Sep 12

What is Value Investing: Principles, Strategies, And Benefits

Share this article

Value investing has long been hailed as a robust investment strategy, with Warren Buffett often being cited as its most successful practitioner. This comprehensive guide will demystify the concept of value investing, its principles, strategies, and its numerous benefits.

What is Value Investing

Value investing is an investment strategy where stocks are selected based on their intrinsic value. This approach was popularized by Benjamin Graham, often referred to as the "father of value investing." His seminal work, "The Intelligent Investor," laid the foundation for this investment philosophy, which has since been embraced and evolved by countless investors, including Warren Buffett, Peter Lynch, Howard Marks, Joel Greenblatt, Ray Dalio.

Evolution of Value Investing

From Benjamin Graham to Warren Buffett

Benjamin Graham's original approach to value investing focused on finding "cigar-butt" stocks—companies trading at prices so low their liquidation value was higher than their market value. These stocks were often mediocre companies trading at bargain prices with a high margin of safety.

Warren Buffett, one of Graham's students, initially followed this methodology but later evolved his approach under the influence of his business partner, Charlie Munger. Instead of focusing solely on undervalued mediocre companies, Buffett began to invest in "wonderful companies at fair value." This shift allowed him to invest in high-quality companies with sustainable competitive advantages.

Principles of Value Investing

1. Long-Term Perspective

Value investing is not a get-rich-quick scheme. It requires patience and a long-term perspective. Investors buy undervalued stocks and hold onto them until their market price reflects their true value, which can sometimes take years.

2. Margin of Safety

The margin of safety is a concept introduced by Benjamin Graham. It involves buying stocks at a significant discount to their intrinsic value to minimize investment risk. This ensures that even if the stock doesn't perform as expected, the downside risk is limited.

3. Contrarian Investing

Value investors often take a contrarian approach, buying stocks that are out of favor with the market. This goes against the grain of popular sentiment but can lead to substantial gains when the market corrects itself.

4. Common Metrics

Value investors use various financial metrics to assess a stock's value, such as:

Price-to-Earnings (P/E) Ratio: A low P/E ratio might indicate that a stock is undervalued.

Price-to-Book (P/B) Ratio: This compares a company's market value to its book value.

Debt-to-Equity Ratio: A lower ratio suggests a company is less reliant on debt for growth.

5. Circle of Competence

Popularized by Warren Buffett, the circle of competence principle advises investors to stick to industries and businesses they understand well. This allows for more accurate valuation and risk assessment.

Case Study: Coca-Cola

One of the most famous examples of value investing is Warren Buffett's move with Coca-Cola. Back in the late 1980s, Coca-Cola hit a rough patch, causing its stock to plummet. While most investors panicked and saw the drop as a huge red flag, Buffett spotted a golden opportunity.

He recognized that Coca-Cola was more than just a drink; it was a global icon, a symbol of enjoyment and refreshment woven into cultures everywhere. Buffett understood the company's knack for consistent earnings, even when the economy was shaky. This gave him the confidence to view the stock as undervalued—an exceptional brand available at a fair price.

In fact, during the market crash of 1987, Buffett seized the moment and purchased even more shares, doubling down on his belief in the company. His philosophy is all about snagging quality companies when the market doesn't appreciate their true value. This strategic mindset has paid off big time, proving that value investing works.

Buffett's choice to hang onto his Coca-Cola shares has been a game changer for his portfolio, turning what many considered a risky bet into a cornerstone of his success.

As of today, he still holds onto those shares, never selling a single one. That’s the power of believing in great companies!

As of today, he still holds onto those shares, never selling a single one. That’s the power of believing in great companies!

Pros and Cons of Value Investing

Pros:

Lower Risk: Value investing focuses on acquiring undervalued stocks with a margin of safety, meaning the stock price is significantly lower than its intrinsic value. This buffer helps mitigate potential losses and reduces overall investment risk. By concentrating on financially stable companies with strong fundamentals, value investors can navigate market volatility with greater confidence, knowing their investments are less susceptible to steep declines.

