’s goal was to provide financial support and awards to those pursuing the “big questions” and their impact on human life. It provides awards for exceptional work in a variety of fields, including personal virtue, applied genetics and free enterprise. The same year, he was also knighted for his accomplishments in business and philanthropy.

Renouncement of US Citizenship

The John Templeton Foundation

In 1987, Templeton created the John Templeton Foundation. The foundation’s goal was to provide financial support and awards to those pursuing the “big questions” and their impact on human life. It provides awards for exceptional work in a variety of fields, including personal virtue, applied genetics and free enterprise. The same year, he was also knighted for his accomplishments in business and philanthropy.

Renouncement of US Citizenship

Templeton renounced his US citizenship in 1964, allowing him to avoid paying $100 million that he would have paid in US income taxes when he sold his international investment fund, instead channeling the funds toward his philanthropy efforts.

Lauren C. Templeton

Lauren C. Templeton is the founder and President of Templeton & Phillips Capital Management, LLC, a global value investing boutique located in Chattanooga, Tennessee. Lauren is the great niece of Sir John M. Templeton and is a current member of the John M. Templeton Foundation. Ms. Templeton received a B.A. in Economics from the University of the South, Sewanee.

2018 Investify Symposium Keynote Speaker: Lauren C. Templeton

Lauren began her career working with managed portfolios and investments in 1998, starting off as a junior associate at the financial advisor Homrich and Berg and later the hedge fund management company New Providence Advisors both of Atlanta.

In 2001, she launched her own hedge fund management company which dedicates its efforts to the practice of value investing across the global markets using the same methods learned from her great-uncle, Sir John Templeton.

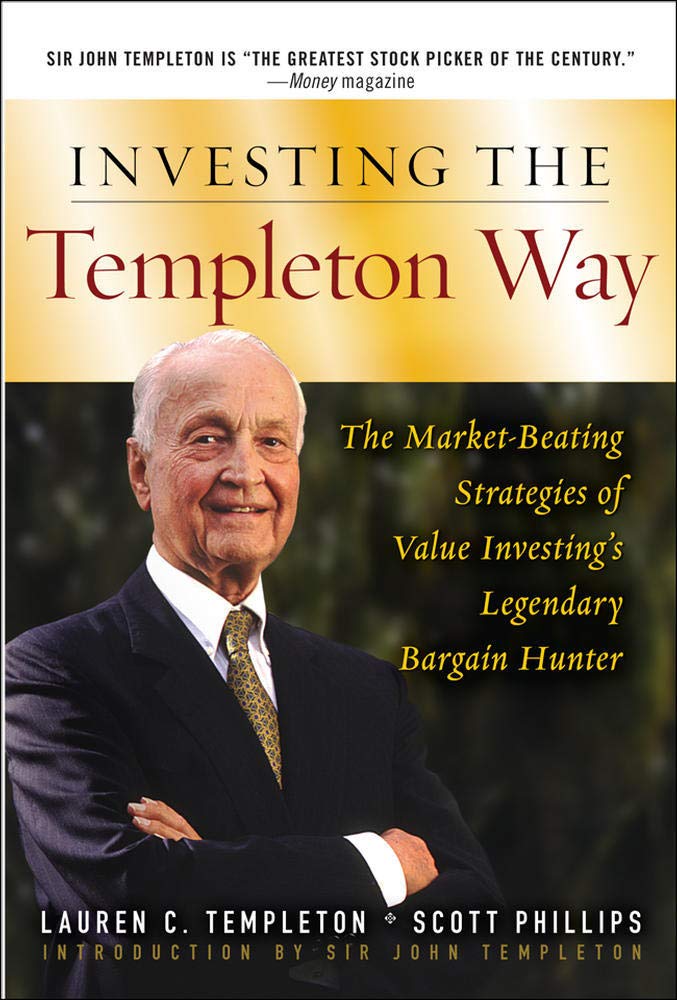

Ms. Templeton is also the co-author of Investing the Templeton Way: The Market Beating Strategies of Value Investing Legendary Bargain Hunter, 2007, McGraw Hill, which has been translated into nine languages.

In 2001, she launched her own hedge fund management company which dedicates its efforts to the practice of value investing across the global markets using the same methods learned from her great-uncle, Sir John Templeton.

Ms. Templeton is also the co-author of Investing the Templeton Way: The Market Beating Strategies of Value Investing Legendary Bargain Hunter, 2007, McGraw Hill, which has been translated into nine languages.

Summary

Sir John Templeton's investment philosophy offers timeless guidance for investors, emphasizing:

- Value investing

- Contrarian strategies

- In-depth research

- Long-term focus

- Global diversification

Templeton advocated for patience and discipline, recognizing the importance of understanding both value and market dynamics. His emphasis on diversification helped reduce risk and fostered a well-rounded approach to investing.

For those seeking clarity in a complex financial world, his principles continue to be highly relevant today, offering a solid foundation for prudent and informed investing decisions.

For those seeking clarity in a complex financial world, his principles continue to be highly relevant today, offering a solid foundation for prudent and informed investing decisions.

Empty space, drag to resize

Get a FREE Value Investing Simplified Book

Lauren C. Templeton

Founder and President of Templeton & Phillips Capital Management, LLC

"I highly recommend Cayden Chang's book and his investment courses to anyone who are interested in getting started on investing. "I highly recommend Cayden Chang's book and his investment courses to anyone who are interested in getting started on investing.

Related Posts

How to Apply a Fundamental-First Approach to Investing

In the midst of global trade tensions and market uncertainties, discover how smart investors are adapting and thriving using ViA Atlas.

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017, 2025 Spirit of Enterprise Honouree

You will learn:

- How to navigate market uncertainty amidst geopolitical tensions and market uncertainty

- How can all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction.

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing can help you cope with market uncertainty

- How ViA Atlas could help you strengthen your portfolio and streamline your decision-making process

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying high-quality resilent companies

Click the button below to reserve your spot now.

ViA Atlas by Value Investing Academy

Transforming lives by empowering individuals through financial education to take charge of their financial future, and make a positive change in their lives and communities worldwide. We Care To Make You A Better Investor.

Suitable For

Solutions For

Copyright © 2025. VIA Global Online Pte Ltd,

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Disclaimer: The information provided by ViA Atlas by Value Investing Academy, Mind Kinesis Investments Pte Ltd is meant for educational purposes, and is in no instance to be regarded as investment advice. You are advised to practice due diligence before making any financial decisions. All forms of investments carry risks and such activities may not be suitable for everyone. We are not liable for any losses incurred from your investment activities. Past investment performance is not necessarily indicative of future performance, even if the same strategies are adopted.