Discovering Hidden Gems: This investment strategy often involves a contrarian mindset, allowing investors to uncover undervalued companies before the broader market recognizes their potential. Once the market catches up, these stocks can see rapid price appreciation as demand rises, enabling early investors to reap substantial gains.

Peace of Mind: Value investing emphasizes the quality of the company over daily stock price fluctuations. This focus allows investors to remain confident during short-term price dips, trusting that the company’s intrinsic value will ultimately be reflected in its stock price. Additionally, this approach encourages long-term holding, minimizing the need for constant market monitoring and frequent portfolio adjustments.

Cons:

Patience is Essential: Being a contrarian investor often means going against the prevailing market sentiment, which can demand considerable patience. It may take time for the market to recognize a stock's true value, resulting in stagnation before any price appreciation materializes.

Value Traps: Not all undervalued stocks are sound investments. Sometimes, a company may seem fundamentally solid yet its stock price remains low due to hidden issues, known as value traps. This can create uncertainty about whether to hold onto the stock or pursue alternative opportunities. Investors can minimize the risk of falling into these traps by being mindful of the cyclical nature of certain industries.

How to get started

ViA has encapsulated this investing methodology in the acronym S.E.G.A, which stands for:

A) S (Search) – Identifying promising, money-making companies for investment.

B) E (Evaluate) – Assessing whether a company is strong or weak.

C) G (Gauge) – Determining the worth of a company’s shares to buy low and sell high.

D) A (Asset Portfolio) – Strategically allocating shares in your portfolio is crucial.

A) Search

There are various strategies for uncovering undervalued companies, particularly those experiencing challenges, such as a drop in share price due to a temporary corporate scandal, economic shifts, political events, or recessions. However, it's essential to conduct proper research and analysis before investing.

Some companies attract negative attention for the wrong reasons, such as Boeing. In 2019, two crashes involving Boeing’s 737 Max led to a more than 20% decline in the company's stock price. This created an opportunity for value investors to acquire shares in a fundamentally sound company at a discounted rate, as the price drop was viewed as temporary.

B) Evaluate

Evaluating a company can be approached in two primary ways: quantitative and qualitative.

The quantitative approach involves a thorough analysis of a company’s financial metrics, ratios, and other numerical data to assess its intrinsic value and long-term growth potential. This includes scrutinizing financial statements—balance sheets, income statements, and cash flow statements—as well as historical financial performance.

Value investors often employ various financial ratios, such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield, to ascertain if a company's stock is undervalued compared to its intrinsic worth.

Value investors often employ various financial ratios, such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield, to ascertain if a company's stock is undervalued compared to its intrinsic worth.

The qualitative approach, on the other hand, focuses on non-financial elements, including a company's competitive advantages, management quality, brand reputation, and industry trends, to determine its intrinsic value and potential for sustained growth.

This perspective recognizes that a company’s future success is influenced by factors extending beyond financial statements. The objective is to pinpoint companies with strong competitive positions and effective management teams that can sustain their advantages and foster long-term growth.

This perspective recognizes that a company’s future success is influenced by factors extending beyond financial statements. The objective is to pinpoint companies with strong competitive positions and effective management teams that can sustain their advantages and foster long-term growth.

However, it's important to acknowledge that not everyone possesses in-depth knowledge of every industry—even Warren Buffett historically avoided investing in the technology sector. Buffett advises investors to operate within their "Circle of Competence," meaning they should invest only in companies they thoroughly understand, steering clear of those they do not.

Some of his famous quotes include:

“Invest in what you know. If you understand a business, it’s difficult for anyone to undermine that.”

“Stick within the circle of competence. The size of that circle is not as crucial as understanding its boundaries.”

C) Gauge

A fundamental principle of value investing is to acquire quality companies at attractive prices. But how can one ascertain if a share price is undervalued?

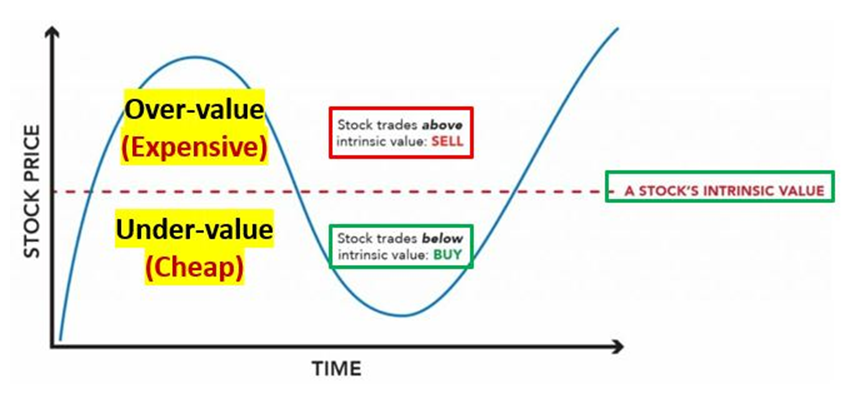

Value investors determine a company's valuation by calculating its intrinsic value (true worth) based on financial statements.

If a company’s current share price falls below its intrinsic value, it is considered undervalued, presenting a buying opportunity for value investors after thorough research and analysis.

Conversely, if a company's share price exceeds its intrinsic value, it is deemed overvalued or expensive, prompting investors to consider selling their shares if they believe the company is no longer a viable long-term investment.

Several methods exist for determining a company’s intrinsic value, with one of the simplest being the Price-to-Book (P/B) Ratio. The P/B ratio is calculated by dividing a company’s current market price per share by its book value per share.

A low P/B ratio may suggest that a company’s stock is undervalued relative to its book value, indicating that the market price per share is lower than its book value per share.

A low P/B ratio may suggest that a company’s stock is undervalued relative to its book value, indicating that the market price per share is lower than its book value per share.

For insights into what P/B ratio you should target when investing in Warren Buffett’s Berkshire Hathaway stock.

D) Asset Portfolio

One of the most critical factors to building a passive income-generating portfolio is asset allocation.

So how should you allocate your portfolio if you have $10,000 to invest? Click here to claim a Free Company Analysis based on Value Investing Principles, and get “Portfolio Hero”, our free Risk Management Framework course.

Doing this properly requires time to consider your financial goals and risk tolerance.

So how should you allocate your portfolio if you have $10,000 to invest? Click here to claim a Free Company Analysis based on Value Investing Principles, and get “Portfolio Hero”, our free Risk Management Framework course.

Related Posts

How to Apply a Fundamental-First Approach to Investing

In the midst of global trade tensions and market uncertainties, discover how smart investors are adapting and thriving using ViA Atlas.

Presented by Cayden Chang

Founder of Value Investing Academy and Award-Winning International Speaker, Lifelong Learner Award 2008, Personal Brand Award 2017, 2025 Spirit of Enterprise Honouree

You will learn:

- How to navigate market uncertainty amidst geopolitical tensions and market uncertainty

- How can all-weather portfolio of stocks, bonds, and ETFs can help you stay calm and thrive no matter the market direction.

- How Cash-Flow Options Strategies (CFOS), modelled after Warren Buffett's principles of Value Investing can help you cope with market uncertainty

- How ViA Atlas could help you strengthen your portfolio and streamline your decision-making process

- Actionable & Duplicable Step-By-Step Value Investing Framework on identifying high-quality resilent companies

Click the button below to reserve your spot now.

ViA Atlas by Value Investing Academy

Transforming lives by empowering individuals through financial education to take charge of their financial future, and make a positive change in their lives and communities worldwide. We Care To Make You A Better Investor.

Suitable For

Solutions For

Copyright © 2025. VIA Global Online Pte Ltd,

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Mind Kinesis Investments Pte Ltd. All Rights Reserved.

Disclaimer: The information provided by ViA Atlas by Value Investing Academy, Mind Kinesis Investments Pte Ltd is meant for educational purposes, and is in no instance to be regarded as investment advice. You are advised to practice due diligence before making any financial decisions. All forms of investments carry risks and such activities may not be suitable for everyone. We are not liable for any losses incurred from your investment activities. Past investment performance is not necessarily indicative of future performance, even if the same strategies are adopted.